Theranos CEO Holmes and former president Balwani charged with massive fraud

Theranos CEO Holmes and former president Balwani charged with massive fraud

Anita Balakrishnan4 Hours Ago | 02:37

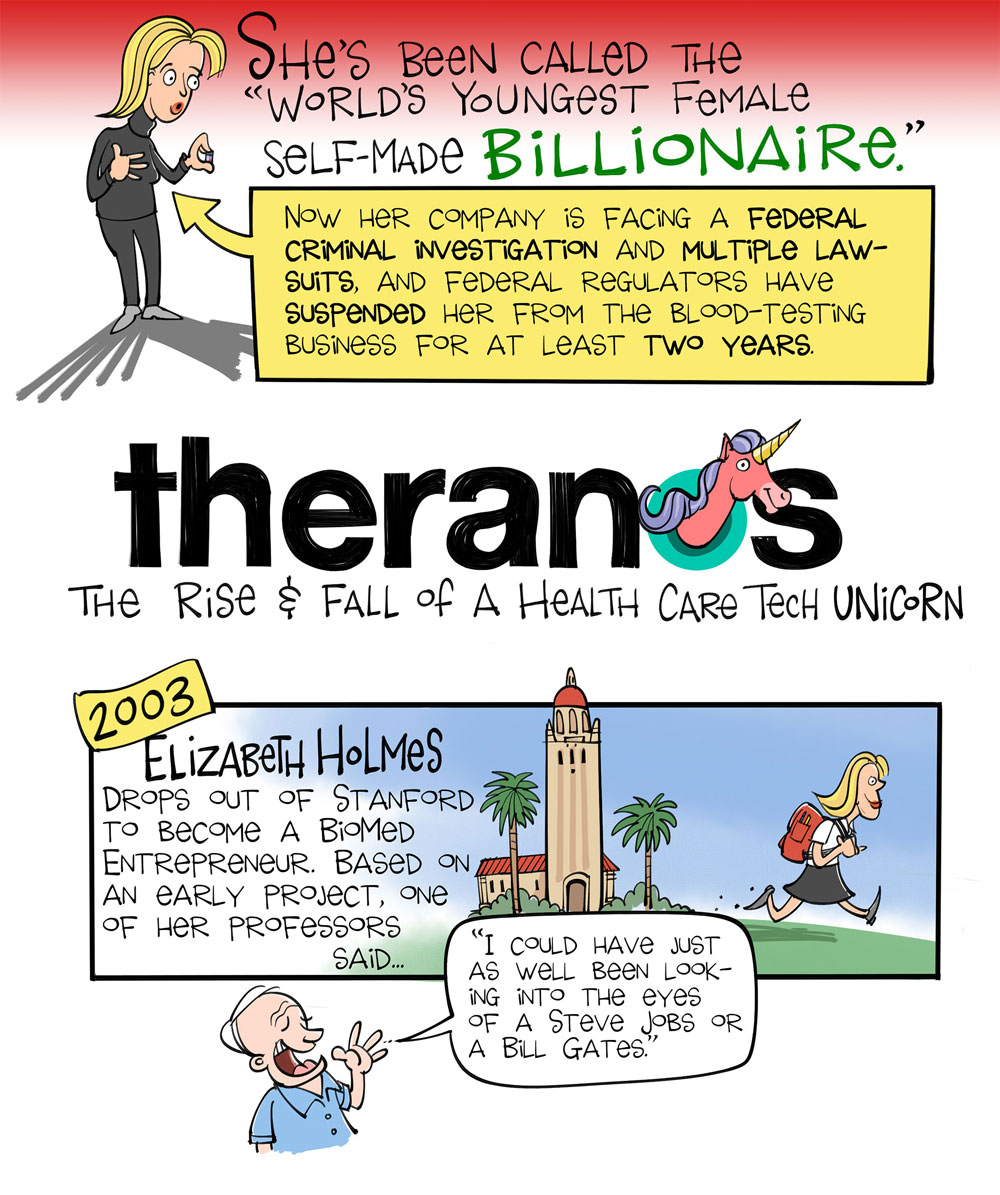

Elizabeth Holmes, founder of embattled blood testing start-up Theranos, has been charged with "massive fraud," the Securities and Exchange Commission said Wednesday.

Theranos said Holmes agreed to settle and pay a $500,000 fine, and will be barred from serving as a director or officer of a public company for 10 years.

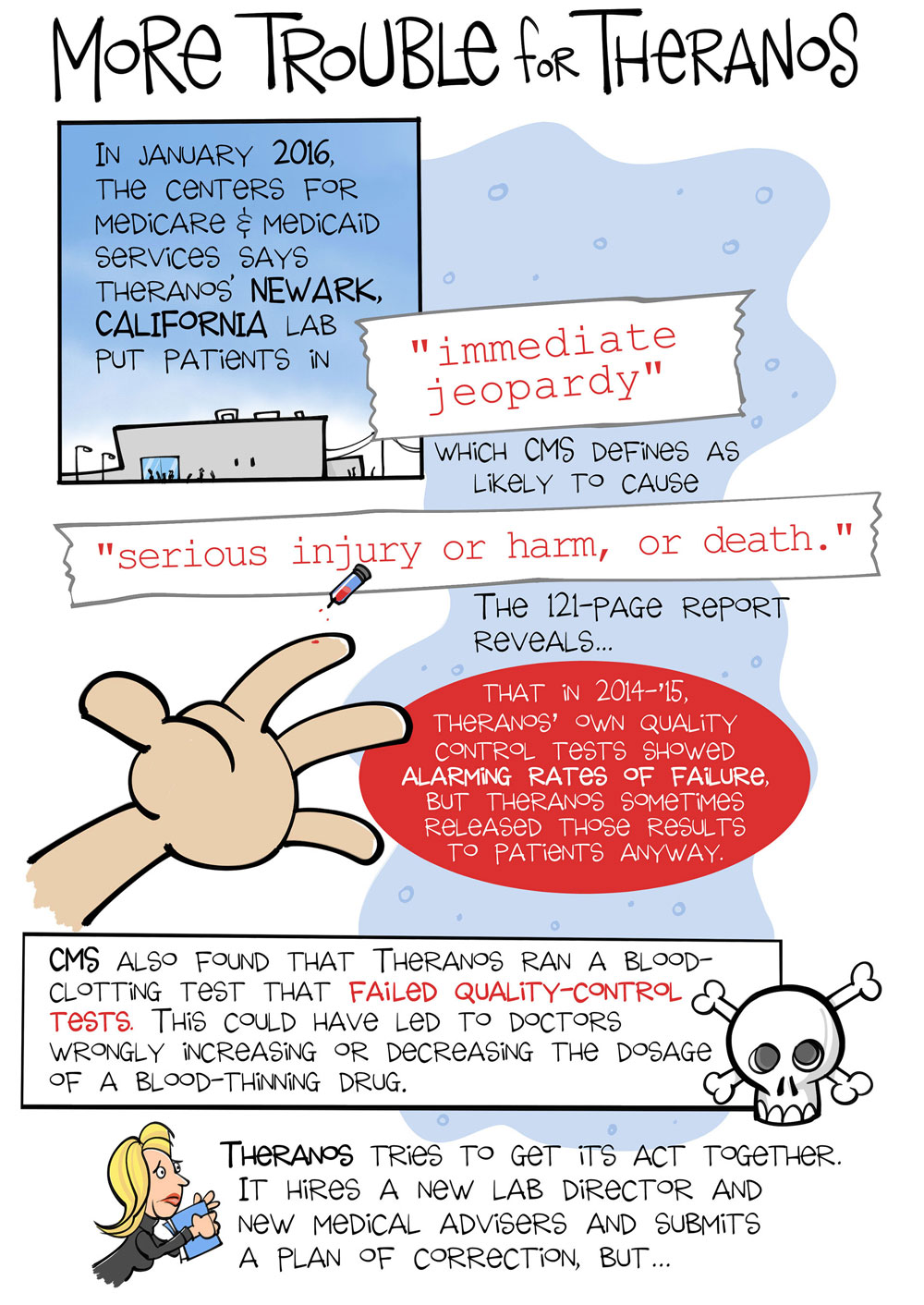

In its case in civil court, the SEC alleged that Theranos raised more than $700 million from late 2013 to 2015 while "deceiving investors by making it appear as if Theranos had successfully developed a commercially-ready portable blood analyzer that could perform a full range of laboratory tests from a small sample of blood."

The agency wouldn't comment about whether a criminal investigation is going on.

Gilbert Carrasquillo | Getty Images

Founder & CEO of Theranos Elizabeth Holmes.

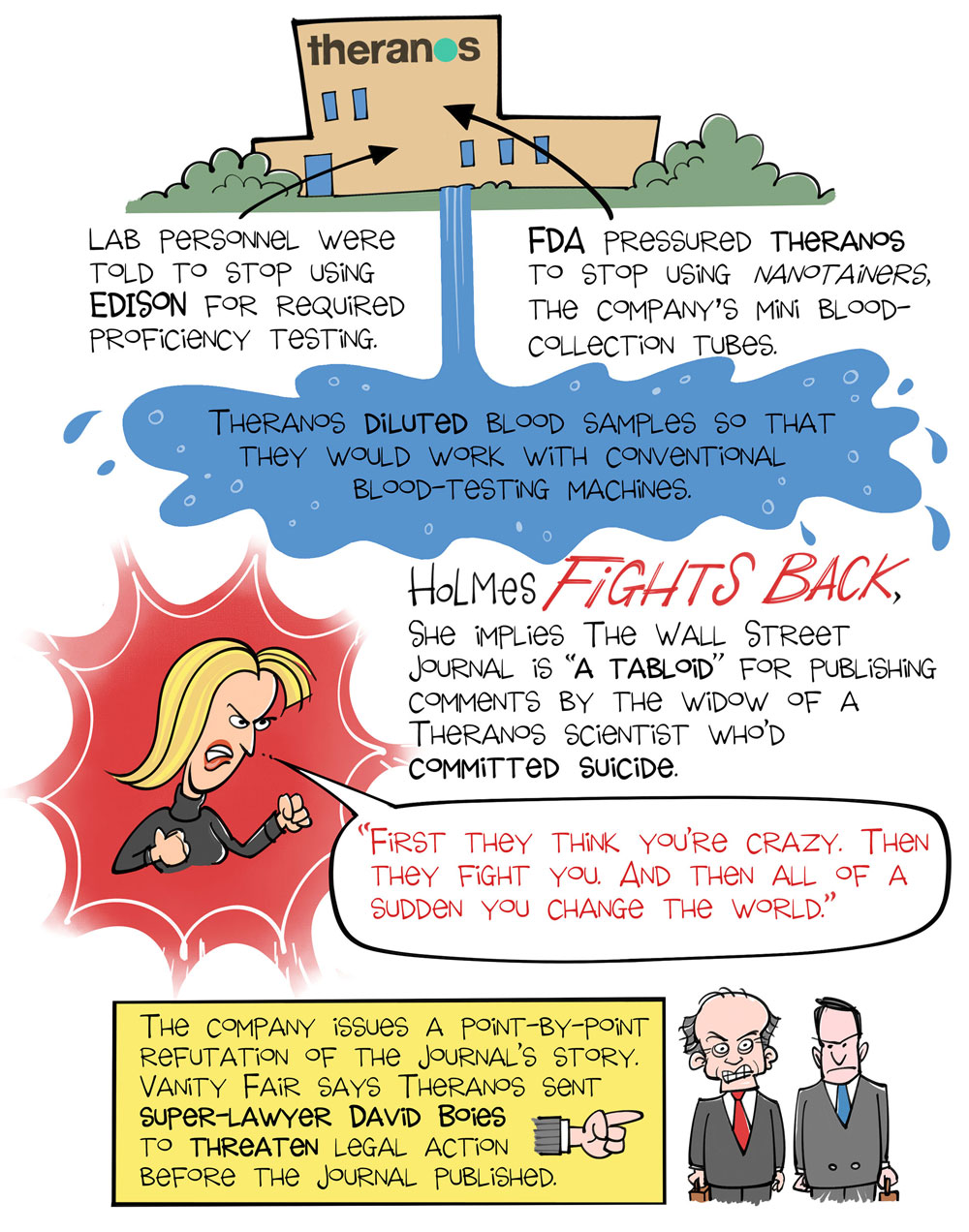

The SEC said Theranos deceived investors by "hosting misleading technology demonstrations, and overstating the extent of Theranos' relationships with commercial partners," noting that at times Theranos' technology performed could only do about 12 tests of the over 200 tests advertised. The SEC also said former Theranos President Ramesh "Sunny" Balwani and Holmes lied about the extent of Theranos' involvement with the military.

Balwani worked at Theranos from 2009 to 2016, after extending credit to his then-girlfriend Holmes. The pair collaborated closely, the SEC said, with Holmes working on innovation, strategic relationships and the board, while Balwani concentrated on technology and human resources. The SEC said it is also seeking an order requiring Balwani to pay a fine and prohibiting him from acting as an officer or director of a public company.

Balwani's attorney told CNBC he believed the SEC action was "unwarranted," and that Balwani

"accurately represented Theranos to investors to the best of his ability" and "took on significant financial risk investing in Theranos."

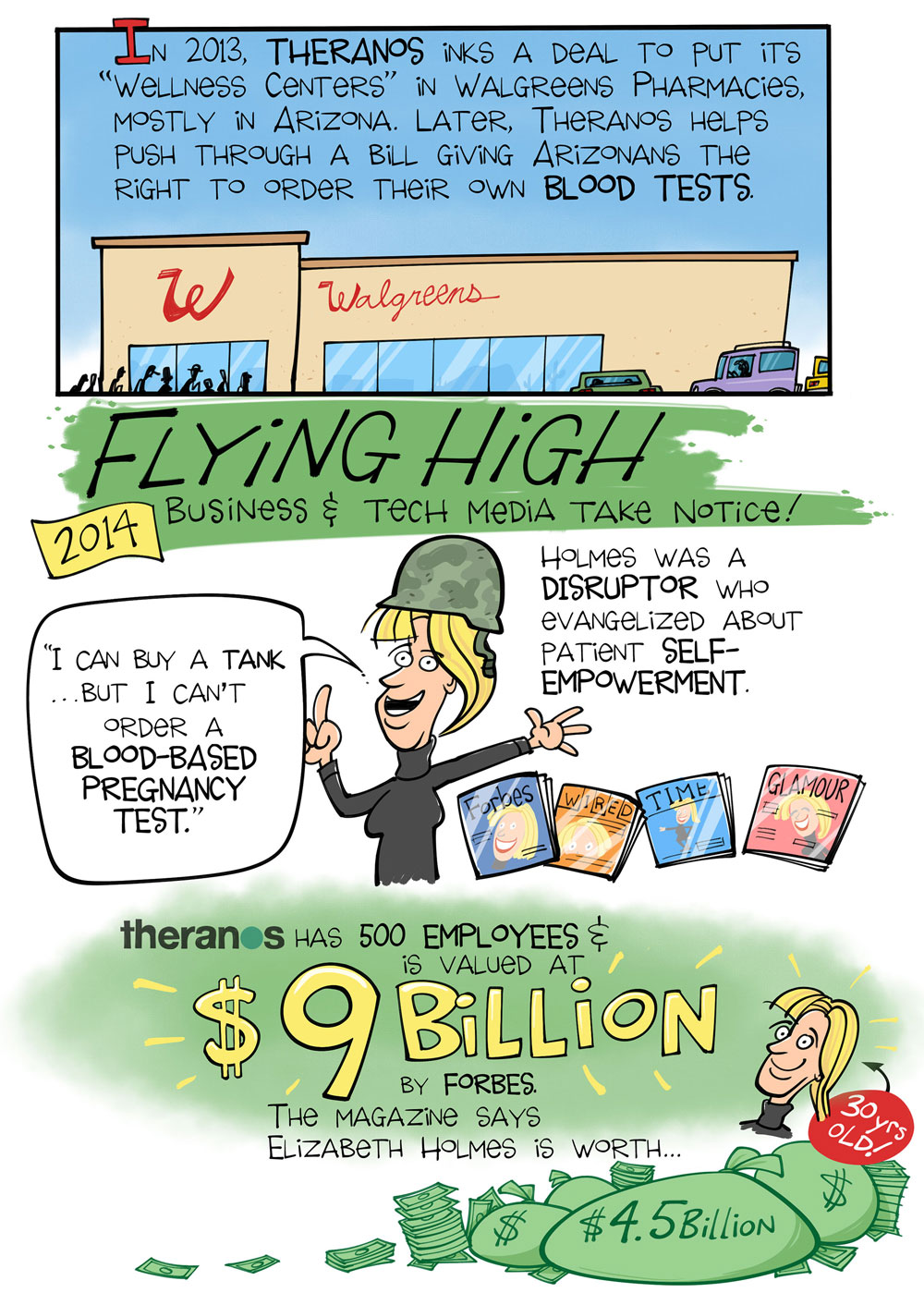

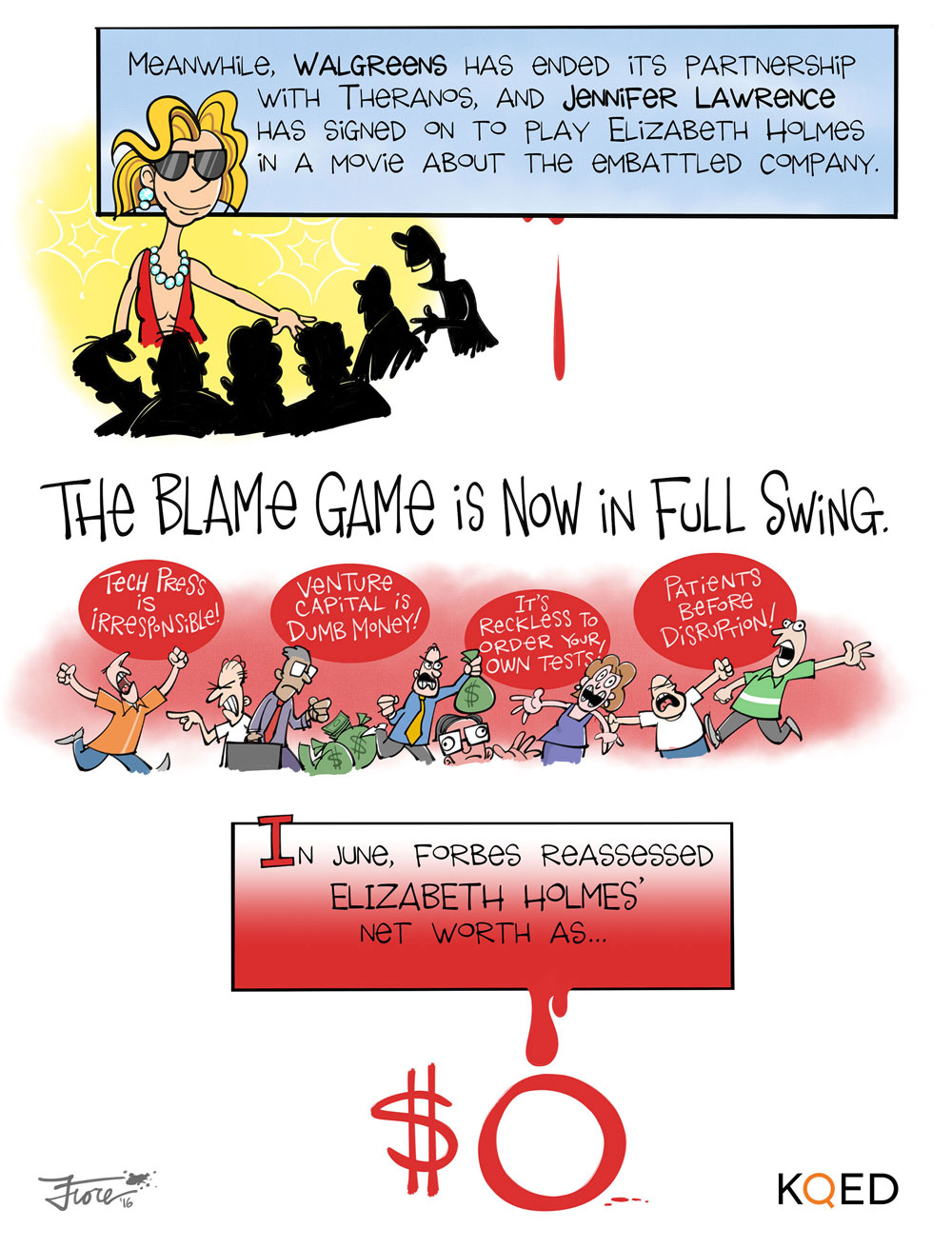

Theranos was once considered a high-flying start-up, and Holmes graced major magazine covers, touted as the personification of innovation. But Wall Street Journal investigations over the past five years questioned the efficacy of Theranos' blood testing technology, raising flags for regulators.

(Read more of the Wall Street Journal's original Theranos reporting on WSJ.com)

Holmes responded to the Journal's investigations in 2015, telling CNBC's Jim Cramer, "This is what happens when you work to change things. First they think you're crazy, then they fight you, and then all of a sudden you change the world," mirroring a quote that's often misattributed to Mahatma Gandhi.

Theranos has now resolved proceedings with the Centers for Medicare & Medicaid Services, as well as with the Arizona attorney general.

Theranos previously settled a lawsuit with one of its biggest investors, Partner Fund Management, which invested more than $96 million in Theranos in 2014. Holmes has already said she plans to give away shares to the "most significant shareholders."

If Theranos is acquired or "otherwise liquidated," Holmes will not profit from her ownership until over $750 million is returned to investors, the SEC said.

"The Theranos story is an important lesson for Silicon Valley,'' Jina Choi, director of the SEC's San Francisco regional office, said in a statement. ''Innovators who seek to revolutionize and disrupt an industry must tell investors the truth about what their technology can do today, not just what they hope it might do someday.''

Here's the full complaint against Holmes.

— CNBC's Regina Gilgan contributed to this report.

Theranos CEO Holmes and former president Balwani charged with massive fraud

Anita Balakrishnan4 Hours Ago | 02:37

Elizabeth Holmes, founder of embattled blood testing start-up Theranos, has been charged with "massive fraud," the Securities and Exchange Commission said Wednesday.

Theranos said Holmes agreed to settle and pay a $500,000 fine, and will be barred from serving as a director or officer of a public company for 10 years.

In its case in civil court, the SEC alleged that Theranos raised more than $700 million from late 2013 to 2015 while "deceiving investors by making it appear as if Theranos had successfully developed a commercially-ready portable blood analyzer that could perform a full range of laboratory tests from a small sample of blood."

The agency wouldn't comment about whether a criminal investigation is going on.

Gilbert Carrasquillo | Getty Images

Founder & CEO of Theranos Elizabeth Holmes.

The SEC said Theranos deceived investors by "hosting misleading technology demonstrations, and overstating the extent of Theranos' relationships with commercial partners," noting that at times Theranos' technology performed could only do about 12 tests of the over 200 tests advertised. The SEC also said former Theranos President Ramesh "Sunny" Balwani and Holmes lied about the extent of Theranos' involvement with the military.

Balwani worked at Theranos from 2009 to 2016, after extending credit to his then-girlfriend Holmes. The pair collaborated closely, the SEC said, with Holmes working on innovation, strategic relationships and the board, while Balwani concentrated on technology and human resources. The SEC said it is also seeking an order requiring Balwani to pay a fine and prohibiting him from acting as an officer or director of a public company.

Balwani's attorney told CNBC he believed the SEC action was "unwarranted," and that Balwani

"accurately represented Theranos to investors to the best of his ability" and "took on significant financial risk investing in Theranos."

Theranos was once considered a high-flying start-up, and Holmes graced major magazine covers, touted as the personification of innovation. But Wall Street Journal investigations over the past five years questioned the efficacy of Theranos' blood testing technology, raising flags for regulators.

(Read more of the Wall Street Journal's original Theranos reporting on WSJ.com)

Holmes responded to the Journal's investigations in 2015, telling CNBC's Jim Cramer, "This is what happens when you work to change things. First they think you're crazy, then they fight you, and then all of a sudden you change the world," mirroring a quote that's often misattributed to Mahatma Gandhi.

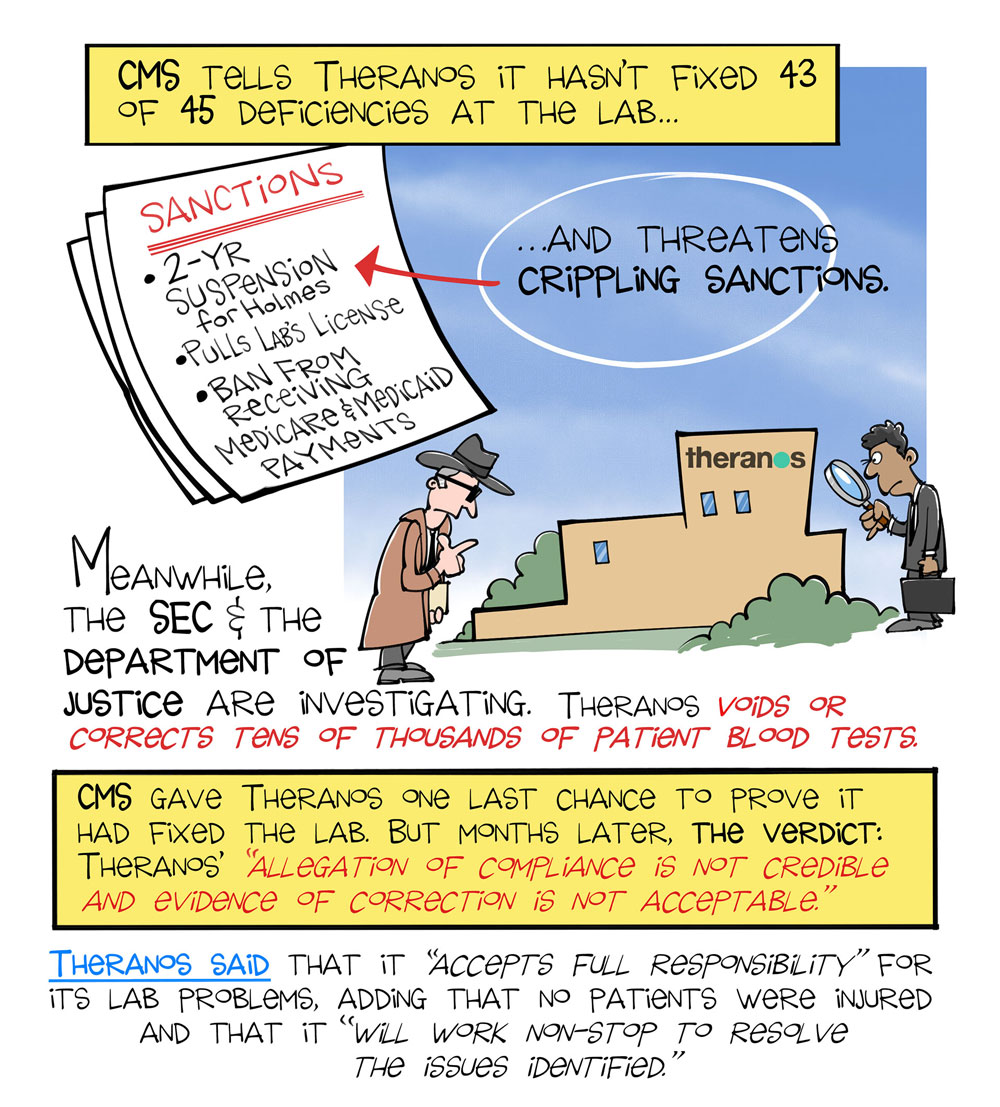

Theranos has now resolved proceedings with the Centers for Medicare & Medicaid Services, as well as with the Arizona attorney general.

Theranos previously settled a lawsuit with one of its biggest investors, Partner Fund Management, which invested more than $96 million in Theranos in 2014. Holmes has already said she plans to give away shares to the "most significant shareholders."

If Theranos is acquired or "otherwise liquidated," Holmes will not profit from her ownership until over $750 million is returned to investors, the SEC said.

"The Theranos story is an important lesson for Silicon Valley,'' Jina Choi, director of the SEC's San Francisco regional office, said in a statement. ''Innovators who seek to revolutionize and disrupt an industry must tell investors the truth about what their technology can do today, not just what they hope it might do someday.''

Here's the full complaint against Holmes.

— CNBC's Regina Gilgan contributed to this report.