they sent money to cacs in ukraine

they bail out billionaires who are already evading taxes

but they wont bail you out on student loans, they won't give you tax breaks

Washington, DC -- The following statement was released by Secretary of the Treasury Janet L. Yellen, Federal Reserve Board Chair Jerome H. Powell, and FDIC Chairman Martin J. Gruenberg:

Today we are taking decisive actions to protect the U.S. economy by strengthening public confidence in our banking system. This step will ensure that the U.S. banking system continues to perform its vital roles of protecting deposits and providing access to credit to households and businesses in a manner that promotes strong and sustainable economic growth.

After receiving a recommendation from the boards of the FDIC and the Federal Reserve, and consulting with the President, Secretary Yellen approved actions enabling the FDIC to complete its resolution of Silicon Valley Bank, Santa Clara, California, in a manner that fully protects all depositors. Depositors will have access to all of their money starting Monday, March 13. No losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer.

We are also announcing a similar systemic risk exception for Signature Bank, New York, New York, which was closed today by its state chartering authority. All depositors of this institution will be made whole. As with the resolution of Silicon Valley Bank, no losses will be borne by the taxpayer.

Shareholders and certain unsecured debtholders will not be protected. Senior management has also been removed. Any losses to the Deposit Insurance Fund to support uninsured depositors will be recovered by a special assessment on banks, as required by law.

Finally, the Federal Reserve Board on Sunday announced it will make available additional funding to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors.

The U.S. banking system remains resilient and on a solid foundation, in large part due to reforms that were made after the financial crisis that ensured better safeguards for the banking industry. Those reforms combined with today's actions demonstrate our commitment to take the necessary steps to ensure that depositors' savings remain safe.

its not comparable to the student loan debt issue.

it would be comparable if when you took out the loan the bank never gave you the money and you now owed the school and bank money.

you're right. it would be easier for the US government to bail out people with student loans than it would to bail out 'victims' of irresponsible and incompetent unregulated banks.its not comparable to the student loan debt issue.

it would be comparable if when you took out the loan the bank never gave you the money and you now owed the school and bank money.

it's better to show than to tell

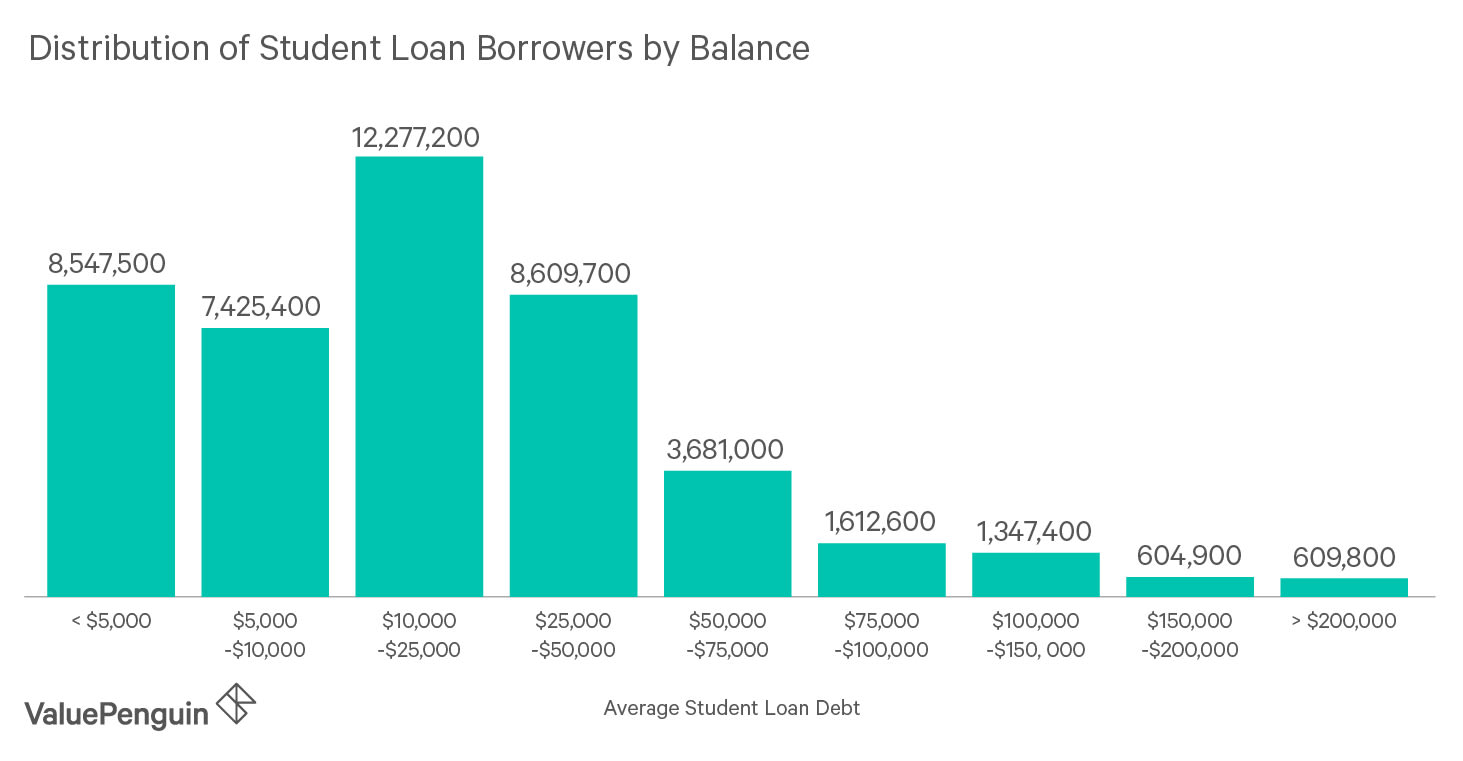

at least 15 million people will no longer have debt or have significantly less debt.

if another round of 10k or even higher comes through, millions of people will no longer be in debt

Moral HazardThese banks can continue to do risky things because they know they will get bailed out. On the other hand, we'll have to brace for a financial collapse if we just let all of these banks fail. A lot of companies won't be making payroll if this bank doesn't get 'bailed out'.