OfTheCross

Veteran

How Much Did Supply Constraints Boost U.S. Inflation? - Liberty Street Economics

What factors are behind the recent inflation surge has been a huge topic of debate amongst academics and policymakers. We know that pandemic-related supply constraints such as labor shortages and supply chain bottlenecks have been key factors pushing inflation higher. These bottlenecks started...

libertystreeteconomics.newyorkfed.org

U.S. Results

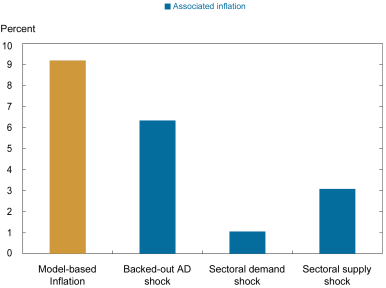

The first bar in the chart below presents our estimation of the U.S. CPI inflation rate over the 2019-21 period, which was calculated to be 9.18 percent from December 2019 to December 2021, annualized. The actual observed inflation during this period is 8.47 percent, so the model-calibrated rate is very close. The next three bars decompose the drivers of inflation. Notice that the sum of these bars is 10.5 percent, which is slightly higher given the nonlinear interactions between sixty-six sectors. The aggregate demand shock (“backed-out AD shock”) explains roughly 60 percent of model-based inflation. The remaining 40 percent of the model-based inflation is primarily explained by sectoral supply shocks (“sectoral supply shock”), while the change in households’ consumption patterns across sectors (“sectoral demand shock”) accounts for very little. The bottom line of this decomposition is that supply constraints magnified the impact of higher demand in inflation. Consequently, most sectors in the U.S.—fifty-eight out of sixty-six—were supply-constrained. This result is consistent with other research that shows that expansionary fiscal policy has increased the share of sectors classified as supply-constrained.The model calibration shows the quantitative importance of both demand and supply shocks

Notes: The chart presents a U.S. closed-economy inflation decomposition for a sixty-six sector economy, 2019-21. The first bar shows model-based inflation considering all shocks (demand and supply). The second bar considers the aggregate demand shift only. The third bar uses sectoral demand shocks only. Finally, the fourth bar uses sectoral supply shocks only.

how about all of it.. shyt was manufactured in order for companies to maximize profits

how about all of it.. shyt was manufactured in order for companies to maximize profits