get these nets

Veteran

Mortgage

Landmark study confirms troubling 'appraisal gap' in minority enclaves

Mortgage giant Freddie Mac's analysis of 12 million appraisals comes as federal task force prepares action report to address appraisal bias

September 21, 2021

Researchers at Freddie Mac have confirmed the existence of an “appraisal gap” for homeowners in predominantly Latino and Black neighborhoods, where appraisals are more likely to come in below the contract price than in majority white census tracts.

The mortgage giant’s analysis of 12 million home purchase appraisals conducted between 2015 and 2020 adds statistical weight to media reports and formal complaints by individual homeowners who have claimed they were discriminated against by biased appraisers who undervalued their properties.

In their report, “Racial and Ethnic Valuation Gaps In Home Purchase Appraisals,” Freddie Mac researchers identified some practices that could be contributing to the appraisal gap, including a greater willingness by appraisers to seek out comparable sales, or “comps,” that are further away when valuing properties in white neighborhoods. But those factors accounted for only part of the appraisal gaps that showed up in the work of “a large portion” of appraisers, the report said.

“The appraisal gaps identified are not being driven by only a small fraction of appraisers — a large portion of appraisers who completed appraisals in both minority and non-minority areas generated statistically significant gaps,” Freddie Mac said in announcing the publication of the report.

Federal task force to issue action report on appraisal bias

Freddie Mac’s research comes in the wake of a June 1 Biden administration initiative that launched an interagency initiative to address appraisal bias, as part of a larger effort to build black wealth and narrow the racial wealth gap. Biden announced the creation of an interagency task force to address home appraisal inequities. That group, called the Property Appraisal and Valuation Equity task force, chaired by U.S. Department of Housing and Urban Development Secretary Marcia Fudge and Domestic Policy Council Director Susan Rice, will release a report in the detailing the “extent, causes and consequences” of appraisal discrimination and a policy roadmap to help root it out.

Task force members, including cabinet-level leaders from executive departments and additional members from independent agencies, held their first meeting on Aug. 5 to outline the scope of the group’s work, which will include creating a “comprehensive approach to combating valuation bias through enforcement and other efforts.”

The PAVE task force will deliver a final action report in 180 days, which will also seek to combat appraisal bias by making high-quality data available, and educating consumer and training appraisers.

Appraisal gap quantified in Black and Latino neighborhoods

Freddie Mac’s research was focused on analyzing the appraisal gap — whether minority groups are more likely than whites to receive an appraisal that comes in below the contract price agreed to between a buyer and seller.

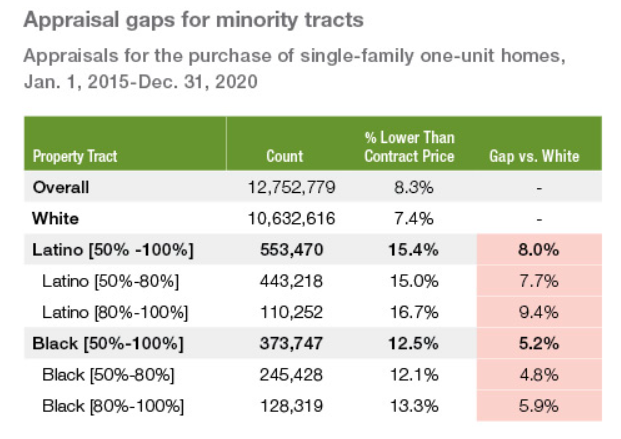

Researchers concluded that 15.4 percent of homes in predominantly Latino census tracts were appraised at less than the contract price, compared to 7.4 percent for homes in white census tracts. The difference between the two groups translates to an appraisal gap of 8 percent.

In predominantly Black census tracts, 12.5 percent of homes were appraised at less than the contract price, compared to 7.4 percent for homes in white census tracts, an appraisal gap of 5.2 percent.

As the concentration of a minority group in a census tracks increases, so does the appraisal valuation gap.

Source: Freddie Mac research.

In census tracts where Latinos made up 80 percent or more of the population, the appraisal gap increased to 9.4 percent. In census tracts that were at least 80 percent Black, the appraisal gap was 5.9 percent.

When Freddie Mac researchers looked at the minority status provided by homebuyers on their mortgage applications, the appraisal gap was not as drastic — 2.9 percent for Latino homebuyers, and 2.1 percent for Black. But that analysis could underestimate the appraisal gap, the report concluded, since the information on race and ethnicity was only collected from homebuyers, and not the sellers whose properties were appraised.

Having determined that valuations produced by “a large portion” of appraisers working in both minority and white census tracts exhibit “statistically significant” appraisal gaps, Freddie Mac researchers attempted to determine the cause.

Since valuations depend largely on the comparable sales, or “comps,” chosen by the appraiser, the analysis examined differences in comparable sale distances, comparable reconciliation, variances in comparable sale prices and possible systematic overpayment for properties by minorities.

But those factors “can explain only a modest amount of the observed appraisal gaps for the minority tracts,” Freddie Mac researchers concluded. Conceding that their analysis “has not yet determined the full root cause of the gap,” Freddie Mac researchers said they plan further research “to better understand the key drivers contributing to the gap and share findings with the industry.”

Freddie Mac is exploring opportunities to collect and analyze more data, and “testing whether alternatives to traditional appraisals offer a more objective analysis of property value.”

“Our research marks the beginning of a comprehensive effort to better understand the key drivers contributing to the appraisal gap,” said Freddie Mac researcher Michael Bradley, in a statement. “Our goal is to develop solutions to this persistent problem, including appraisal best practices, uniform standards for automated valuation models, enhanced consumer disclosures, improved value processes, and revised fair lending exam procedures and risk assessments.”

Industry efforts to address appraisal bias

Rival Fannie Mae says it’s also working to address the problem of appraisal bias, and is currently sifting through a database of about 54 million appraisals “to analyze undervaluation that could indicate bias. We believe the results of this research will help identify root causes of undervaluation, and through our industry partnerships, we hope to create solutions that will address them.”

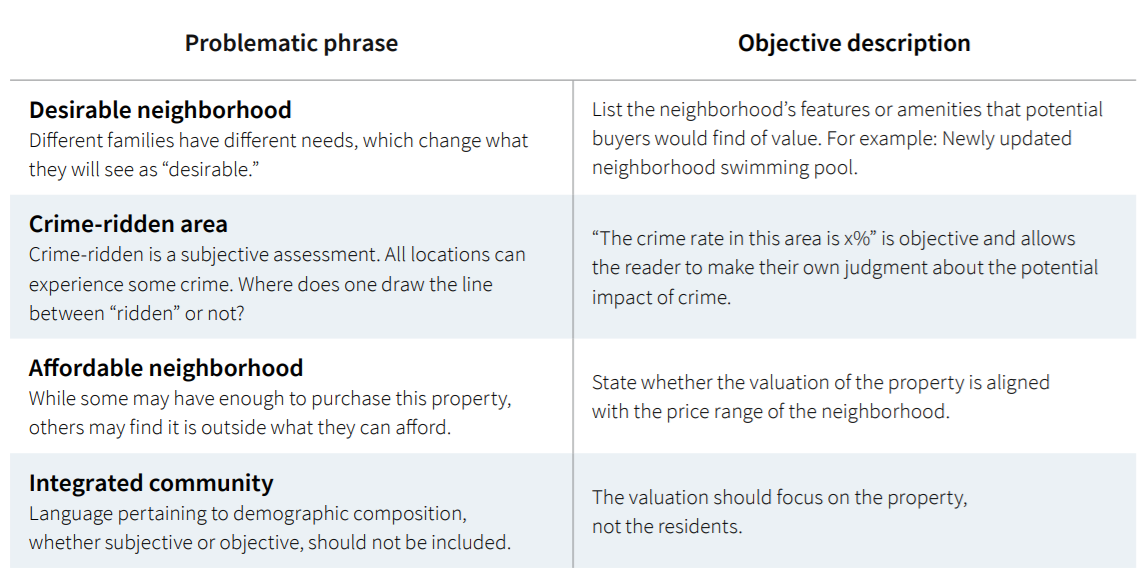

An initial scan of 14 million appraisals from 2019 and 2020 prompted Fannie Mae to warn appraisers to stop using “potentially problematic words and phrases” that “can undermine the credibility of the appraisal by implying that demographics influenced the outcome.”

Source: June 2021 Fannie Mae Appraiser Update.

Another potential solution is to increase diversity in the ranks of appraisers to more closely match the population as a whole. According to the Appraisal Institute, 85 percent of appraisers in 2018 were white, and 78 percent were men.

Fannie, Freddie and a number of other companies in the lending industry have partnered with the National Urban League and the Appraisal Institute on an Appraiser Diversity Initiative, which seeks to “attract new entrants to the residential appraisal field, overcome barriers to entry (such as education, training and experience requirements) and to foster diversity.”

Last fall, the Appraisal Institute and three other appraiser trade groups announced an initiative to develop training that tackles “unconscious bias” in real estate valuations, with each group pledging to review their code of ethics and other governing documents to ensure awareness and compliance.