JetFueledThoughts

Superstar

I know the answer obviously varies, so below is some quick background / detail:

I’ve been blessed enough to have a really great year at work, and got a bonus that is an amount of money that I’ve never seen even close to before in one time.

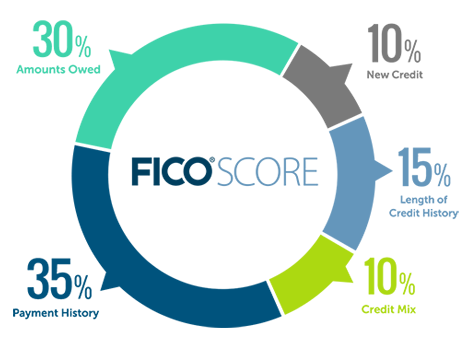

Debt : I’ve had right around $30,000 in credit debt circulating across 5-7 cards for the last few years. My credit utilization was high, over 80%. Candidly, I make good money but my credit score is uglehh

Once this check hit I immediately paid off 90% all of those cards, with plans to pay off the final 10% this week & next week (seemed smarter to spread it out?). By this time next week I will be fully free of credit card debt (not to mention cutting up all cards but my Amex Gold ). And after using the bonus to wipe out that 30k in debt, I still have a little over 80% of it sitting in my account.

). And after using the bonus to wipe out that 30k in debt, I still have a little over 80% of it sitting in my account.

My question, how long will it take for me to see my credit score get back to where I’d feel comfortable making a larger purchase like a property?

Credit Details : My credit score is prob around 630-660. But I have no bankruptcies or defaults on me ever, if anything it was small claims dollars from a dentist I stiffed and I’d pay it off later.

My only current debt : I have a car note on a Lexus that’s below $200 per month, as I paid 75% of the car in cash. First year into a 4 year note to own, I haven’t missed a payment. Also I have a small loan out that I took out a few years ago that I’ve paid out each month on time for over 2 years now. 18 months left at a total of $13,500. Wondering if I should just pay all that down now as well? Or if it looks good on my credit to have this loan consistently paid on time each month?

Or if it looks good on my credit to have this loan consistently paid on time each month?

Open to all advice on credit score, as well as investment suggestions for steady growth. I have around 15k in a vanguard that I’ll be adding two w/ more stable growth and dividend paying stocks.

I’ve been blessed enough to have a really great year at work, and got a bonus that is an amount of money that I’ve never seen even close to before in one time.

Debt : I’ve had right around $30,000 in credit debt circulating across 5-7 cards for the last few years. My credit utilization was high, over 80%. Candidly, I make good money but my credit score is uglehh

Once this check hit I immediately paid off 90% all of those cards, with plans to pay off the final 10% this week & next week (seemed smarter to spread it out?). By this time next week I will be fully free of credit card debt (not to mention cutting up all cards but my Amex Gold

). And after using the bonus to wipe out that 30k in debt, I still have a little over 80% of it sitting in my account.

). And after using the bonus to wipe out that 30k in debt, I still have a little over 80% of it sitting in my account.My question, how long will it take for me to see my credit score get back to where I’d feel comfortable making a larger purchase like a property?

Credit Details : My credit score is prob around 630-660. But I have no bankruptcies or defaults on me ever, if anything it was small claims dollars from a dentist I stiffed and I’d pay it off later.

My only current debt : I have a car note on a Lexus that’s below $200 per month, as I paid 75% of the car in cash. First year into a 4 year note to own, I haven’t missed a payment. Also I have a small loan out that I took out a few years ago that I’ve paid out each month on time for over 2 years now. 18 months left at a total of $13,500. Wondering if I should just pay all that down now as well?

Or if it looks good on my credit to have this loan consistently paid on time each month?

Or if it looks good on my credit to have this loan consistently paid on time each month?Open to all advice on credit score, as well as investment suggestions for steady growth. I have around 15k in a vanguard that I’ll be adding two w/ more stable growth and dividend paying stocks.