It's time more of these money guys start preaching this. American society indoctrinates people to go out and get the best house in the best neighborhood they can get access to. In many cases this financially burdens them and holds them back.

Obviously it's not don't ever buy a home but especially in your early years you can rent a space and minimize your living expenses and invest that difference. That can get you ahead in life.

That whole buy a home it's the best investment you'll make is boomer shit. I know if I went out and bought a home today my cost of living would almost triple overnight and I'd be able to invest far less. My living expenses are crazy low because I don't have to pay a mortgage, taxes, and maintenance on a home.

it really just depends on the math. the phrase is "marry the house, date the rate". this means if you can afford a home with rates at like 6.5% and it's not gonna break you, then go for it. cuz if worse come worse, if there's ever an opportunity to refinance, you will drop your housing expense.

the house I live in I bought in 2015, and it was only $240K. now this house is worth like 350K-400K.

also, when I bought this house, my mortgage rate was 4.125%. then I refinanced it down to 3% in 2021 (dropped payment about $300).

what I'm getting at is for me, it would actually cost more money to rent a nice 1BR apartment as opposed to mortgage the 5BR house I currently have.

I currently have enough money to pay off my current mortgage today if I chose to (yes, I would deplete the majority of my cash and investments), but I am HYPER focused on having it paid off within 5 years. in 2 years, I get a huge income increase cuz I won't be paying child support anymore, and I will split that excess between this mortgage and increasing my investing.

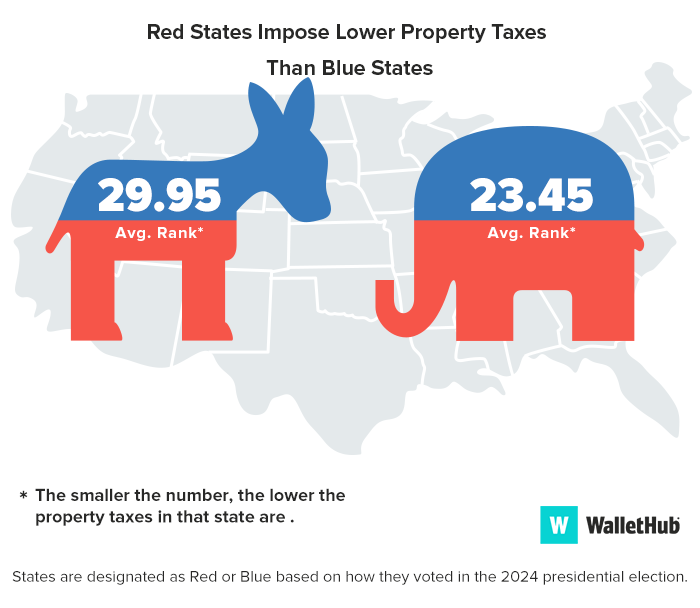

Property tax raises higher in TX than CA...

Property tax raises higher in TX than CA... some people can’t do it and thats all right

some people can’t do it and thats all right