V-2

[ [ AT/GC ] ]

Umm... Good? China is out of control with their bullshyt. They've built a substantial part of their economy on the strength of overbuilding, subsidization, product dumping, intellectual property theft and lack of reciprocity. When Chuck Schumer of all fukking people is standing and applauding Cheetolini, there may be something to it.

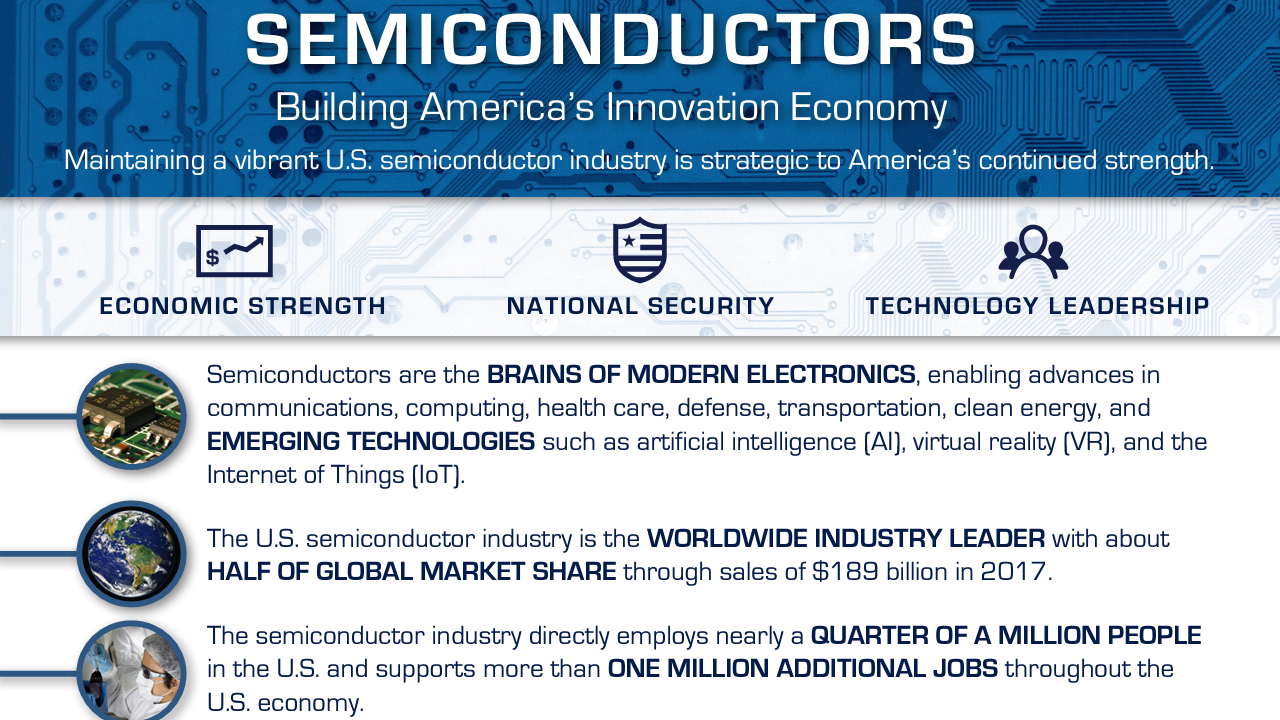

An overview of what's gone on.

Not that it hasn't already been happening on a large scale.

Trump Blocks China-Backed Lattice Bid

President Donald Trump blocked a Chinese-backed investor from buying Lattice Semiconductor Corp., casting a cloud over Chinese deals seeking U.S. security clearance and spurring a call for fairness from Beijing.

It was just the fourth time in a quarter century that a U.S. president has ordered a foreign takeover of an American firm stopped on national-security concerns. Trump acted on the recommendation of a multi-agency panel, the White House and the Treasury Department said Wednesday. The spurned buyer, Canyon Bridge Capital Partners LLC, is a private-equity firm backed by a Chinese state-owned asset manager.

The Trump administration has maintained a tough stance against Chinese takeovers of American businesses even as it seeks China’s help to resolve the North Korean nuclear crisis. Other deals under review include MoneyGram International Inc.’s proposed sale to Ant Financial, the financial-services company controlled by Chinese billionaire Jack Ma. The government is also examining an agreement by Chinese conglomerate HNA Group Co. to buy a stake in SkyBridge Capital LLC.

U.S. blocks chip equipment maker Xcerra's sale to Chinese state fund

U.S. semiconductor testing company Xcerra Corp (XCRA.O) said on Thursday a U.S. national security panel had blocked its $580-million sale to a Chinese state-backed semiconductor investment fund, the latest such deal to be thwarted.

The acquisition of Xcerra by Hubei Xinyan was seen as a key test of the ability of Chinese firms to acquire U.S. technology assets, because the company does not make chips itself, but provides testing equipment used in making semiconductors.

The deal’s demise comes as the Committee on Foreign Investment in the United States (CFIUS) has become increasingly skeptical of Chinese acquisitions of U.S. companies following the inauguration of U.S. President Donald Trump a year ago.

Trump’s Message in Blocking Broadcom Deal: U.S. Tech Not for Sale

With his swift rejection of Broadcom Ltd.’s hostile takeover of Qualcomm Inc., President Donald Trump sent a clear signal to overseas investors: Any deal that could give China an edge in critical technology will be swatted down in the name of national security.

Although Broadcom is based in Singapore, China loomed large over the U.S. government’s fears about a foreign takeover of chipmaker Qualcomm. That’s because Qualcomm is locked in a head-to-head race with China’s Huawei Technologies Co. over which company will dominate the development of next-generation wireless technology.

"This decision hangs a huge ‘not-for-sale’ sign on just about every American semiconductor firm," said Scott Kennedy, who studies China’s economic policy at the Center for Strategic & International Studies in Washington. "A Chinese entity doesn’t need to be anywhere near a transaction now in semiconductors for the deal to be nixed."

An overview of what's gone on.

Not that it hasn't already been happening on a large scale.

Trump Blocks China-Backed Lattice Bid

President Donald Trump blocked a Chinese-backed investor from buying Lattice Semiconductor Corp., casting a cloud over Chinese deals seeking U.S. security clearance and spurring a call for fairness from Beijing.

It was just the fourth time in a quarter century that a U.S. president has ordered a foreign takeover of an American firm stopped on national-security concerns. Trump acted on the recommendation of a multi-agency panel, the White House and the Treasury Department said Wednesday. The spurned buyer, Canyon Bridge Capital Partners LLC, is a private-equity firm backed by a Chinese state-owned asset manager.

The Trump administration has maintained a tough stance against Chinese takeovers of American businesses even as it seeks China’s help to resolve the North Korean nuclear crisis. Other deals under review include MoneyGram International Inc.’s proposed sale to Ant Financial, the financial-services company controlled by Chinese billionaire Jack Ma. The government is also examining an agreement by Chinese conglomerate HNA Group Co. to buy a stake in SkyBridge Capital LLC.

U.S. blocks chip equipment maker Xcerra's sale to Chinese state fund

U.S. semiconductor testing company Xcerra Corp (XCRA.O) said on Thursday a U.S. national security panel had blocked its $580-million sale to a Chinese state-backed semiconductor investment fund, the latest such deal to be thwarted.

The acquisition of Xcerra by Hubei Xinyan was seen as a key test of the ability of Chinese firms to acquire U.S. technology assets, because the company does not make chips itself, but provides testing equipment used in making semiconductors.

The deal’s demise comes as the Committee on Foreign Investment in the United States (CFIUS) has become increasingly skeptical of Chinese acquisitions of U.S. companies following the inauguration of U.S. President Donald Trump a year ago.

Trump’s Message in Blocking Broadcom Deal: U.S. Tech Not for Sale

With his swift rejection of Broadcom Ltd.’s hostile takeover of Qualcomm Inc., President Donald Trump sent a clear signal to overseas investors: Any deal that could give China an edge in critical technology will be swatted down in the name of national security.

Although Broadcom is based in Singapore, China loomed large over the U.S. government’s fears about a foreign takeover of chipmaker Qualcomm. That’s because Qualcomm is locked in a head-to-head race with China’s Huawei Technologies Co. over which company will dominate the development of next-generation wireless technology.

"This decision hangs a huge ‘not-for-sale’ sign on just about every American semiconductor firm," said Scott Kennedy, who studies China’s economic policy at the Center for Strategic & International Studies in Washington. "A Chinese entity doesn’t need to be anywhere near a transaction now in semiconductors for the deal to be nixed."