1/22

@KobeissiLetter

We just witnessed history:

After "Liberation Day" tariffs, the weighted-average US tariff rate has jumped to a whopping 29%.

Not even the Smoot-Hawley Act during the 1930s Great Depression saw tariff rates this high.

Are you ready for what's next?

(a thread)

2/22

@KobeissiLetter

If it wasn't already clear to you, it should be clear now:

Markets are bracing for a recession.

This morning, oil prices are down nearly -7% as investors price-in a collapse in global demand.

If these tariffs are implemented long-term, we could see oil prices fall 40%+.

3/22

@KobeissiLetter

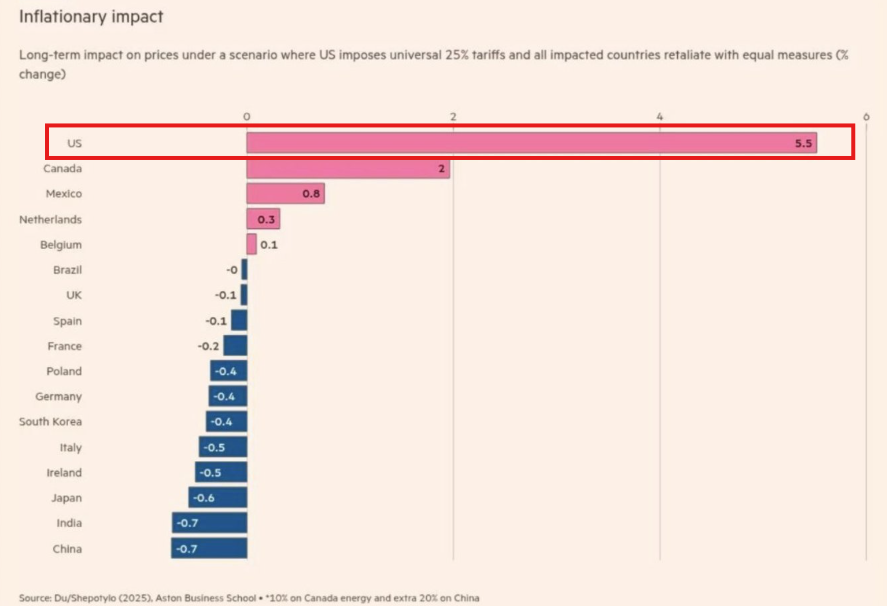

If the average tariff rate remains at 29%, inflation is expected to rise to ~5.0%-5.5%.

UBS also agrees with this estimate as price increases will be at least partially passed on to consumers.

Canada is the only other country that is expected to see inflation rise by 2%+.

4/22

@KobeissiLetter

This explains the seemingly "strange" price action during the announcement yesterday.

Markets initially believed that reciprocal tariffs were limited to the 10% baseline tariff.

However, this quickly changed as Trump began outlining many other tariffs, well above 10%.

5/22

@KobeissiLetter

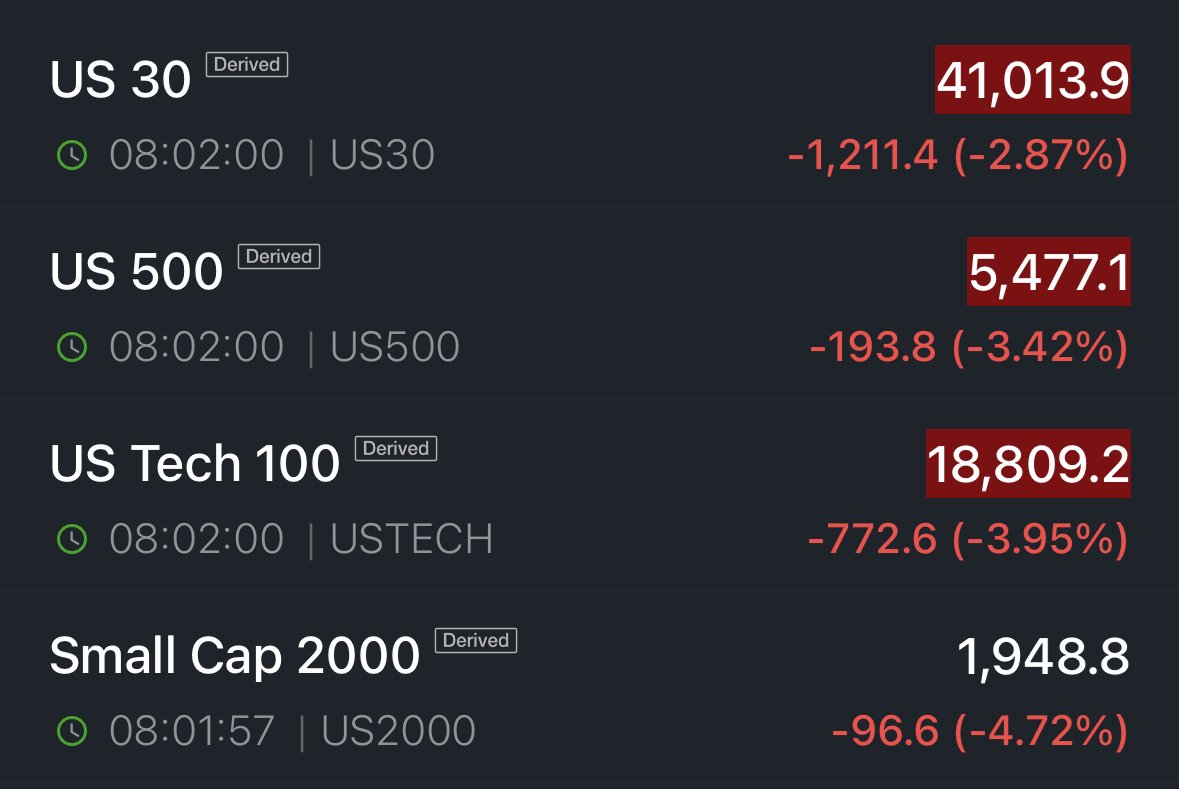

S&P 500 futures have gone from a +100 point gain to a -200 point drop.

Today could mark the largest single-day drop in the S&P 500 since the 2020 pandemic lockdowns.

Including the after hours gap higher, more than -$2.5 trillion in market cap was erased after the tariffs.

6/22

@KobeissiLetter

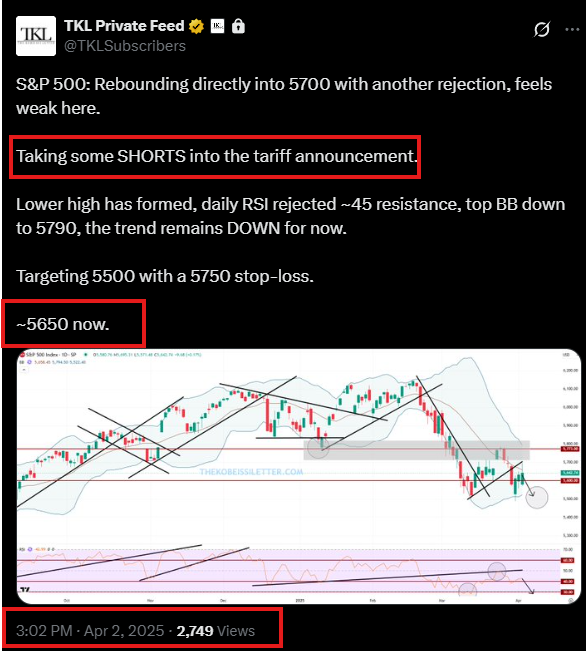

Heading into the close yesterday, we posted the below alert for our premium members.

This morning, the S&P 500 is set to open BELOW our 5,500 target.

That's a +170 point gain or over 500% using options.

Subscribe below to access our alerts:

Pricing

7/22

@KobeissiLetter

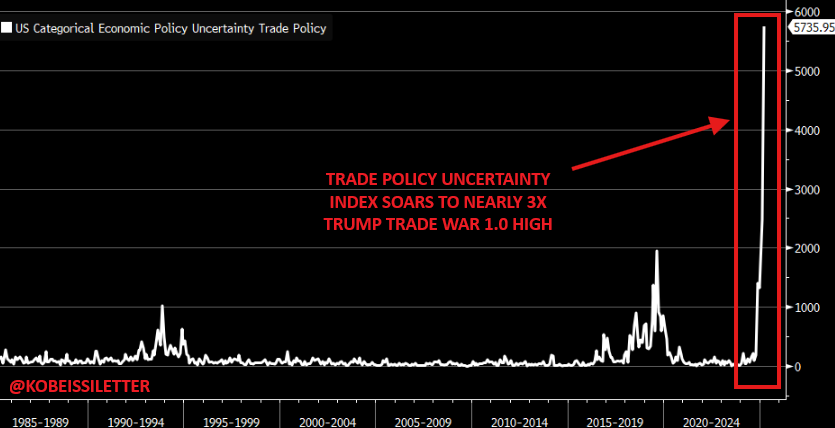

Today, the Trade Policy Uncertainty Index is surging to new record highs.

We are now seeing uncertainty levels that are 3 TIMES as high as the Trump Trade War 1.0 HIGH.

Uncertainty is the market's biggest enemy, particularly in a time where we have rebounding inflation.

8/22

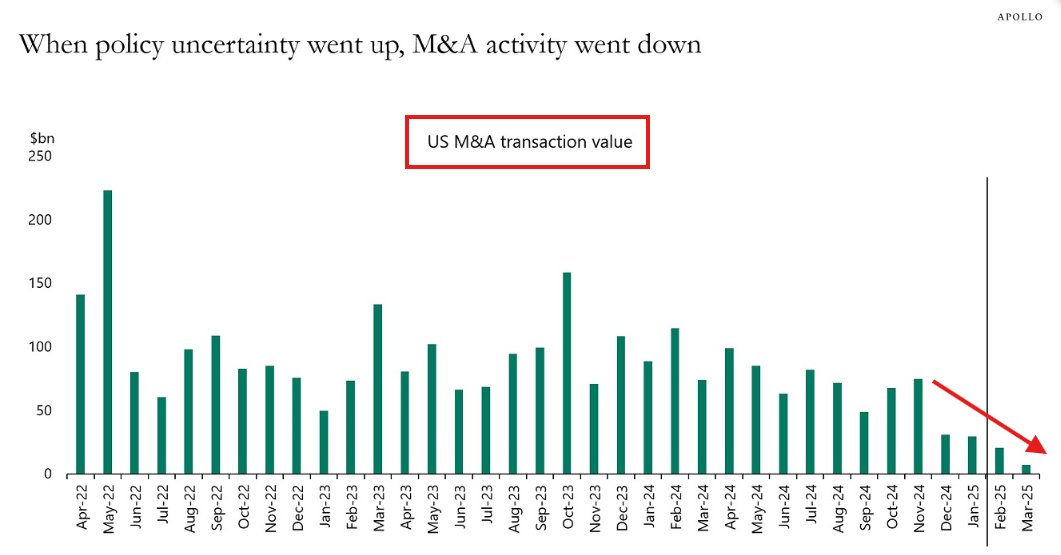

@KobeissiLetter

As a result, many parts of the market and economy are slowing down.

M&A transaction value has collapsed in the wake of economy uncertainty.

Private equity funds are deploying less capital and taking on less debt.

The consensus is that it's "too risky" to do anything.

9/22

@KobeissiLetter

Another telling sign?

The 10-year note yield fell to its lowest level since September 29th this morning.

Even as inflation is about to ramp up to 5%+, interest rates are falling.

This is the number 1 sign that markets are currently pricing-in a recession this year.

10/22

@KobeissiLetter

Certain large cap names, such as Nike,

/search?q=#NKE, are getting crushed even harder this morning.

Nike has 450,000 employees and 130 factories in Vietnam.

Yesterday, President Trump imposed a massive 46% tariff rate on Vietnam.

The stock is currently 70%+ from its all time high.

11/22

@KobeissiLetter

Today will be one of the market's most volatile days since March 2020.

Our subscribers continue to capitalize on the swings in the market.

Want to see how we are trading it?

Subscribe at the link below to access our latest analysis and alerts:

Pricing

12/22

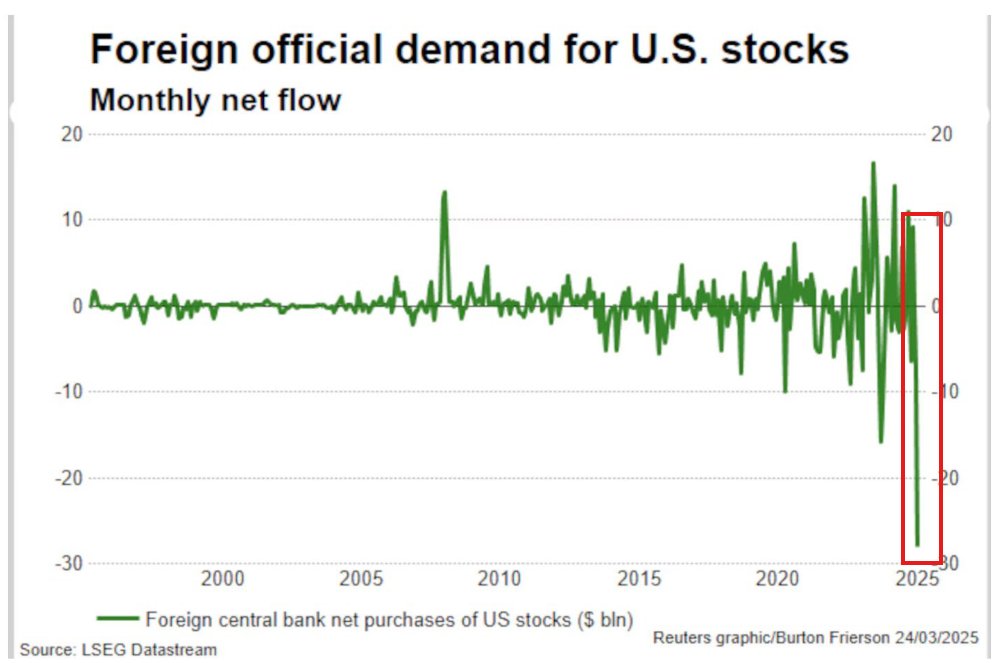

@KobeissiLetter

As a result, foreign demand for US stocks has collapsed to multi-decade lows.

Monthly net outflows of foreign central bank net purchases of US stocks are nearing -$30 BILLION.

We are witnessing history.

Follow us @KobeissiLetter for real time analysis as this develops.

13/22

@pamelabacon5

Not ready, but understand the effort to change the dynamic

14/22

@KobeissiLetter

It's a great time to be an objective investor.

15/22

@Invst_Informant

I don't think it'll last Smoot Hawley was a law, very different but good to use as a point of reference

I think it's part of a new economic recalibration, to shift from a consumption-based to production-based economy

[Quoted tweet]

x.com/i/article/190763315734…

16/22

@0xSweep

what's next ser?

17/22

@chriskent23

Yes

18/22

@trylimitless

Recessions odds surging to 50% tells a lot

[Quoted tweet]

CRYPTO

RECESSION

After Trump's 10% universal tariff announcement, US recession odds spiked to 50%.

LIVE ODDS: bit.ly/recession2025

19/22

@ttkkcc_crowe

An intense and busy K Street lobbying and negotiation process begins, with many foreign tariffs disappearing and the rest being negotiated lower on a case by case basis.

20/22

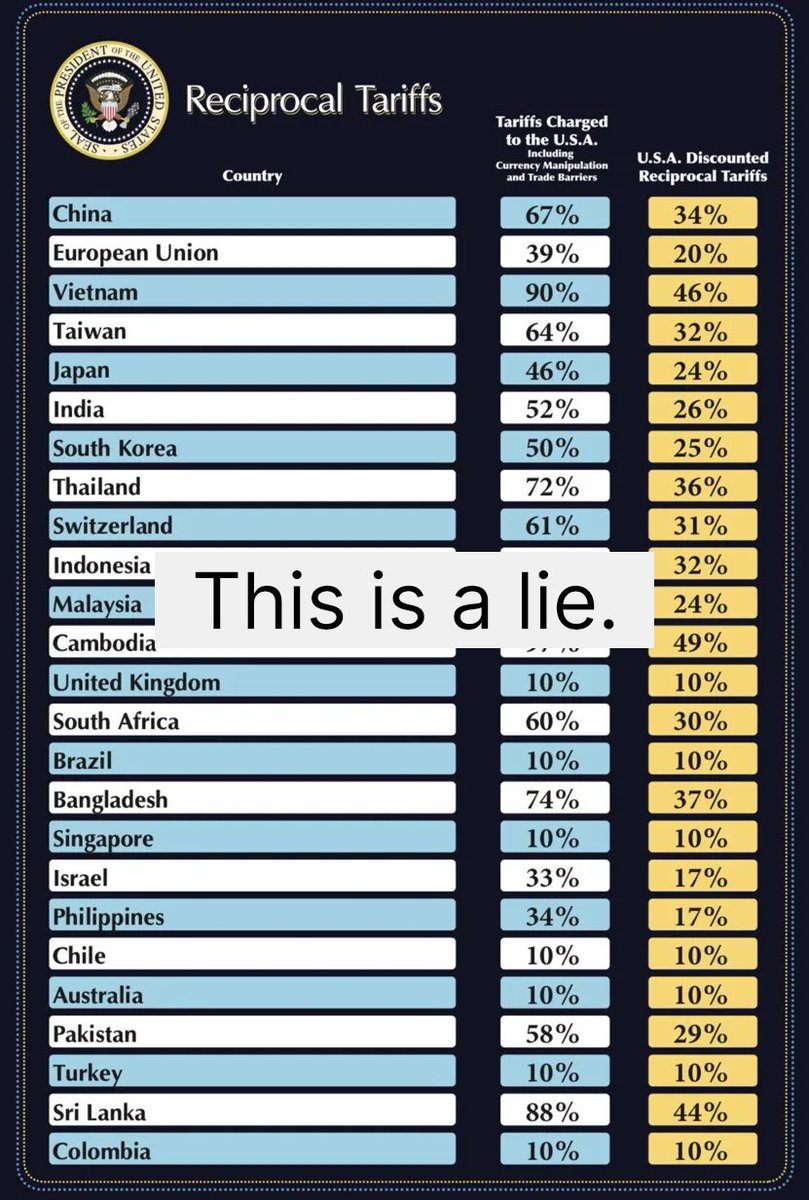

@ReefInsights

This isn’t even to mention that they were framed as reciprocal tariffs when they were not based on actual tariff rates:

[Quoted tweet]

The Administration's Trade Policy Lie

Trump recently announced tariffs on several countries, claiming that the rates were determined based on the "tariffs charged to the USA including currency manipulation and trade barriers."

However, it's now been revealed that this is a lie.

The way these rates were calculated was as follows:

Trade Deficit / Imports = X

X / 2 = Tariff Rate

If X was lower than 10%, it was set at 10%.

For example, let's look at China:

295 / 439 = 67%

67% / 2 = 34%

Another example is Australia:

-18 / 17 = -107%

This is lower than 10%, so the tariff is set at 10%.

Understanding What This Means

To understand how misleading and dubious this announcement was, you need to understand that the stated tariff rate from other countries in the graphic provided by the White House is not the actual tariff rate imposed on U.S. goods.

The World Bank provides tariff data for most countries, and as of 2022, Australia's applied, weighted mean tariff rate was 1.0%.

The term "applied, weighted mean tariff rate" refers to the average tariff a country imposes on imports, adjusted by the relative importance of each product in total imports.

This measure gives more weight to products that make up a larger share of trade, providing a realistic view of the overall tariff burden compared to a simple average.

In addition to having a much lower applied, weighted mean tariff rate, the U.S. and Australia have a free-trade agreement, which allows Australian goods to enter the U.S. without tariffs and Americans goods to enter Australia without tariffs.

In other words, the administration's claim that Australia has a tariff rate of 10% on U.S. goods is a lie.

Let's turn to South Africa, which the administration says has a 60% tariff rate for U.S. goods.

When looking at the applied, weighted mean tariff rate, we find that the rate was 4.7% in 2022.

This is not surprising, as the "tariff rate" was not calculated by evaluating the actual tariffs applied to U.S. goods. Rather, we find that the rate aligns with the aforementioned formula:

8.9 / 14.7 = 60%

60% / 2 = 30%

The final example we'll look at is Germany. The tariff rate applied to Germany is wrapped into the tariff rate that is going to be applied to the European Union, which is 20%.

This is unfortunate, as Germany would've qualified for the 10% minimum tariff if they used the formula:

-84.8 / 160.4 = -112%

This is lower than 10%, so the tariff is set at 10%.

Except, it's not.

It is set at 20% because Germany is part of the European Union. Additionally, as shown in the formula, we actually export more goods to Germany than import, which means we have a trade surplus with the Germans.

This is, and we're not being hyperbolic, fukking stupid.

Misleading the public and formulating trade policy based on falsehoods is both unwise and undiplomatic.

21/22

@BigJTA

I’m ready and have the patience and generosity to see all of this play out for future generations.

22/22

@pilotinvestor7

Here’s what had happened after the Smoot-Harley tariff act :-

(Are you Ready?)

[Quoted tweet]

1/7 This isn’t the first time the US has raised #tariffs . Let’s look at how it ended the last time America tried raising tariffs by 20% on just 26 nations.

Spoiler: It didn’t go well…

To post tweets in this format, more info here: https://www.thecoli.com/threads/tips-and-tricks-for-posting-the-coli-megathread.984734/post-52211196

To post tweets in this format, more info here: https://www.thecoli.com/threads/tips-and-tricks-for-posting-the-coli-megathread.984734/post-52211196 I don't think it's bottomed yet, unfortunately. Dead cat bounce looking shakey after today's action.

I don't think it's bottomed yet, unfortunately. Dead cat bounce looking shakey after today's action.

I don't think it's bottomed yet, unfortunately. Dead cat bounce looking shakey after today's action.

I don't think it's bottomed yet, unfortunately. Dead cat bounce looking shakey after today's action.