Make ourselves richer?

Lets make ourselves richer

!!!!

!!!!

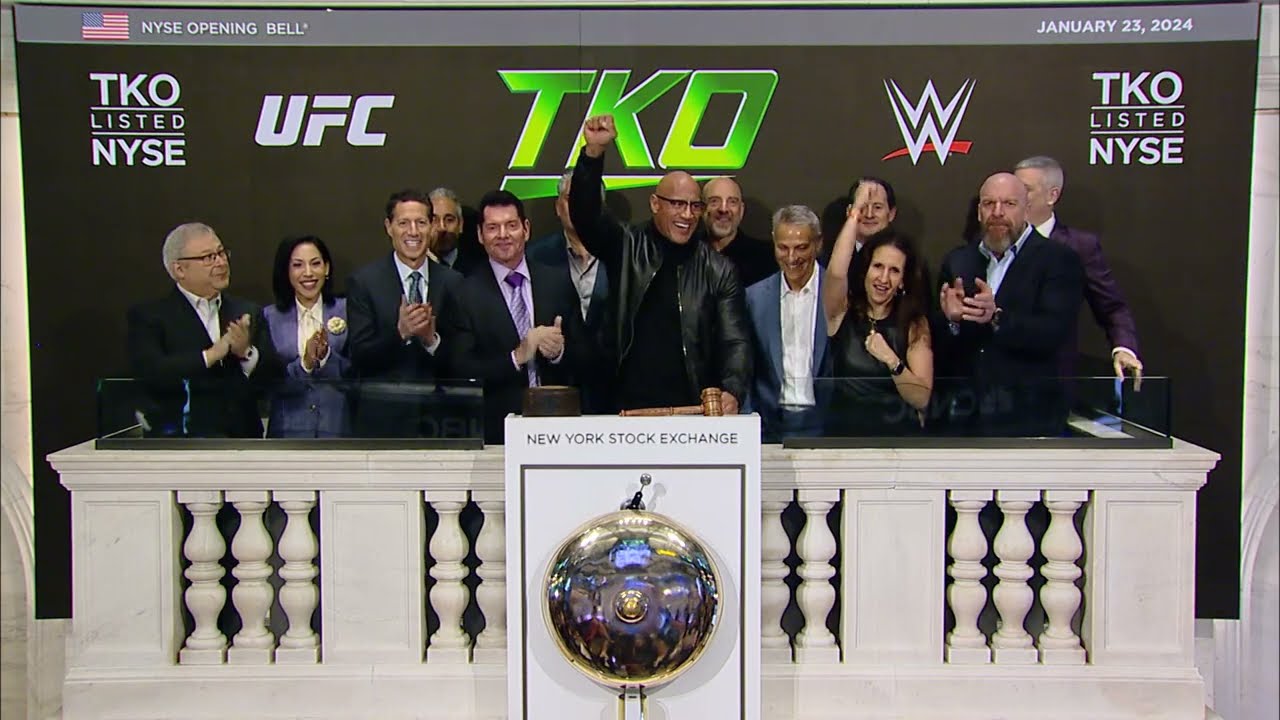

TKO announces $1 billion in share repurchases, stock reacts to announcement

TKO is embarking on a major buyback program of its Class A stock with a commitment of up to $1 billion.

Not even a complaint by me, just an observation...capitalism is a cold motherfukker man lmaoTKO is embarking on a major buyback program of its Class A stock with a commitment of up to $1 billion.

The company has announced via press release that it an entered into an accelerated share repurchase agreement to repurchase $800 million in Class A common stock.

The news includes TKO also entering a trading plan for the repurchase of Class A common stock up to a maximum of $174 million.

Earlier this month, TKO repurchased around $26 million of Class A common stock in a private transaction.

“This plan to repurchase $1 billion in shares reflects our conviction in the business and the intrinsic value of our stock,” said Mark Shapiro, President and COO, TKO. “The repurchases, together with the recent 100% increase to our quarterly cash dividend program, reflect our continued commitment to a robust and sustainable capital return program. We remain focused on executing our balanced capital deployment strategy to deliver long-term value for our shareholders.”

The press release outlined its plan moving forward with the accelerated buyback program and a forthcoming payment of $800 million to Morgan Stanley & Co. in exchange for over 3.1 million shares of Class A common stock.

Under the ASR Agreement, on September 16, 2025, the Company will pay $800 million to Morgan Stanley & Co. LLC and expects to receive an initial delivery of 3,161,430 shares of Class A common stock. The total number of shares to be repurchased pursuant to the ASR Agreement will be based on the volume-weighted average price of Class A common stock on specified dates during the term of the ASR Agreement. Transactions under the ASR Agreement are expected to be completed in December 2025.

Repurchases contemplated under the 10b5-1 Plan are to commence once transactions under the ASR Agreement are completed.

The Company intends to fund the above-mentioned share repurchases with proceeds from the $1.0 billion first lien term loan borrowing that closed on September 15, 2025.

On Monday morning, TKO’s stock saw a near four percent increase after the stock buyback announcement and is trading at nearly $210 per share, and continues to trade at record levels for the company.

Last edited: