Wells Fargo Left Black Homeowners Behind in Pandemic Mortgage Refinancing Boom

Fewer than half of Black applicants were approved by the biggest bank mortgage lender

By Shawn Donnan, Ann Choi, Hannah Levitt and Christopher Cannon

March 11, 2022

When Mauise Ricard III paid a $560.43 application fee to Wells Fargo & Co. on Valentine’s Day in 2020 to refinance his mortgage on a four-bedroom brick colonial in a leafy suburb of Atlanta, he had every reason to expect an easy ride. The Microsoft Corp. engineer is married to a doctor and has a credit score north of 800, putting him in America’s credit elite. The loan officer at the bank even told him he was probably eligible for a fast-track appraisal.

It didn’t take long for problems to appear. Ricard’s house—an investment property that was his home before he moved to another Atlanta suburb in 2017—is in a predominantly Black neighborhood, and in April, the loan officer emailed to say that “perhaps the area is not eligible” for a rapid valuation. By May, she was writing to say the underwriter had more questions. Soon after, Ricard was told he would have to pay a higher 4.5% rate, even though the Federal Reserve had slashed rates to historic lows. Within weeks, Wells Fargo had denied his application. “They kept moving the needle,” Ricard says. “They didn’t want to move forward for whatever reason.”

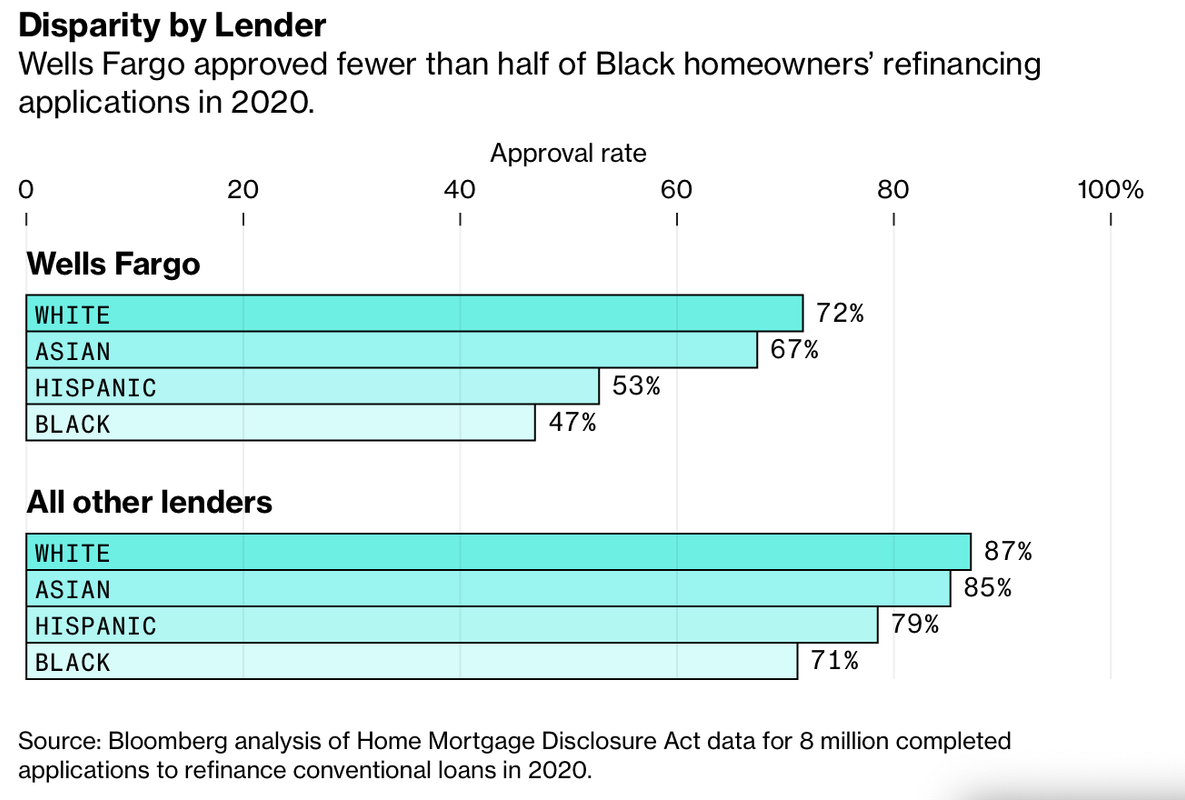

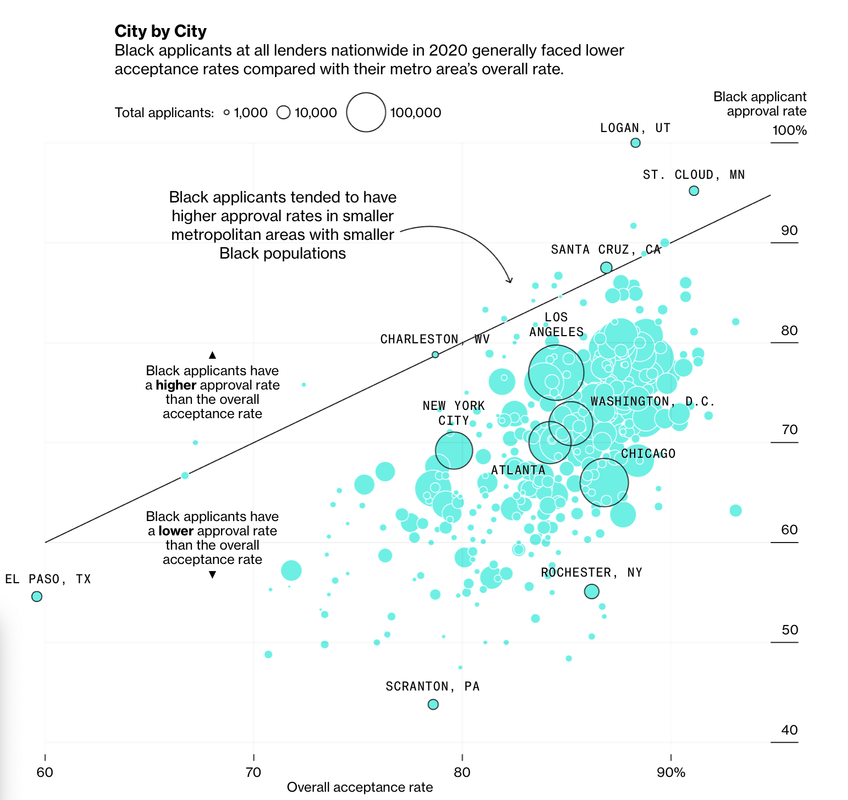

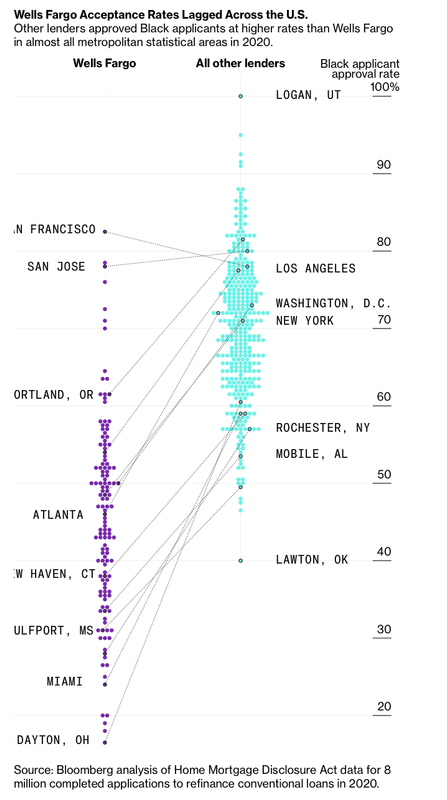

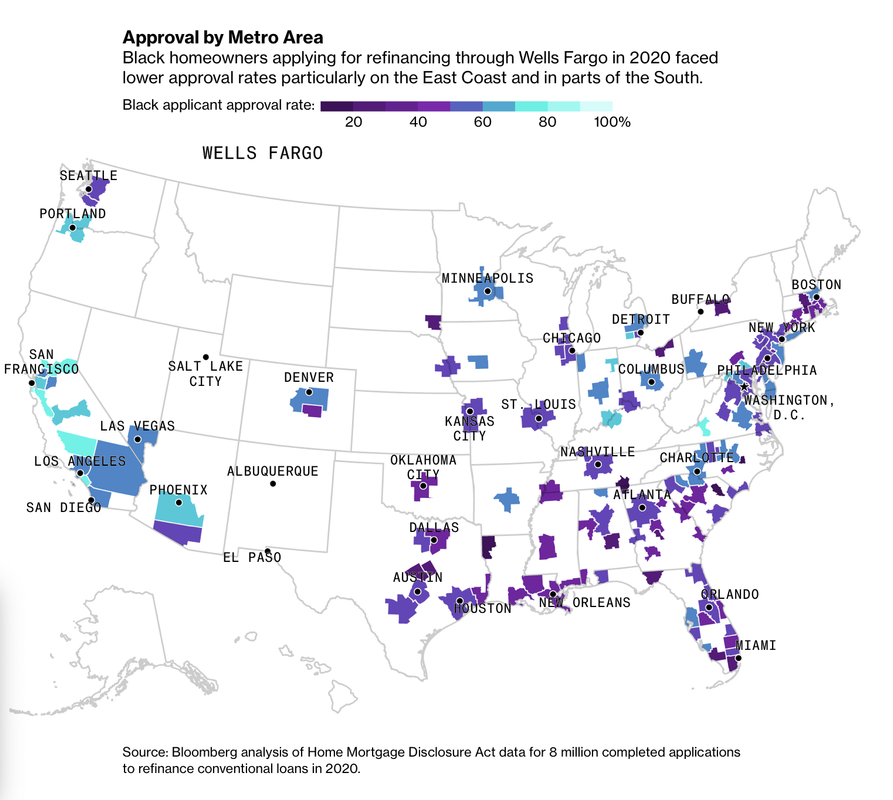

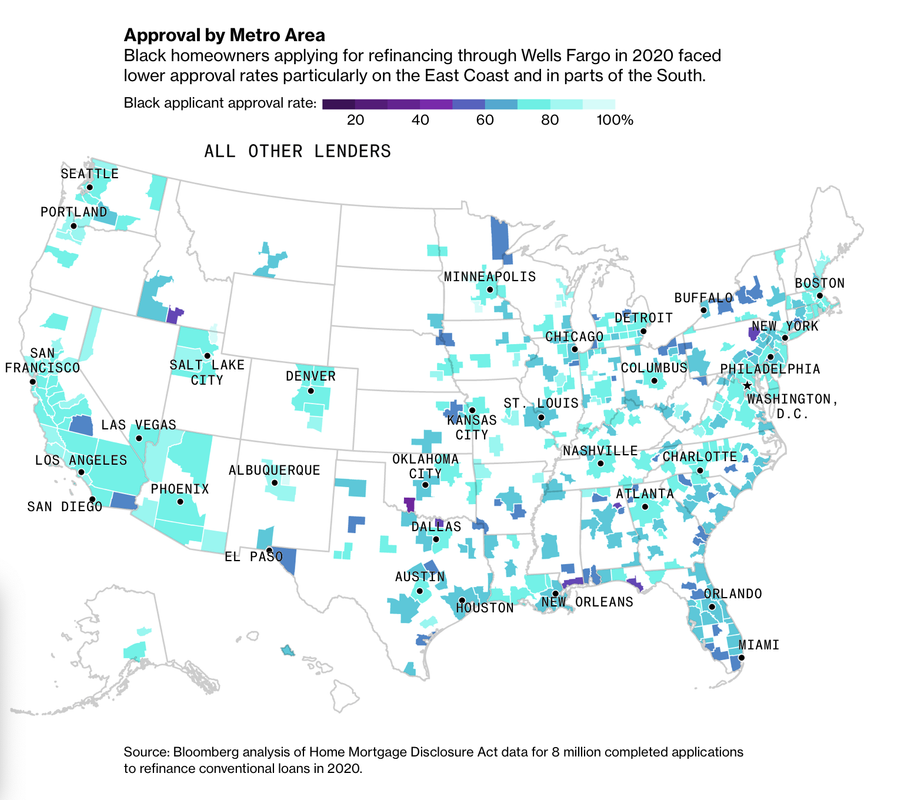

Ricard wasn’t alone. Nationwide, only 47% of Black homeowners who completed a refinance application with Wells Fargo in 2020 were approved, compared with 72% of White homeowners, according to a Bloomberg News analysis of federal mortgage data. While Black applicants had lower approval rates than White ones at all major lenders, the data show, Wells Fargo had the biggest disparity and was alone in rejecting more Black homeowners than it accepted.

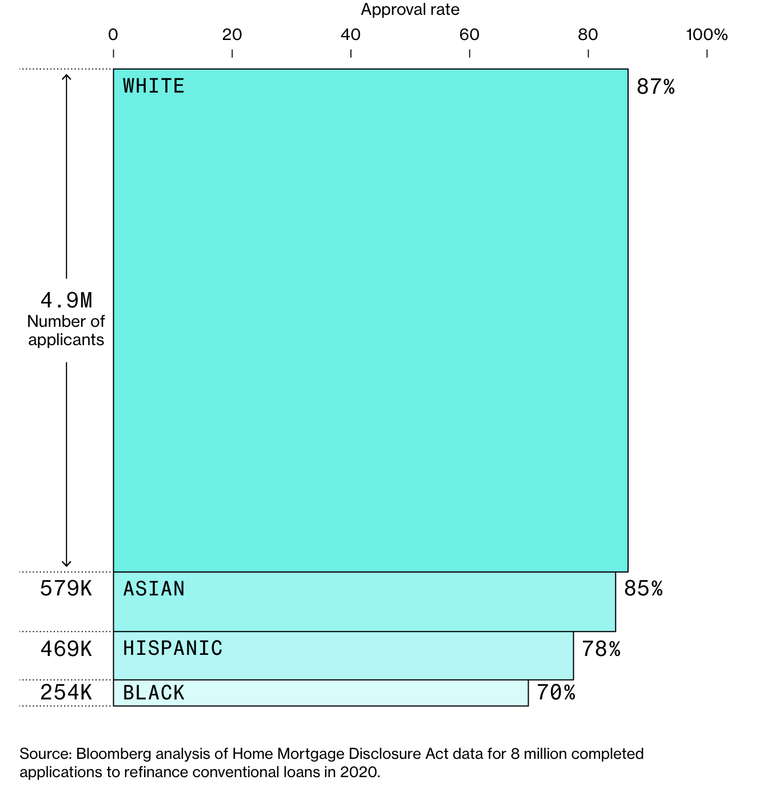

If, as expected, the Fed’s policy committee moves to hike interest rates at its March meeting, it will begin closing the door on a remarkable wealth event that has seen U.S. homeowners refinance almost $5 trillion in mortgages over the past two years, the most since the early 2000s. It’s one that allowed White homeowners to save an estimated $3.8 billion annually by refinancing their mortgages in 2020, according to researchers at the central bank. But it’s a door that barely opened for Black Americans, who make up 9% of all homeowners and locked in just $198 million a year, less than 4% of the savings.

Wells Fargo, which declined to comment about individual customers, didn’t dispute Bloomberg’s statistical findings. It says it treats all potential borrowers the same, is more selective than other lenders, and an internal review of the bank’s 2020 refinancing decisions confirmed that “additional, legitimate, credit-related factors” were responsible for the differences. But even when taking selectivity into account, the San Francisco-based bank had by far the worst record among major lenders when it came to refinancings by Black homeowners, according to Bloomberg’s analysis of Home Mortgage Disclosure Act data for 8 million completed applications to refinance conventional loans in 2020.

JPMorgan Chase & Co., the largest U.S. bank by assets, accepted 81% of refinancing applications from Black homeowners in 2020 compared with 90% from White ones. Bank of America Corp. approved 66% of its Black applicants and 78% of White ones. Rocket Mortgage LLC, which received 1 million refinancing applications in 2020, more than any other lender, had the smallest gap: It approved 79% of Black applicants and 86% of White ones.

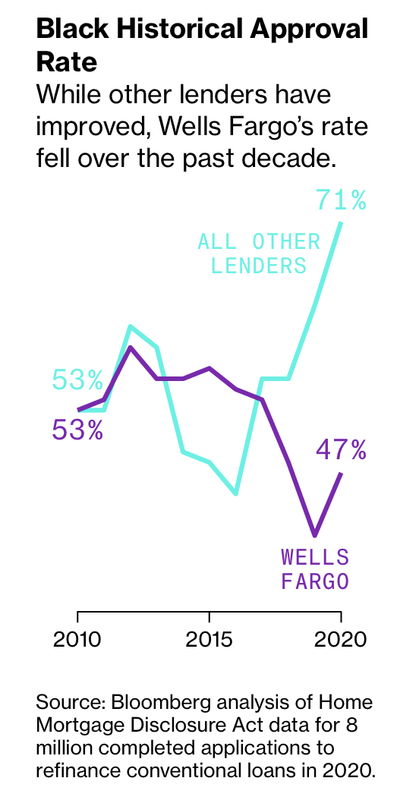

Among major lenders, only Wells Fargo approved a smaller share of refinancing applications from Black homeowners in 2020 than a decade earlier. The bank’s 47% approval rate was its second lowest during the past decade. JPMorgan, Bank of America and Rocket Mortgage, formerly known as Quicken Loans, all approved Black borrowers in 2020 at the highest rate since 2010.

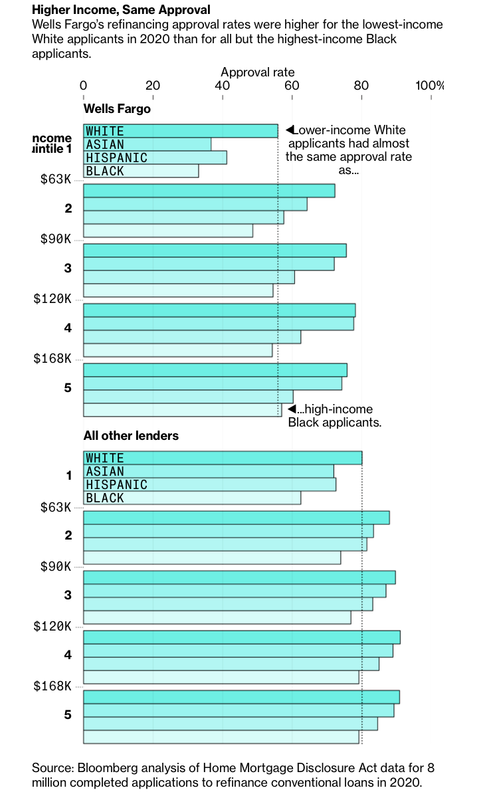

The data also show that 27% of Black borrowers who began an application with Wells Fargo in 2020 withdrew it. That meant only one-third of the 17,702 Black homeowners who sought refinancing were successful. Like the industry as a whole, Wells Fargo approved a greater share of applications from low-income White homeowners than all but the highest-income Black applicants, who had an approval rate about the same as White borrowers in the lowest-income bracket.

Data for 2021 won’t be released until later this year. Wells Fargo says it hasn’t completed an analysis yet and couldn’t comment about whether its refinancing outcomes had changed.

The U.S. Justice Department has hammered banks for lending practices that tend to elevate costs for minority borrowers. After the 2008 housing crisis revealed discriminatory treatment, authorities unleashed a wave of penalties against U.S. lending giants. Wells Fargo agreed in 2012 to pay more than $184 million to settle federal claims that it unfairly steered Black and Hispanic homeowners into subprime mortgages and charged them higher fees and interest rates. The bank didn’t admit to any wrongdoing and said at the time that it treated all customers fairly regardless of race.

U.S. law has long held that a “disparate impact” on minority communities can be evidence of institutional discrimination, meaning regulators don’t have to prove a bank was engaging in deliberate racism to show that it broke fair-lending or fair-housing laws.

The Biden administration is increasing scrutiny of banks and modern forms of discrimination. “If we allow racist and discriminatory policies to persist, we will not live up to our country’s ideals,” Rohit Chopra, head of the Consumer Financial Protection Bureau, said at a press conference in October announcing a new push by the Justice Department and regulators to combat so-called redlining by financial institutions. Among the issues he singled out was the role of mortgage underwriting algorithms that banks have long used, calling the disparities in lending outcomes a sign of “digital redlining, disguised through so-called neutral algorithms.”

Kristy Fercho, who in August 2020 became the first Black woman to oversee Wells Fargo’s home-lending business and its more than 25,000 employees

, says the bank’s processes are race-blind and that its lending decisions were “consistent across racial and ethnic groups.” Any racial disparity in outcomes for refinancing in 2020 was the result of variables Wells Fargo doesn’t control, she and other executives say, including credit scores, the appraised value of homes and broader inequities in the U.S. economy.

, says the bank’s processes are race-blind and that its lending decisions were “consistent across racial and ethnic groups.” Any racial disparity in outcomes for refinancing in 2020 was the result of variables Wells Fargo doesn’t control, she and other executives say, including credit scores, the appraised value of homes and broader inequities in the U.S. economy.The problem is certainly broader than any one bank and gets at the root causes of the racial wealth gap in the U.S. Housing activists have long pointed to a history of mortgage discrimination and resulting disparities in homeownership rates as the major source of enduring wealth inequality. A typical White family had eight times more wealth than a Black one, according to a triennial Fed survey last published in 2019. By the end of September 2021, separate Fed quarterly wealth data showed the gap between White and Black Americans had widened by $20 trillion during the pandemic.

The refinancing gap gets at the ability of Black families to build on the wealth they have. Not being able to refinance a home “means that people have less resources to invest in their children, less resources to start businesses, less resources to renovate their homes, less resources to buy additional homes,” says Andre Perry, a senior fellow at the Brookings Institution whose 2018 study found that the average Black home was valued at $48,000 less than its White equivalent. That differential amounts to $156 billion in missing Black wealth.

The anticipated move by the Fed to raise interest rates in March to combat inflation “effectively locks us out of this wealth-creation event,” Perry says. “It was a brief period of time where we really did need lenders, especially, to step up to the plate in terms of racial equity.”

Perry says that while Wells Fargo and other banks have made efforts to increase lending to minority communities, some still treat Black homeowners with institutional disdain. “How you know that Black people are valued less is by looking at the data,” Perry says. “And for me, Wells Fargo has to look itself in the mirror collectively and say, ‘OK, why are our outcomes worse than other lenders?’”

WELLS FARGO, like other lenders, has been working to distance itself from the past. When the murder of George Floyd prompted a nationwide reckoning over race and America’s economic inequities in 2020, the bank joined the chorus of companies promising to do better. “This is an important moment at our company, and we will not let it go by without substantive changes,” Chief Executive Officer Charlie Scharf wrote in that year’s annual report. “We must move with haste to execute on our plans, and know we will be judged based on our outcomes.”

Scharf was hired in late 2019 after a series of scandals that began with the revelation that employees opened millions of fake accounts to meet sales goals. That led to sanctions, including a Fed-imposed growth ban and the departures of two of Scharf’s predecessors. He’s installed new leaders, including Fercho, who took over a home-lending unit that’s been the source of some of Wells Fargo’s long-standing problems. Regulators spotlighted improper mortgage fees in a 2018 order, and the bank was handed a fresh sanction over lack of progress on that order last year.

The bank has settled several class-action lawsuits brought by municipalities claiming that foreclosures during the financial crisis depressed property values and that Wells made it difficult for minority homeowners to refinance high-interest mortgages. It still faces others. In one federal case filed last year, lawyers for Georgia’s Cobb, DeKalb and Fulton counties cited foreclosures Wells Fargo had sought in minority neighborhoods as recently as May 2019. The foreclosure files included an Atlanta property with a 12.125% adjustable-rate mortgage. Wells Fargo has denied any wrongdoing and in court filings questioned both the counties’ standing to bring a suit and whether too much time had elapsed since the alleged wrongdoing.

Fercho says Wells Fargo is looking at how to better serve Black communities that have often been suspicious of lenders based on generations of discrimination. Among the steps: encouraging Black homeowners, who refinance less frequently than White ones, to take advantage of opportunities to lower their rates. Fercho cites her own mother’s reluctance to refinance her mortgage at any point in its 30-year life as an example of a broader issue. When she asked her mother why she had never refinanced given the money she could have saved, “her answer was ‘I could afford my payments. So there was no reason for me to change it.’”

Wells Fargo has also announced a push to increase Black homeownership and in 2021 invested $50 million in 13 Black-owned community banks. In 2017, it pledged to help create 250,000 new Black homeowners by 2027, a goal Fercho says the bank is on pace to meet or exceed.

But the difficulties some Black customers faced left them frustrated with Wells Fargo. When Cherylnita Cone sought to refinance the Wells Fargo mortgage on her three-bedroom bungalow in College Park, Georgia, in 2020, she was surprised to find that the bank quoted her a rate half a percentage point higher than she found elsewhere. Cone, a software systems analyst for a packaging company, and her husband, an aircraft painter for Lockheed Martin Corp., have lived in the home for 25 years. “I would think, ‘Hey, I’m with you all,’” she says. “I pay timely. I have a good credit score. And this is all with the same lender, hoping it would be cheaper.”

Last edited:

after all those years of criminal activity, discrimination and fraud.

after all those years of criminal activity, discrimination and fraud.