Contrefaire

Superstar

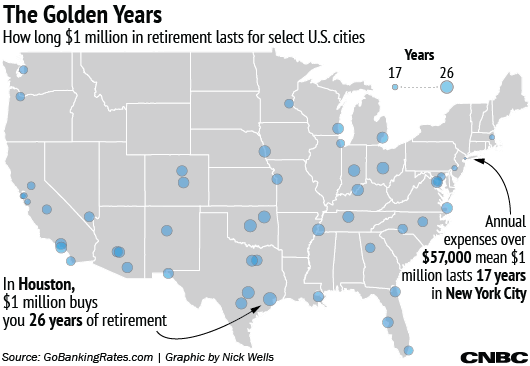

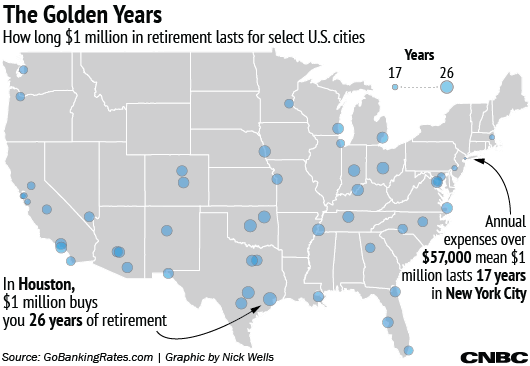

Once a nest egg hits the $1 million mark, most soon-to-be retirees assume they are set. Depending on where you live, that may not be enough.

For those on the East and West coasts, that sum will last less than two decades.

GoBankingRates measured how long $1 million in savings would last in cities across the country by comparing average expenses for people age 65 and older, including groceries, housing, utilities, transportation and health care.

Dollars stretched the furthest in cities like Houston, Austin, Texas, and Memphis, Tennessee, where annual expenditures were around $40,000 a year.

It's little surprise that retirees could blow through $1 million much faster in hotspots like New York, Boston and San Francisco by spending upward of $55,000 annually just getting by.

This is how long $1 million in retirement really lasts

Imagine retiring a "millionaire" only to turn around and have to penny pinch and live off of $40k a year just to make it.

That means no lazy days of leisure on your boat, no fukking off to South America or Africa for weeks or months at a time, no trips across the country with your wife and kids (or grandkids) no paying for tuition; hell, if you make it to 90 you're broke and have zero to leave behind outside of maybe life insurance and real estate if you're lucky.

For those on the East and West coasts, that sum will last less than two decades.

GoBankingRates measured how long $1 million in savings would last in cities across the country by comparing average expenses for people age 65 and older, including groceries, housing, utilities, transportation and health care.

Dollars stretched the furthest in cities like Houston, Austin, Texas, and Memphis, Tennessee, where annual expenditures were around $40,000 a year.

It's little surprise that retirees could blow through $1 million much faster in hotspots like New York, Boston and San Francisco by spending upward of $55,000 annually just getting by.

This is how long $1 million in retirement really lasts

Top 5 cities where $1 million will last the longest:

1. Houston

$1 million will last: 25 years, 11 months

2. Oklahoma City

$1 million will last: 24 years, 7 months

3. Austin, Texas

$1 million will last: 24 years, 6 months

4. Tulsa, Oklahoma

$1 million will last: 24 years, 4 months

5. Memphis, Tennessee

$1 million will last: 24 years, 3 months

Top 5 cities where $1 million will last the shortest:

1. New York

$1 million will last: 17 years, 6 months

2. Boston

$1 million will last: 17 years, 11 months

3. San Francisco

$1 million will last: 17 years, 11 months

4. Philadelphia

$1 million will last: 18 years, 0 months

5. San Jose, California

$1 million will last: 18 years, 2 months

1. Houston

$1 million will last: 25 years, 11 months

2. Oklahoma City

$1 million will last: 24 years, 7 months

3. Austin, Texas

$1 million will last: 24 years, 6 months

4. Tulsa, Oklahoma

$1 million will last: 24 years, 4 months

5. Memphis, Tennessee

$1 million will last: 24 years, 3 months

Top 5 cities where $1 million will last the shortest:

1. New York

$1 million will last: 17 years, 6 months

2. Boston

$1 million will last: 17 years, 11 months

3. San Francisco

$1 million will last: 17 years, 11 months

4. Philadelphia

$1 million will last: 18 years, 0 months

5. San Jose, California

$1 million will last: 18 years, 2 months

Imagine retiring a "millionaire" only to turn around and have to penny pinch and live off of $40k a year just to make it.

That means no lazy days of leisure on your boat, no fukking off to South America or Africa for weeks or months at a time, no trips across the country with your wife and kids (or grandkids) no paying for tuition; hell, if you make it to 90 you're broke and have zero to leave behind outside of maybe life insurance and real estate if you're lucky.

Last edited: