At least five interesting things for the middle of your week (#21)

Saudi oil, delayed economic optimism, the EV revolution, U.S. education performance, Indian industrialization, and Chinese urbanism

1. Why is Saudi Arabia producing less oil?

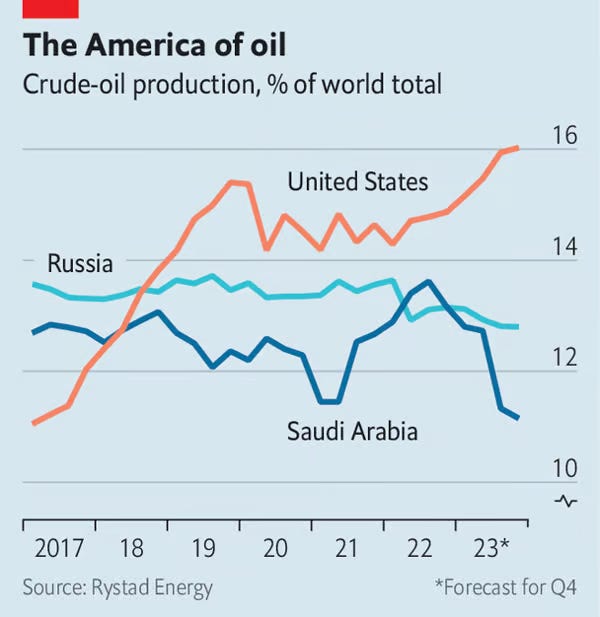

Traditionally, people thought that Saudi Arabia was the world’s crucial “swing producer” of oil. The basic idea was that even though Saudi was far from a monopolist in the global oil market, they were the only producer who could increase or decrease production by huge amounts in a very short time frame. And so it was thought that the Saudis could basically control global oil prices, both because global demand is inelastic (meaning that modest swings in production can change prices a lot) and because the other OPEC countries would follow the Saudis’ lead.But in recent years, another key swing producer has emerged: the United States. Since around 2010, the biggest swing by far has been the rise of U.S. shale oil production. And even as the Saudis have slashed production in 2023, the U.S. has raised its own oil output by almost as much.

Source: The Economist via Stefan Schubert

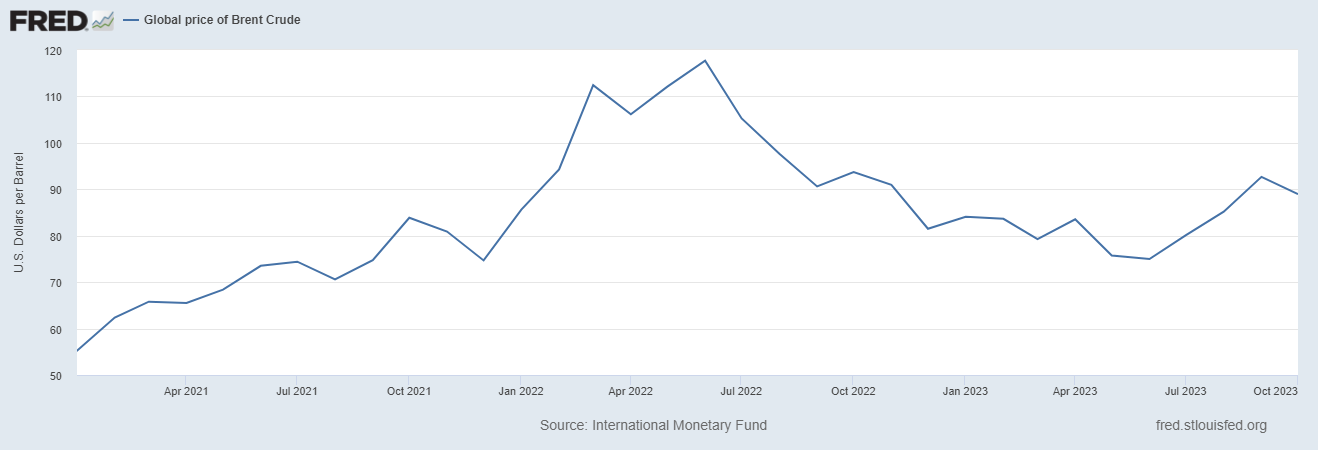

And guess which way prices have moved as a result:

The U.S. is winning the tug-of-war. Saudi has cut production, but prices have gone down anyway. The combination of fewer barrels sold and fewer dollars per barrel is dealing a crushing blow to the Saudi economy. The country is now in a recession, with GDP shrinking at a stupendous 4.5% annualized rate in the third quarter.

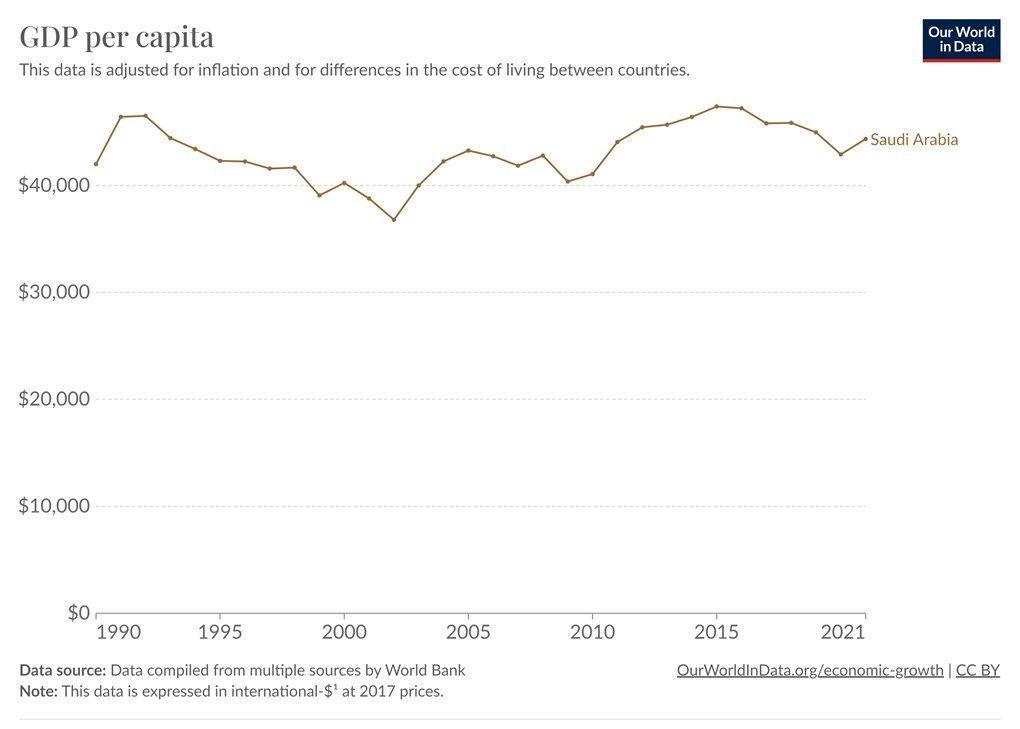

The Saudis are in big trouble. Their ability to push oil prices around like a monopolist is gone, so cutting production simply impoverishes them. That’s bad news for a country that has seen zero GDP growth in 30 years:

So did the Saudis just make a simple mistake when they cut output? Did they think they were still the swing producer? Or is there some other reason they’re curbing production? Are they even able to maintain production without massively driving up extraction costs? Is it possible that their legendary spare capacity has actually dried up?

If so, that would help explain the country’s eagerness to break into the tech industry. If Saudi oil capacity is weaker than they’re letting on, then diversifying their economy isn’t just a means of resuming growth; it’s necessary to avoid decline.