CAPITAL

1.The Problem: Economic Apartheid. To put it bluntly, White people shut-out Black folk from participation in the economy by limiting access to money and other resources. When they do give us the resources, it often comes with a vicious small print.

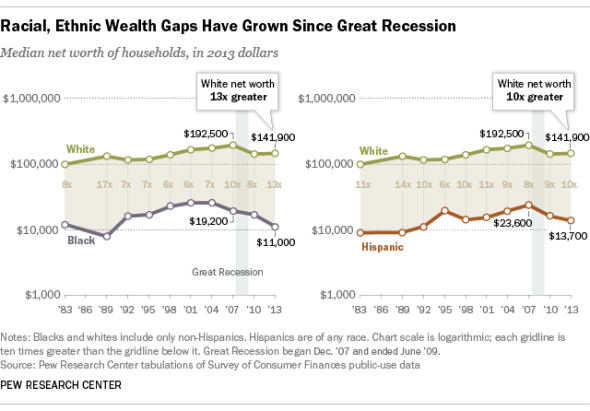

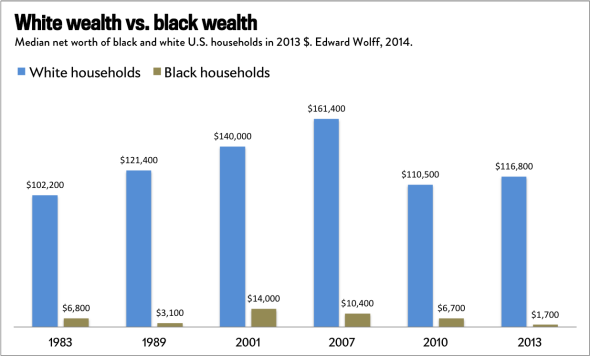

Below is a various graphics depicting the denial of credit and credit at high-cost that have made "Black wealth" something more apt for a science fiction novel.

1.The Problem: Economic Apartheid. To put it bluntly, White people shut-out Black folk from participation in the economy by limiting access to money and other resources. When they do give us the resources, it often comes with a vicious small print.

Below is a various graphics depicting the denial of credit and credit at high-cost that have made "Black wealth" something more apt for a science fiction novel.

Major Banks Profit from Payday Loans; Blacks More Likely to Use ThemAs many states crack down on so-called “payday” loans, a new report reveals that major banks like JP Morgan Chase, Bank of America and Wells Fargo are behind-the-scenes partners in the practice of giving short-term loans to consumers with interest rates as high as 500 percent.

The lenders who issue the payday loans are trying to avoid the bans currently in effect in 15 states by setting up shop in more hospitable states or beyond the U.S. borders, in countries like Belize and Malta, and in the West Indies, according to a story in The New York Times.

“While the banks, which include giants like JPMorgan Chase, Bank of America and Wells Fargo, do not make the loans, they are a critical link for the lenders, enabling the lenders to withdraw payments automatically from borrowers’ bank accounts, even in states where the loans are banned entirely,” Jessica Silver-Greenberg wrote in the Times. “In some cases, the banks allow lenders to tap checking accounts even after the customers have begged them to stop the withdrawals.”

“Without the assistance of the banks in processing and sending electronic funds, these lenders simply couldn’t operate,” Josh Zinner told the Times. Zimmer is co-director of the Neighborhood Economic Development Advocacy Project, which works with community groups in New York.

The study by the Safe Small-Dollar Loans Research Project at Pew found that 10 percent of renters have used a payday loan, compared with 4 percent of homeowners; 11 percent of people making between $15,000 and $25,000 have used a payday loan, with the proportion decreasing further up the income ladder; and 12 percent of African-Americans have taken out payday loans, more than twice the figure for whites (4 percent), and twice the figure for Hispanics and other races or ethnicities (both at 6 percent).

“Although payday loans are marketed as short-term emergency loans, in reality, most borrowers used them for recurring living expenses and become indebted for an average of five months,” Nick Bourke, the research project’s director, told USNews.com.

http://www.theguardian.com/us-news/...ke-ends-meet-owe-36-times-that-sum?CMP=twt_guThis is the alternative economy of payday loans, which has sprung up where the old economy has died.

In St Louis, a payday loan is something with which you are either intimately familiar or completely oblivious. The locations of payday loan outlets correspond to income: the lower the regional income, the more payday loan centers you will find. The 249 payday lenders in the St Louis metro area are almost entirely absent from wealthy or middle class areas. The outlets supply small loans – usually under $500 – at exorbitant interest rates to be paid off, ideally, with one’s next paycheck.

“You only see them in poor neighborhoods,” says Tishaura Jones, the treasurer of St Louis and an active campaigner to regulate the industry. “They target people who don’t have access to normal banking services or who have low credit scores. It’s very intentional.”

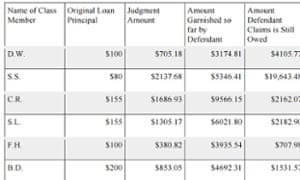

A chart from a publicly available legal brief, Hollins v Capital Solutions Investments Inc, shows how much money a borrower took out and what they ended up owing.

The explosion of payday lending is a recent phenomenon. According to the Better Business Bureau, the number of lenders grew nationally from 2,000 in 1996 to an estimated 22,000 by 2008. In Missouri, there are 958 more payday lenders than there are McDonald’s restaurants, a ratio reflected in most US states. The 2008 economic collapse only increased the outlets’ clientele, particularly in St Louis, which has more unbanked people than any other US city.

“The effects of payday loans on families are tenfold,” explains Jones. “If they can’t pay it back they have two choices. They can roll it over to another one and then pay more, or they can try to pay it back – but then something else goes unpaid. They can’t get out. They’re in a constant cycle of debt. Fifty percent of families are in liquid-asset poverty, which means they lack any sort of savings. The average amount that a family lacks for what they call liquid-asset poverty is $400. It seems insignificant, but $400 can mean life or death.”

“Here’s a client of ours,” he says, showing me a legal brief. “She borrowed $100. She made one instalment payment, couldn’t pay the rest, and was sued. Since then they’ve collected $3,600 in payments by garnishing her wages. That’s 36 times the hundred bucks she owed. They told her she still owes $3,600 more. The wage garnishments are reducing the debt slower than the high interest, which is 200%. She called her attorney and asked ‘When will I be done paying this?’ And he said: ‘Never.’ It’s indentured servitude. You will never, ever be done.”

Vieth’s client is lucky compared with others mentioned in the case file: one borrowed $80 and now owes the payday lender $19,643.48.

Poor Americans no longer live check to check: they live loan to loan, with no end in sight.

Inside the Battle Over Florida's Racially-Charged Payday Loan Racket | VICE | United StatesBut the report's authors determined the addresses for every single payday loan location in Jacksonville, Miami, Orlando, and Tampa, and found that a majority are concentrated in African American and Latino communities.

"Neighborhoods where over fifty percent of the population is black or Latino you have payday loan store concentrations that are twice as large than neighborhoods where less than twenty-five percent of the population is black or Latino," Davis said. "Also low income communities that are eighty percent below Florida's median income level have four times the concentration of payday loan stores than communities that are one hundred twenty percent over the median income level."

To combat this, many Black folk think the solution is forming an alternate/group economy within the USA to ensure the best use of the capital we do have. While I think this is a piece of the puzzle, this has huge flaws that requires Black folks to look beyond "Black economics" as a means to dismantle White supremacy. As this author puts it more eloquently than I:

“The Black Dollar”Now. The call for moving money to Black Banks. If you wish to do so, you can. But once again, this does not attack the PIC and white supremacy. Everyone, yes including you check account holder, is vulnerable to capitalism. ALL banks, regardless of who owns them, are regulated by the same entity, the FDIC. This institution is set up to make sure that smaller banks never get large and large banks like BoA remain too big too fail. Meaning, moving your money would actually mean nothing to them since they will be bailed out by our government. Also, the FDIC is responsible for shutting down Black owned banks. This isn’t the firebombing of Black Wall Street in 1921, but it’s an attack none the less.