this shows up on ur credit report as 0% utilization which hurts u slightly... better to have low utilization instead of none especially when it comes to asking for higher credit limitsI typically pay it off at the end of each day

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Credit card balances reached a record-setting $866 billion in the third quarter of last year.

- Thread starter Sad Bunny

- Start date

More options

Who Replied?Jokers done did a complete 180 from the savings and paying off they credit cards during the peak of covid

The homie Jerome Powell like this right now.

Yup.

Anyone with over $15k on them damn cards is fukked.

Not know how to use a credit card properly as an adult brehs.

All you gotta do is move the debt to a 0% interest card while paying slightly above the monthly minimum payment. While you do this you save up. Your credit score will go up during this period. Use the credit card on something you know you normally have cash for such as groceries for your monthly payment.

All you gotta do is move the debt to a 0% interest card while paying slightly above the monthly minimum payment. While you do this you save up. Your credit score will go up during this period. Use the credit card on something you know you normally have cash for such as groceries for your monthly payment.

i got hurt in the beginning of the year and i couldnt work for a couple of months and i blew through all my credit cards. the interest is killing me. and they just raised the interest again. idk how ima make it cause the minimum payment aint doin shyt.

Do this.

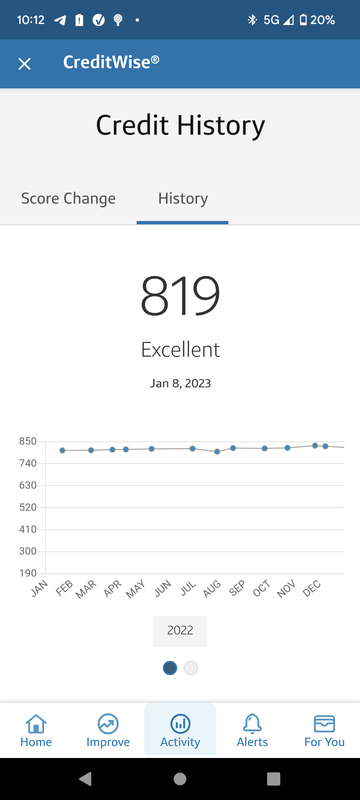

brehs are you suppose to pay your card in full each month or leave a balance?I got $100 just sitting there from my last payment

NO!

This country was built on glorifying not paying up

I had to come back to this post. The layers of truth to this shyt is wild. nikka dropped scripture on a Saturday eve.

I had to come back to this post. The layers of truth to this shyt is wild. nikka dropped scripture on a Saturday eve.All mine add up to 153K73k credit card limit....damn

I'd bewith that much spending power. It's a trap

I was bad and stuck in debt for years 2015-2018 ish.

Learned my lesson. I only have one physical card now. My wife hid the rest and some were cut up and I never use them. I just have a random bill on them (Hulu, Disney, cell phone, Netflix etc)

As long as you pay it off before the interest you’re good, so just pay it whenever.brehs are you suppose to pay your card in full each month or leave a balance?I got $100 just sitting there from my last payment

fukk. Any chance you will get a pay raise at work? I know wages been creeping a bit by demand with all the inflation. Maybe that will help? Or some kind of balance transfer to another card with some sort of 6 month to 1 year introductory 0% APR period? That sort of move to transfer a balance to a competing card for a grace period on interest rates is a bit of a pain in the ass to apply for but it can be a lifesaver if you just need time to get back on your feet so you can cut that balance down enough to stop being drowned by the interest.i got hurt in the beginning of the year and i couldnt work for a couple of months and i blew through all my credit cards. the interest is killing me. and they just raised the interest again. idk how ima make it cause the minimum payment aint doin shyt.

This country operates on debt…. Covid was the test.. shyt recoveredDamn that's wild this country is in serious trouble.

BunchePark

Coli N Calisthenics

Elim Garak

Veteran

On debt yes but too much credit card debt is very bad especially a big jump in such a short time it is very telling.This country operates on debt…. Covid was the test.. shyt recovered

Insensitive

Superstar

I suggest everyone try one of the debt pay off methods suggest in the six figure,six cert area.

I'm doing the "Snow ball" method right now.

I'm focusing on staying within my means, killing off any additional debt while trying to maintain

my monthly investment strategy.

The second you clear up any remaining debts, take the money you were dumping into cleaning up

debt and poor it into your asset accrual. fukk being just over broke constantly paying back debts.

I'm doing the "Snow ball" method right now.

I'm focusing on staying within my means, killing off any additional debt while trying to maintain

my monthly investment strategy.

The second you clear up any remaining debts, take the money you were dumping into cleaning up

debt and poor it into your asset accrual. fukk being just over broke constantly paying back debts.