OfTheCross

Veteran

Covid's pause is giving people a 2nd chance at creditworthiness

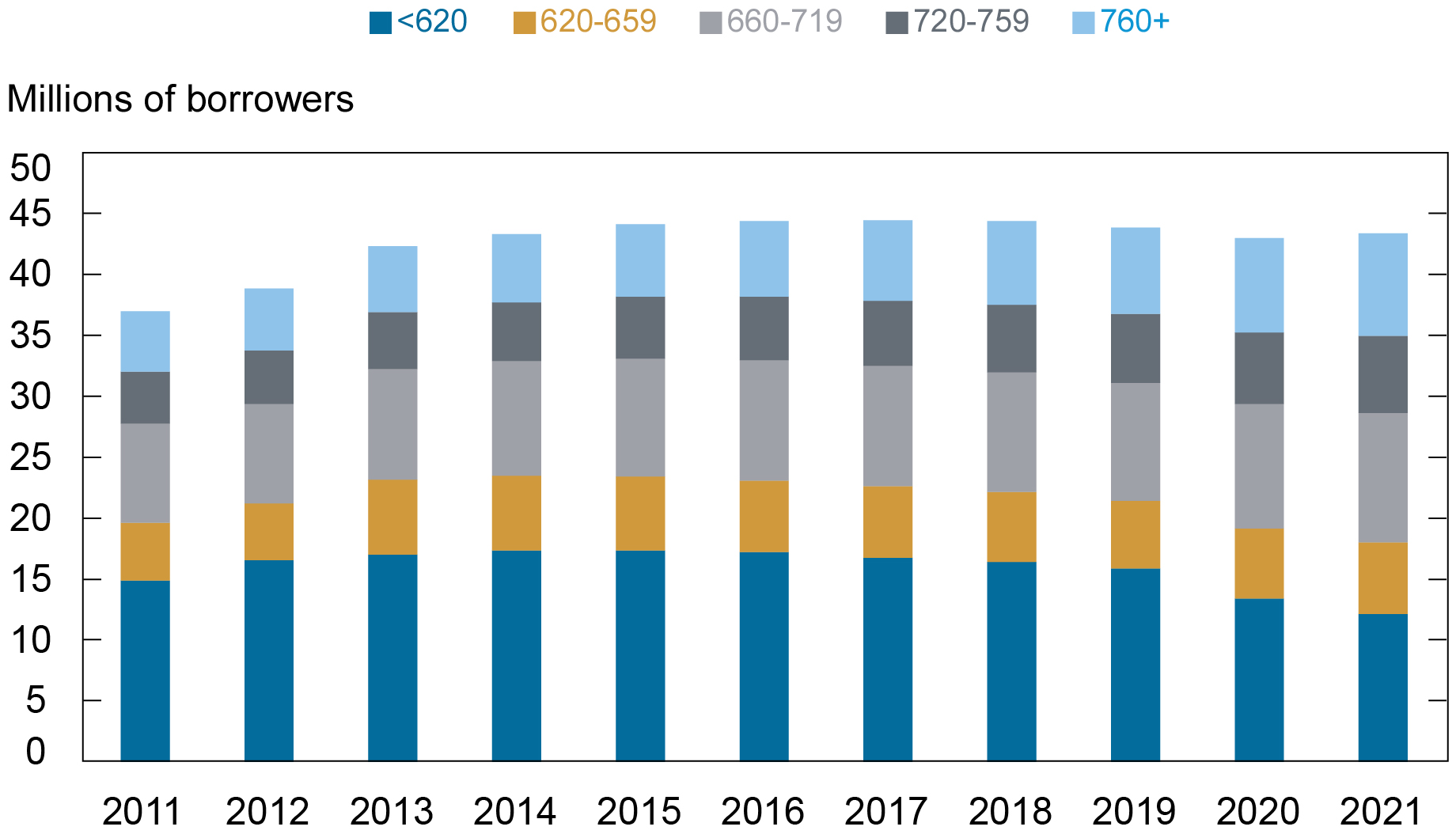

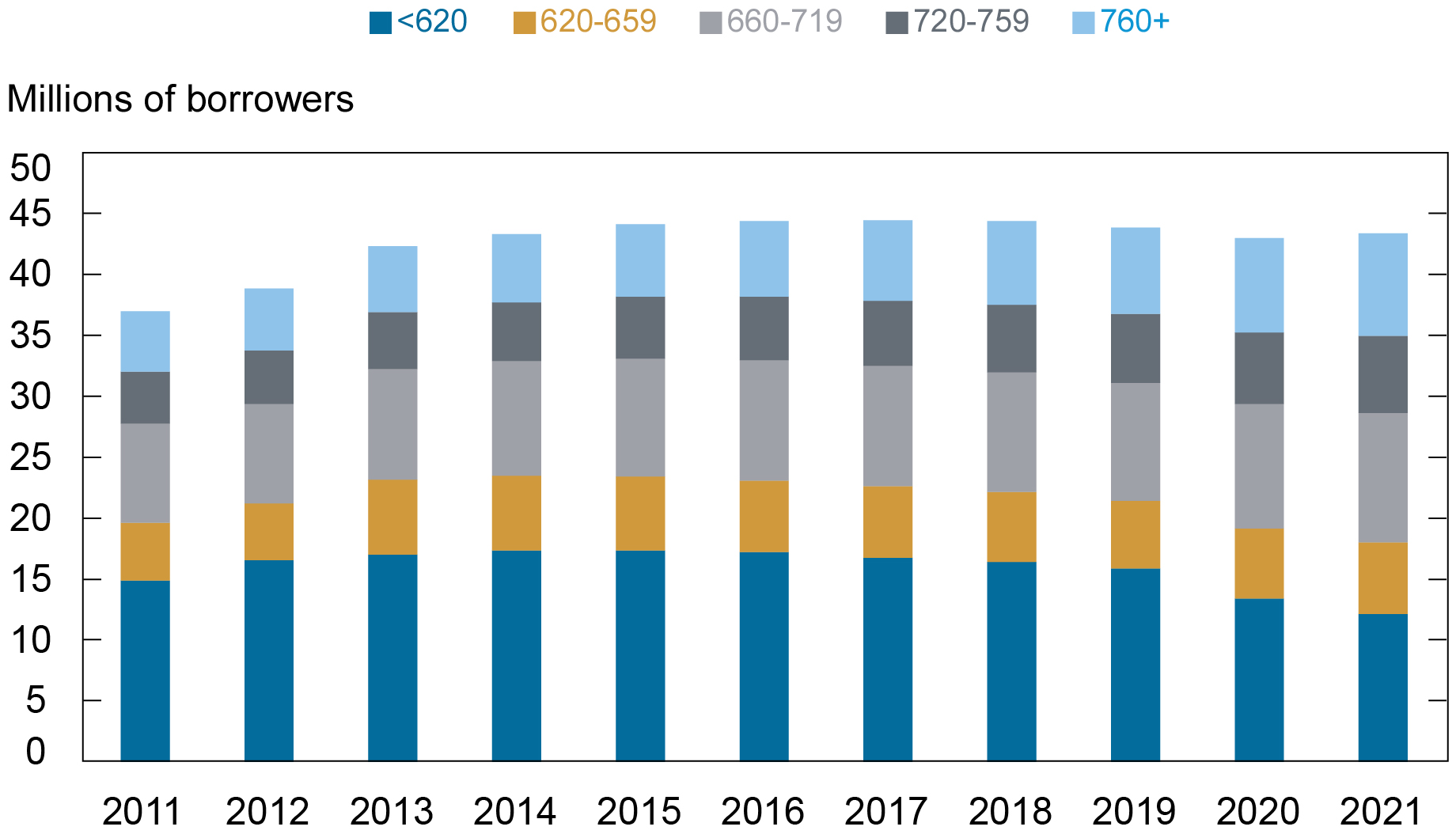

Student Loan Borrowers Reached Highest Overall Creditworthiness in 2021

Source: New York Fed Consumer Credit Panel/Equifax.

Note: Credit scores here are Equifax Risk Scores, which are comparable to FICO credit scores.

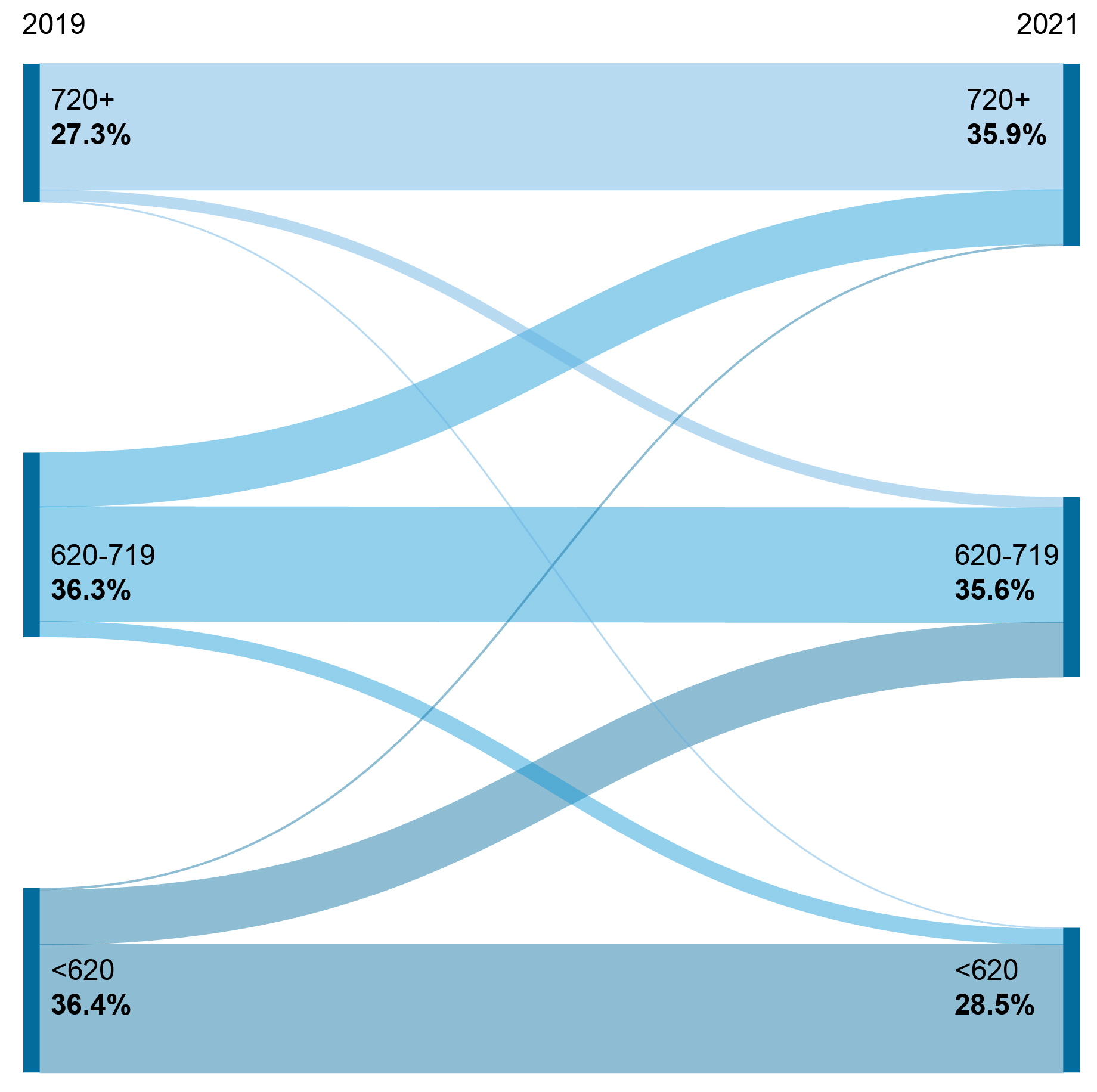

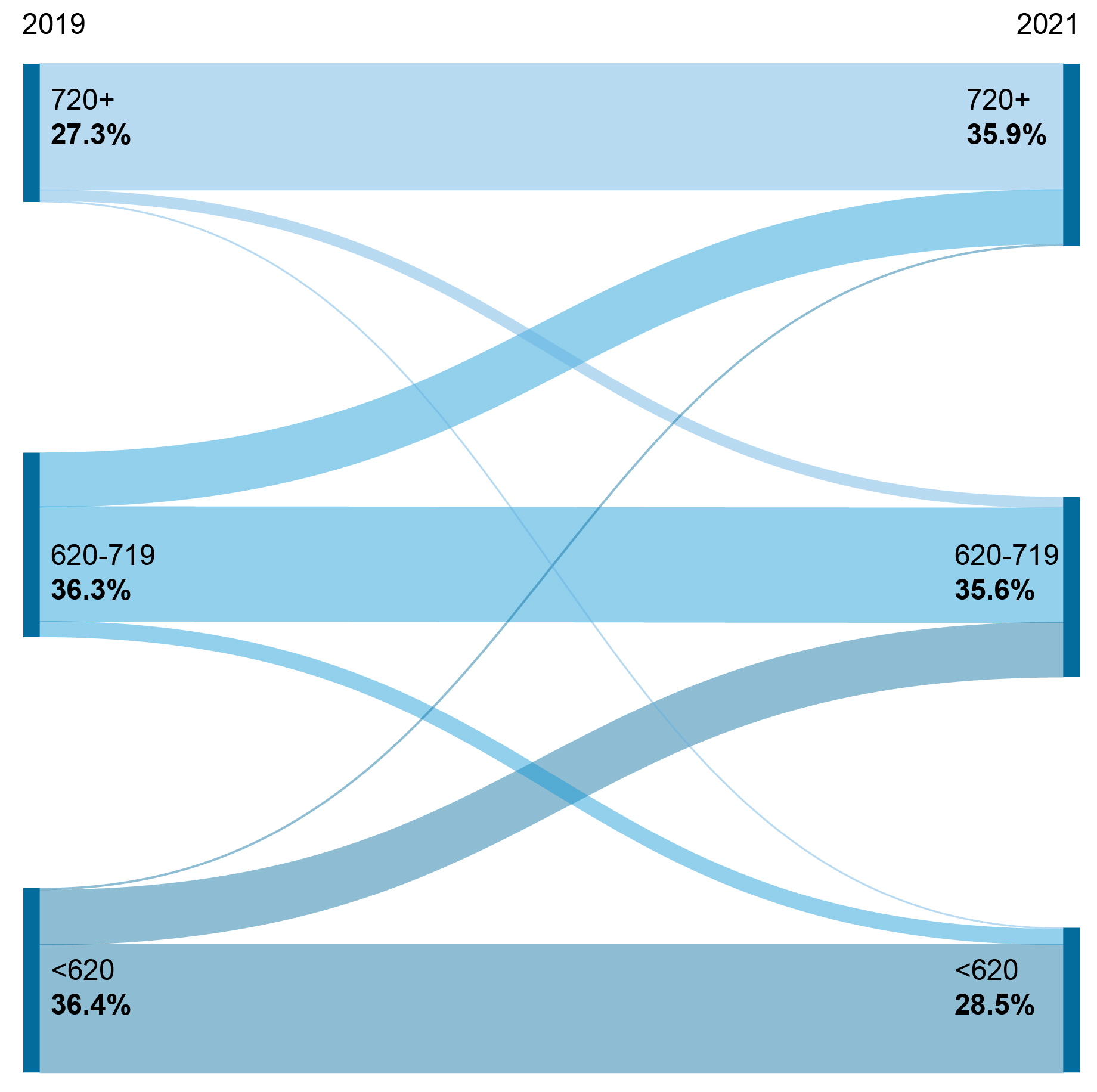

The chart below shows credit score migrations of borrowers with a recorded balance and risk score in both 2019:Q4 and 2021:Q4. For simplicity, we reduce the number of credit score groups to three: subprime borrowers (with credit scores below 620), borrowers with credit scores from 620-719, and super-prime borrowers (with scores over 720). During the pandemic, there were significant flows to higher credit score groups. For example, by the end of 2021, 29.7 percent of formerly subprime borrowers moved to the 620-719 group (with a median risk score increase of 82 points), and 29.4 percent in the middle risk score group moved to the highest group (with a median risk score increase of 54 points). In total, 79.1 percent (30 million) borrowers saw increases to their credit scores during the pandemic, and 21.9 percent (8 million) increased their scores enough to migrate to a higher credit score group as defined here. This shifting of the credit score distribution is greater than for a similar period before the pandemic. Between 2017 and 2019, 71.9 percent (27 million) increased their credit scores, and 16.1 percent (6 million) increased their scores enough to migrate to a higher group. For some, the improvement in risk score stemmed from overall better financial footing; for example, credit card utilization, which influences the score, declined for student loan borrowers from 64.6 percent in 2019 to 58.5 percent in 2021. Student loan borrowers who were delinquent prior to the pandemic saw the largest increases in risk scores when their balances were marked current at the start of the pandemic. The median change among these borrowers was a greater than 100-point increase.

Nearly 80 Percent of Student Loan Borrowers Had Higher Credit Scores by the End of 2021

Source: New York Fed Consumer Credit Panel/Equifax.

Source: New York Fed Consumer Credit Panel/Equifax.

Note: Credit scores here are Equifax Risk Scores, which are comparable to FICO credit scores.

Three Key Facts from the Center for Microeconomic Data's 2022 Student Loan Update - Liberty Street Economics

In connection with the Center for Microeconomic Data's 2022 Student Loan Update, we highlight three facts about the current student loan landscape.

libertystreeteconomics.newyorkfed.org

Student Loan Borrowers Reached Highest Overall Creditworthiness in 2021

Source: New York Fed Consumer Credit Panel/Equifax.

Note: Credit scores here are Equifax Risk Scores, which are comparable to FICO credit scores.

The chart below shows credit score migrations of borrowers with a recorded balance and risk score in both 2019:Q4 and 2021:Q4. For simplicity, we reduce the number of credit score groups to three: subprime borrowers (with credit scores below 620), borrowers with credit scores from 620-719, and super-prime borrowers (with scores over 720). During the pandemic, there were significant flows to higher credit score groups. For example, by the end of 2021, 29.7 percent of formerly subprime borrowers moved to the 620-719 group (with a median risk score increase of 82 points), and 29.4 percent in the middle risk score group moved to the highest group (with a median risk score increase of 54 points). In total, 79.1 percent (30 million) borrowers saw increases to their credit scores during the pandemic, and 21.9 percent (8 million) increased their scores enough to migrate to a higher credit score group as defined here. This shifting of the credit score distribution is greater than for a similar period before the pandemic. Between 2017 and 2019, 71.9 percent (27 million) increased their credit scores, and 16.1 percent (6 million) increased their scores enough to migrate to a higher group. For some, the improvement in risk score stemmed from overall better financial footing; for example, credit card utilization, which influences the score, declined for student loan borrowers from 64.6 percent in 2019 to 58.5 percent in 2021. Student loan borrowers who were delinquent prior to the pandemic saw the largest increases in risk scores when their balances were marked current at the start of the pandemic. The median change among these borrowers was a greater than 100-point increase.

Nearly 80 Percent of Student Loan Borrowers Had Higher Credit Scores by the End of 2021

Note: Credit scores here are Equifax Risk Scores, which are comparable to FICO credit scores.