A rent reform package that will dramatically alter the New York housing landscape became law Friday despite efforts from the real estate to prompt an eleventh-hour reversal.

The legislation — dubbed the Housing Stability and Tenant Protection Act of 2019 — was introduced to the New York Senate floor Friday, after lawmakers reached an agreement on the details of the legislation earlier in the week.

The bill, which supporters say will protect tenants from unscrupulous landlords, passed 36 to 26, and Gov. Andrew Cuomo says he has signed it. He said earlier this week that he plans to sign what the legislature agrees to, despite direct, last-minute lobbying from some of New York's biggest landlords. "I'm confident the measure passed today is the strongest possible set of reforms that the legislature was able to pass and are a major step forward for tenants across New York," Cuomo said in a statement. "As the former Secretary of Housing and Urban Development under President Clinton, I know full well the importance of affordable housing and with the existing rent laws set to expire tomorrow, I have immediately signed this bill into law — avoiding the chaos and uncertainty that a lapse in these protections would have caused for millions of New Yorkers."

Senate Majority Leader Andrea Stewart-Cousins said the Senate Democratic majority had made a commitment to help pass the “strongest tenant protections” in history. “The legislation we passed today achieves that commitment and will help millions of New Yorkers throughout our state," she said. The new regulations, which have been anticipated for months now, sparked an outcry from a number of real estate heavyweights.

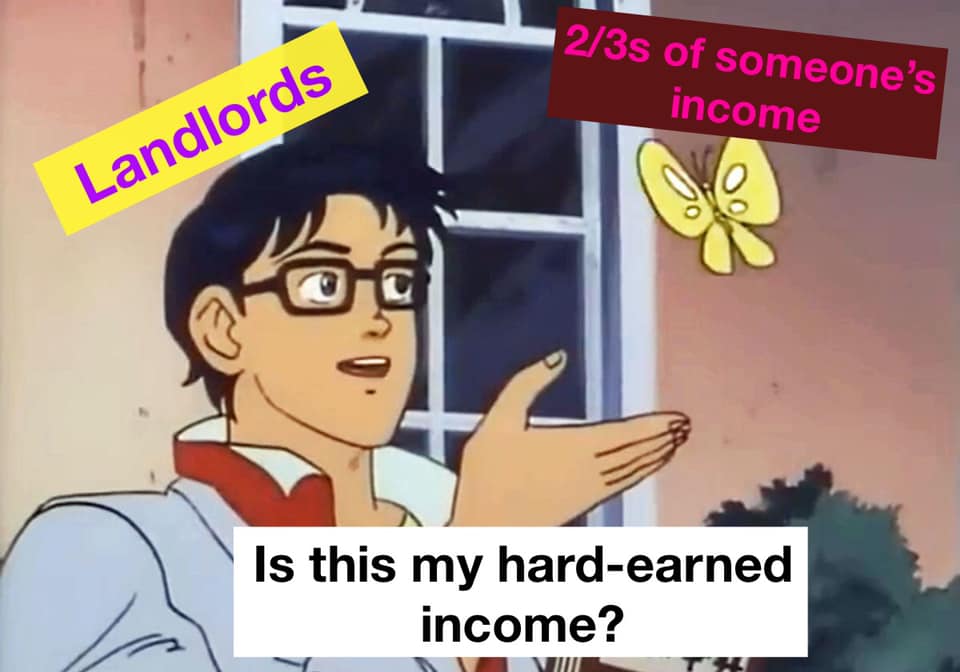

Under new rules, the vacancy bonus — a provision that has allowed landlords to increase rents by as much as 20% when a unit became vacant — will be eliminated. Landlords who provided a preferential rent — meaning a rent lower than they can legally charge — will not be allowed to hike the rents to the full price when leases are renewed.

The Major Capital Improvement and Individual Apartment Improvements programs, which have allowed landlords to pass on the costs of building improvements in rent, have been significantly curtailed. MCI increases will now be capped at 2%, reduced from 6%, and will be eliminated after 30 years. IAIs will be capped at $15K in a 15-year period, and landlords will only be allowed to make three improvements at a maximum during that time.

“For decades, our communities have lost hundreds of thousands of rent regulated units, but with this legislation, we are putting power back in the hands of tenants,” state Sen. Zellnor Myrie said. Many real estate players have slammed the legislation, arguing that it will harm their ability to run their businesses and reduce the city’s housing affordability — not improve it.

“I think the New York legislature has been hijacked [and] they don’t even know it,” Nelson Management Group President Robert Nelson told Bisnow Wednesday as details of the new law were released. Brokers have warned it will further slow the investment sales market. The community banks have felt the impact, with New York Community Bank, Signature Bank and Dime Community Bank having together lost $2.5B in market capitalization over the last few months, The Real Deal reports.

https://www.bisnow.com/new-york/news/commercial-real-estate/rent-regulations-99455