You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Don't move to Texas

- Thread starter bnew

- Start date

More options

Who Replied?Hood Critic

The Power Circle

Anyone following this story?

[THREAD]

[THREAD]

the next guy

Superstar

Anyone following this story?

[THREAD]

1/37

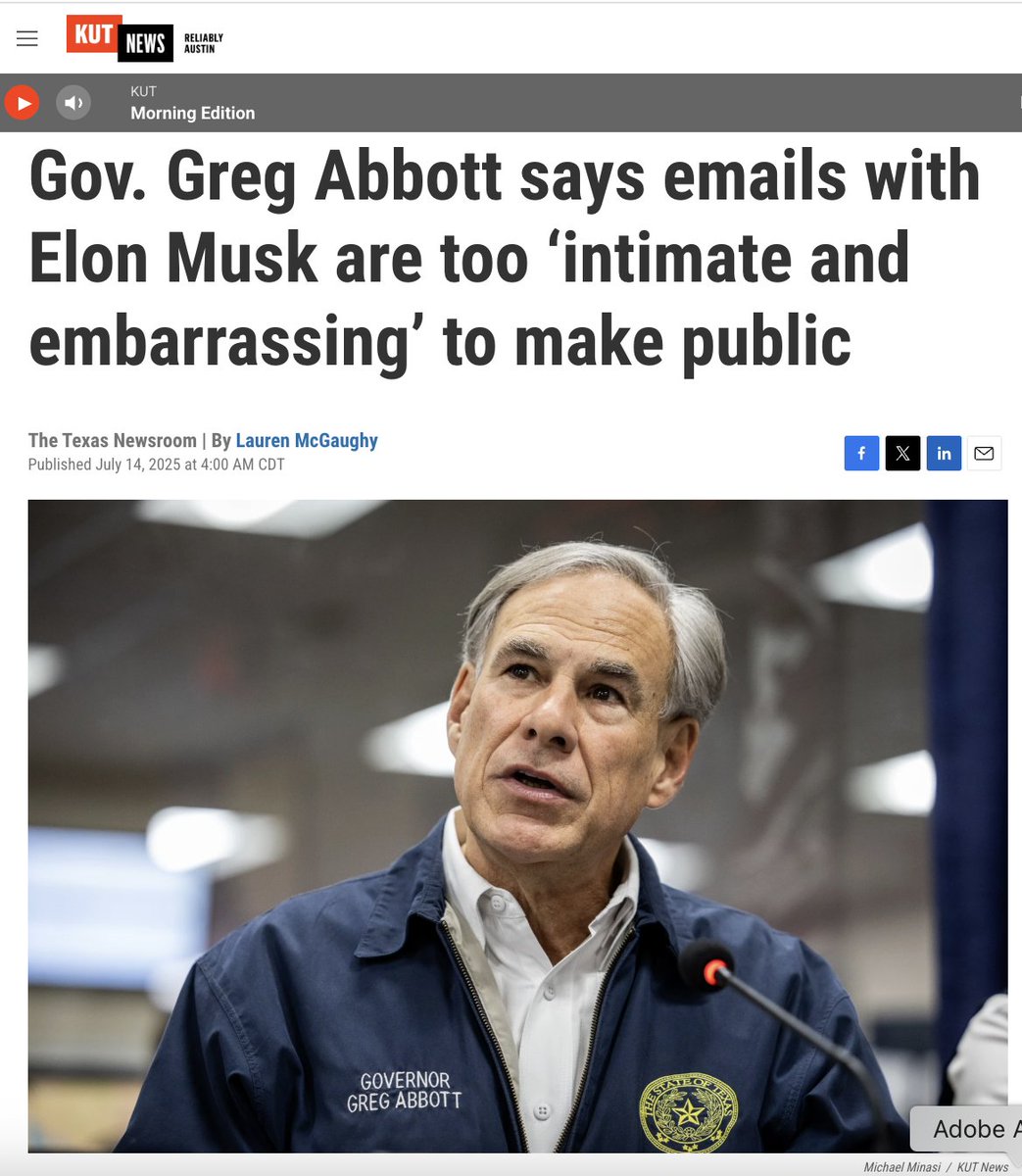

@lmcgaughy

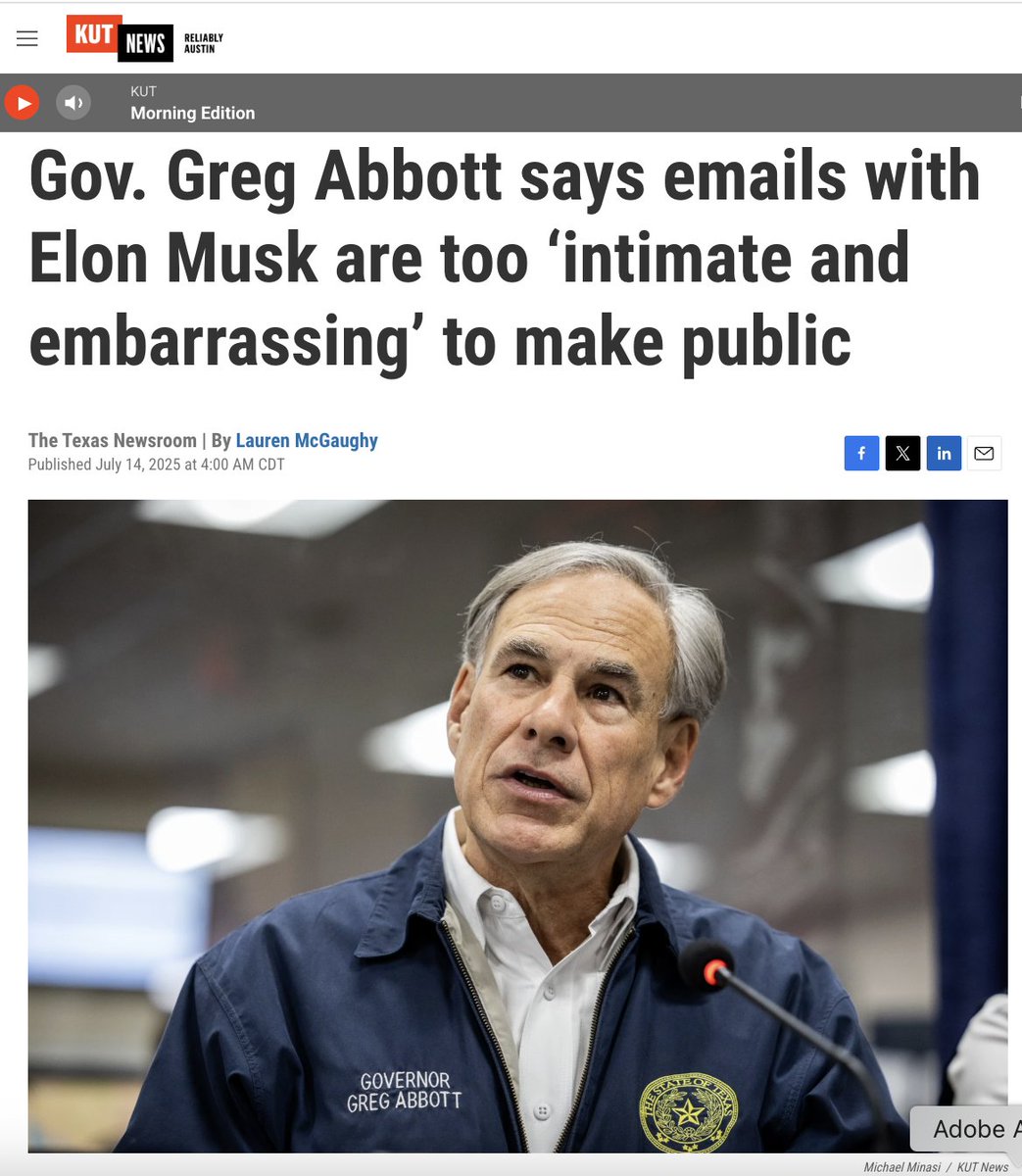

Remember that story we broke a few months ago with @propublica @TexasTribune? It said Texas Gov. Greg Abbott not wanting to release his office's emails with Elon Musk.

Remember that story we broke a few months ago with @propublica @TexasTribune? It said Texas Gov. Greg Abbott not wanting to release his office's emails with Elon Musk.

Well, we have an update. /search?q=#txlege

2/37

@lmcgaughy

Our request for emails between Abbott and Musk kicked off monthslong saga.

First, Abbott's office said it'd cost $244 to review the records. We paid up.

Then, they didn't want to release the records at all. Abbott's office asked the AG to keep the emails secret. /search?q=#txlege

3/37

@lmcgaughy

We got our decision in August.

The AG said Abbott's office must release some emails with Elon Musk. About a month later, we got nearly 1,400 pages from the governor's office.

I was stoked. Until I took a look at the records. They were almost completely redacted. /search?q=#txlege /search?q=#FOIA

https://video.twimg.com/amplify_video/1991146185084583936/vid/avc1/1700x1026/6szW5mPlUXojclvW.mp4

4/37

@lmcgaughy

Many of the records appeared to be redacted under the Public Information Act's exemption for information related to competition or bidding.

Musk did not respond to requests for comment. Abbott's spokesman said the governor followed the law.

Gov. Abbott released 1,400 pages of emails about Elon Musk. Most are blacked out. /search?q=#txlege

5/37

@lmcgaughy

Experts said this case illustrates how hard it's become to get info about government's dealings with business.

Corporate titans like Elon Musk don't want to release records, politicians side with them and the public is left in the dark, they said.

Gov. Abbott released 1,400 pages of emails about Elon Musk. Most are blacked out.

6/37

@lmcgaughy

This is my latest Elon Musk collaboration with @propublica + @TexasTribune, published as part of a five-newsroom initiative to cover powerbrokers in Texas. No paywall!

PP: Gov. Greg Abbott Was Ordered to Release Some of His Emails With Elon Musk. Most Are Blacked Out.

TT: Abbott released his Elon Musk emails. Most were redacted. - The Texas Tribune

Got a tip for me? Reach me at tips@kut.org. /search?q=#txlege

7/37

@KawajaJoe

They were discussing the magic they felt while kissing the Western Wall in Israel. It's either that or Neuralink to cure stupidity in people paralyzed from the neck up.

8/37

@HOUmanitarian

Now i wanna know, what are their pet names for one another?

9/37

@BackOnMyBSToday

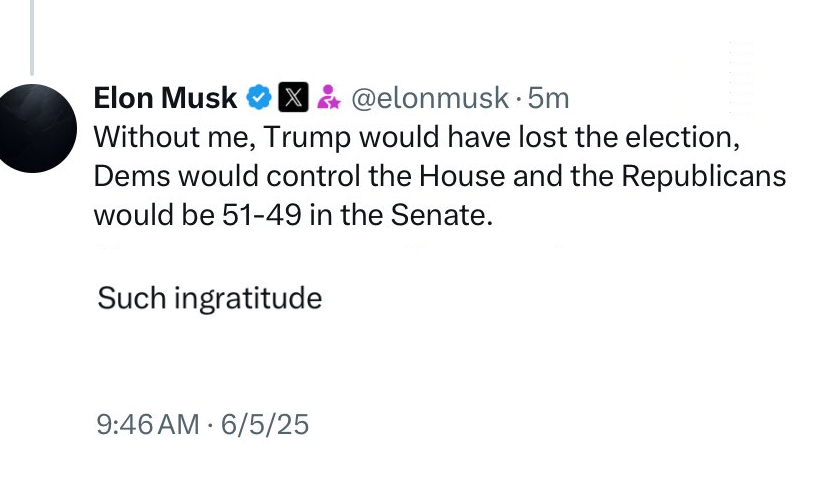

I find the fact that bidding can be redacted to be horseshyt. Arguably the bid and the agreement are about government practices, the public has a right to know about. Particularly if our tax dollars are in any way subsidizing this.

10/37

@TedWilcox7

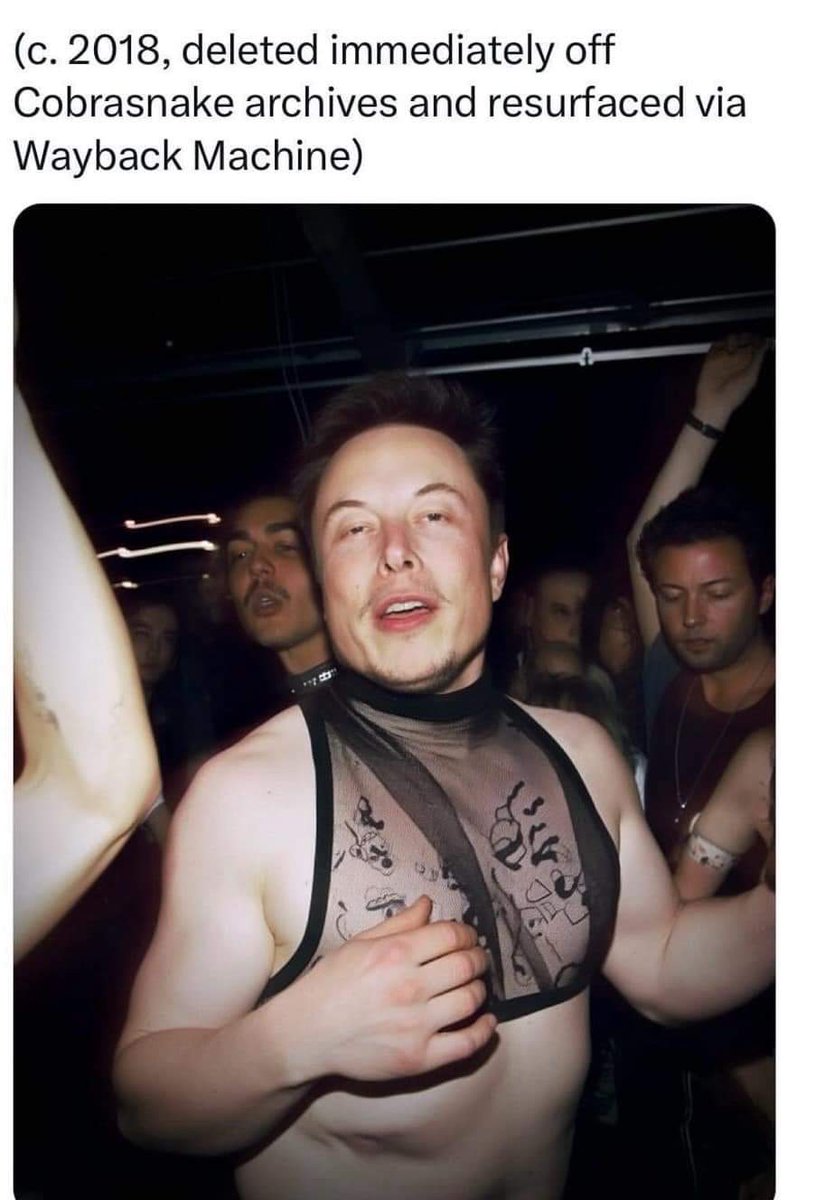

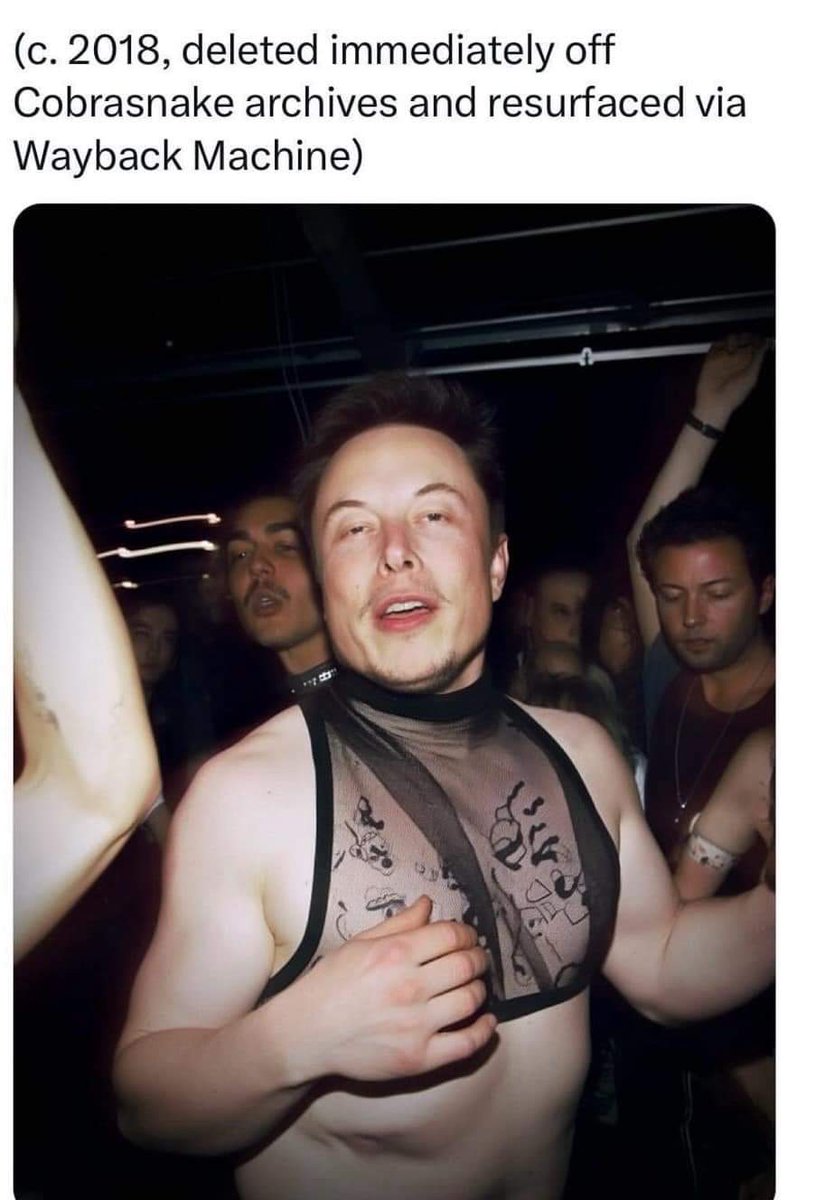

"intimate and embarrassing" - like this?

11/37

@shea_jordan

[Quoted tweet]

Every time Greg Abbott is on the ballot, he remixes the same tired script: “Texas is a disaster, and only I can save it.”

Um… who exactly has been governor this entire time?

12/37

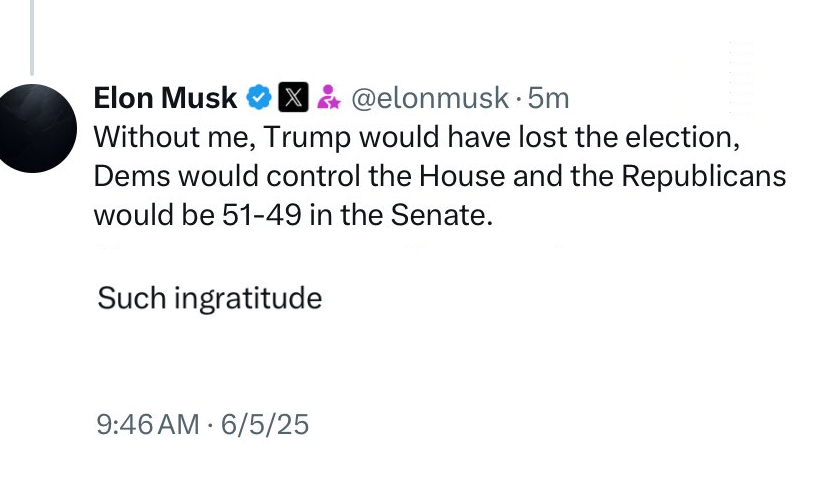

@andreagail_k

Abbott will be much more grateful.

13/37

@surelyagerbil

... Abbott's the next Elon baby mama?

14/37

@humanity195555

Well isn't that special. Deceit classes are a prerequisite before becoming a GOP.

15/37

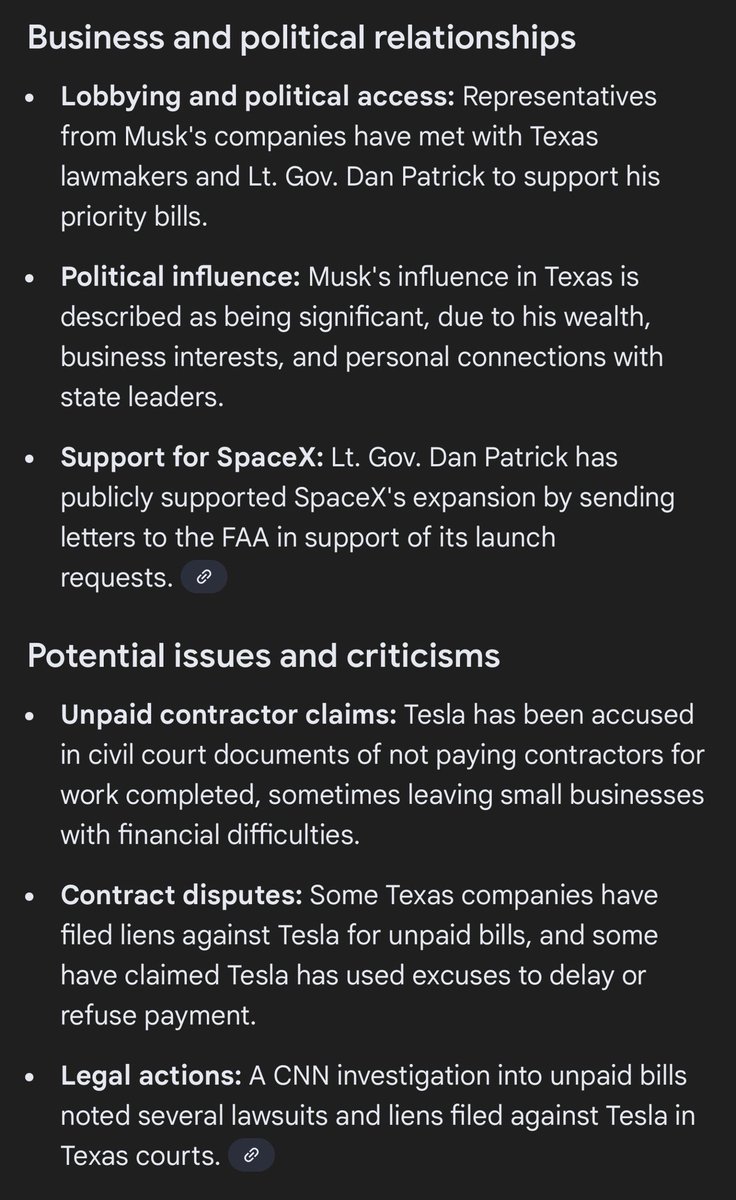

@caveatdata

I wonder if someone would consider calling someone out on their debt “intimate?” And is it Dan Patrick’s job to pave the way with the FAA?

16/37

@MelissaQuinn81

Oh, so now elected officials only have to release information that makes them look good. Do they even hear themselves at this point?

17/37

@JoshMeyerDC

"Intimate" and "embarrassing" have been specifically discounted as reasons for NOT releasing emails to the public under FOIA laws.

18/37

@brad_duren

"Transparency for thee but not for me" personified.

19/37

@KayZed14

"too intimate" to disclose is exactly the problem.

what all did abbott promise musk if he transfered his hq from california to texas.

that deal...def had texas-sized sweeteners in it.

and texans deserve to know what they are.

20/37

@KOldtimedvl

Were they exchanging dik piks or what?

21/37

@SubstCreature

Well now we REALLY want to see them lol

22/37

@marion_curson8

No, it’s all about all the huge tax breaks. He was giving Elon to move to Texas. We’re in California here. We are so happy that Elon lives in Texas now and gets all those hard earned taxpayer dollars to blow up rockets there thank you thank you so much

23/37

@YooglyZoogly

Is every single high-level Republican man secretly schtupping each other?

24/37

@MovieEv

e m is g a's bubba?

25/37

@carolynhbick

Too bad! We need to see them! Greg, you’re an elected public official, and musk is benefiting from billions of dollars of contracts with the government! We need transparency! @GovGregAbbott and @elonmusk

26/37

@martelvonc

Oh I'll just bet they are. Like up to his eyeballs in corruption with Elon kind of embarrassing.

27/37

@PaulaRobinett1

Were they making a Sit n Spin date?

28/37

@Andre_Alyeska

Too 'intimate and embarrassing' is not a valid reason to redact or withhold. But, now that he's described them that way, you know enough people will demand to see them...

29/37

@WFDave

It's interesting Texas Republicans made it legal to redact bidding and contract negotiations, which is probably the most common area for elected officials to be charged with felonies.

30/37

@JenniferCa59650

Elon my Love

31/37

@joedemske101161

Are they in love?

32/37

@AnitaLaLouise

What the....

Does Greg Abbott not work for the people of Texas? Meaning his emails with a rich guy getting all kinds of free stuff from taxpayers is not personal?

Or is Greg sexting with Elon?

33/37

@AkaaInUS

for a party and people so obsessed with EMAILS a few years ago, they aren’t really very diligent about what they put in their own emails!

well, true to Republican form, rules only for thee, not for me!!

34/37

@DavidSt82967657

Were they having an affair?

35/37

@stressed_bkwds

A governor’s emails with Elon Musk are

“too intimate and embarrassing “ to make public?

What on earth on you putting in your emails?

Both of you are public figures.

Seems incredibly reckless.

36/37

@flounder_MA

What is possibly more embarrassing than pulling a "Heil Hitler" on a stage with millions of people watching?

37/37

@Ziekfried877

Too intimate ? Elon love letters?

To post tweets in this format, more info here: https://www.thecoli.com/threads/tips-and-tricks-for-posting-the-coli-megathread.984734/post-52211196

@lmcgaughy

Well, we have an update. /search?q=#txlege

2/37

@lmcgaughy

Our request for emails between Abbott and Musk kicked off monthslong saga.

First, Abbott's office said it'd cost $244 to review the records. We paid up.

Then, they didn't want to release the records at all. Abbott's office asked the AG to keep the emails secret. /search?q=#txlege

3/37

@lmcgaughy

We got our decision in August.

The AG said Abbott's office must release some emails with Elon Musk. About a month later, we got nearly 1,400 pages from the governor's office.

I was stoked. Until I took a look at the records. They were almost completely redacted. /search?q=#txlege /search?q=#FOIA

https://video.twimg.com/amplify_video/1991146185084583936/vid/avc1/1700x1026/6szW5mPlUXojclvW.mp4

4/37

@lmcgaughy

Many of the records appeared to be redacted under the Public Information Act's exemption for information related to competition or bidding.

Musk did not respond to requests for comment. Abbott's spokesman said the governor followed the law.

Gov. Abbott released 1,400 pages of emails about Elon Musk. Most are blacked out. /search?q=#txlege

5/37

@lmcgaughy

Experts said this case illustrates how hard it's become to get info about government's dealings with business.

Corporate titans like Elon Musk don't want to release records, politicians side with them and the public is left in the dark, they said.

Gov. Abbott released 1,400 pages of emails about Elon Musk. Most are blacked out.

6/37

@lmcgaughy

This is my latest Elon Musk collaboration with @propublica + @TexasTribune, published as part of a five-newsroom initiative to cover powerbrokers in Texas. No paywall!

PP: Gov. Greg Abbott Was Ordered to Release Some of His Emails With Elon Musk. Most Are Blacked Out.

TT: Abbott released his Elon Musk emails. Most were redacted. - The Texas Tribune

Got a tip for me? Reach me at tips@kut.org. /search?q=#txlege

7/37

@KawajaJoe

They were discussing the magic they felt while kissing the Western Wall in Israel. It's either that or Neuralink to cure stupidity in people paralyzed from the neck up.

8/37

@HOUmanitarian

Now i wanna know, what are their pet names for one another?

9/37

@BackOnMyBSToday

I find the fact that bidding can be redacted to be horseshyt. Arguably the bid and the agreement are about government practices, the public has a right to know about. Particularly if our tax dollars are in any way subsidizing this.

10/37

@TedWilcox7

"intimate and embarrassing" - like this?

11/37

@shea_jordan

[Quoted tweet]

Every time Greg Abbott is on the ballot, he remixes the same tired script: “Texas is a disaster, and only I can save it.”

Um… who exactly has been governor this entire time?

12/37

@andreagail_k

Abbott will be much more grateful.

13/37

@surelyagerbil

... Abbott's the next Elon baby mama?

14/37

@humanity195555

Well isn't that special. Deceit classes are a prerequisite before becoming a GOP.

15/37

@caveatdata

I wonder if someone would consider calling someone out on their debt “intimate?” And is it Dan Patrick’s job to pave the way with the FAA?

16/37

@MelissaQuinn81

Oh, so now elected officials only have to release information that makes them look good. Do they even hear themselves at this point?

17/37

@JoshMeyerDC

"Intimate" and "embarrassing" have been specifically discounted as reasons for NOT releasing emails to the public under FOIA laws.

18/37

@brad_duren

"Transparency for thee but not for me" personified.

19/37

@KayZed14

"too intimate" to disclose is exactly the problem.

what all did abbott promise musk if he transfered his hq from california to texas.

that deal...def had texas-sized sweeteners in it.

and texans deserve to know what they are.

20/37

@KOldtimedvl

Were they exchanging dik piks or what?

21/37

@SubstCreature

Well now we REALLY want to see them lol

22/37

@marion_curson8

No, it’s all about all the huge tax breaks. He was giving Elon to move to Texas. We’re in California here. We are so happy that Elon lives in Texas now and gets all those hard earned taxpayer dollars to blow up rockets there thank you thank you so much

23/37

@YooglyZoogly

Is every single high-level Republican man secretly schtupping each other?

24/37

@MovieEv

e m is g a's bubba?

25/37

@carolynhbick

Too bad! We need to see them! Greg, you’re an elected public official, and musk is benefiting from billions of dollars of contracts with the government! We need transparency! @GovGregAbbott and @elonmusk

26/37

@martelvonc

Oh I'll just bet they are. Like up to his eyeballs in corruption with Elon kind of embarrassing.

27/37

@PaulaRobinett1

Were they making a Sit n Spin date?

28/37

@Andre_Alyeska

Too 'intimate and embarrassing' is not a valid reason to redact or withhold. But, now that he's described them that way, you know enough people will demand to see them...

29/37

@WFDave

It's interesting Texas Republicans made it legal to redact bidding and contract negotiations, which is probably the most common area for elected officials to be charged with felonies.

30/37

@JenniferCa59650

Elon my Love

31/37

@joedemske101161

Are they in love?

32/37

@AnitaLaLouise

What the....

Does Greg Abbott not work for the people of Texas? Meaning his emails with a rich guy getting all kinds of free stuff from taxpayers is not personal?

Or is Greg sexting with Elon?

33/37

@AkaaInUS

for a party and people so obsessed with EMAILS a few years ago, they aren’t really very diligent about what they put in their own emails!

well, true to Republican form, rules only for thee, not for me!!

34/37

@DavidSt82967657

Were they having an affair?

35/37

@stressed_bkwds

A governor’s emails with Elon Musk are

“too intimate and embarrassing “ to make public?

What on earth on you putting in your emails?

Both of you are public figures.

Seems incredibly reckless.

36/37

@flounder_MA

What is possibly more embarrassing than pulling a "Heil Hitler" on a stage with millions of people watching?

37/37

@Ziekfried877

Too intimate ? Elon love letters?

To post tweets in this format, more info here: https://www.thecoli.com/threads/tips-and-tricks-for-posting-the-coli-megathread.984734/post-52211196