the artist known az

Hail the victors

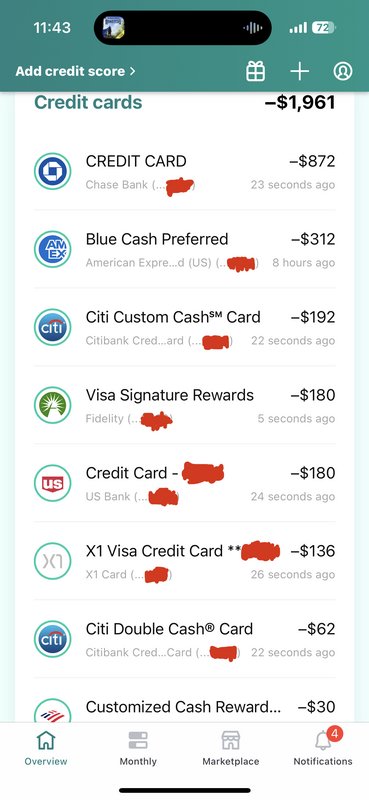

I'm in the same boat and thinking about trying to get a loan through my credit union. I've contemplated a HELOC but I don't know enough about it to trust doing that then we fall into a recession or my home value dropsBeen considering getting a debt consolidation loan since I have a balance spread out on four cards but not sure were to start. Anyone have any positive experience with them? I cut down my expenses as much as possible and only carry my debit card.

. Still saved 8k if I went to the dealership.

. Still saved 8k if I went to the dealership.