There's robo investing

But the first thing you should do is make your budget and aggregate your investments and income streams

Use excel, mint, or personal capital . Links soon drop

I love personal capital

There's robo investing

But the first thing you should do is make your budget and aggregate your investments and income streams

Use excel, mint, or personal capital . Links soon drop

And here I am like a dummy with $10,000 sitting in a checking account collecting no interest. I just quit transferring money to my savings months ago but my best savings account only gets 1.60% APR anyway. My other two get negligible interest.

The thought of a year's-worth of my salary chillin being eaten away by inflation

Congratulations man!

1. Don't tell anybody (chicks, homeboys etc.)

2. Whatever you do, whatever you do: please take a percentage and put it away e.g. 25%. Whatever happens keep that somewhere JUST IN CASE (car breaks down, family issue etc.)

3. Spend some time on quora.com reading about finances and investments

4. Then pick a few that seem interesting

5. Then make appointments with 2 consultants, 1 at a bank and 1 highly recommended independent ones

6. From that point make your best possible decision; whatever you do - don't put all your eggs in one basket

7. Don't trust anybody breh, assume that people want to fukk you over - stay in control and only go with things you truly believe in and have vetted

8. Avoid extremists 'BitCoin will CHANGE THE WORLD MAN!' 'THIS STOCK, ONLY THIS STOCK NOW MAN.. this is the ONE!' watch out, be aware of this

9. Don't borrow/give money - borrowing = throwing away money, you won't get it back

10. Look up an Instagram account called 'investingsimple' they tend to have good investment tips

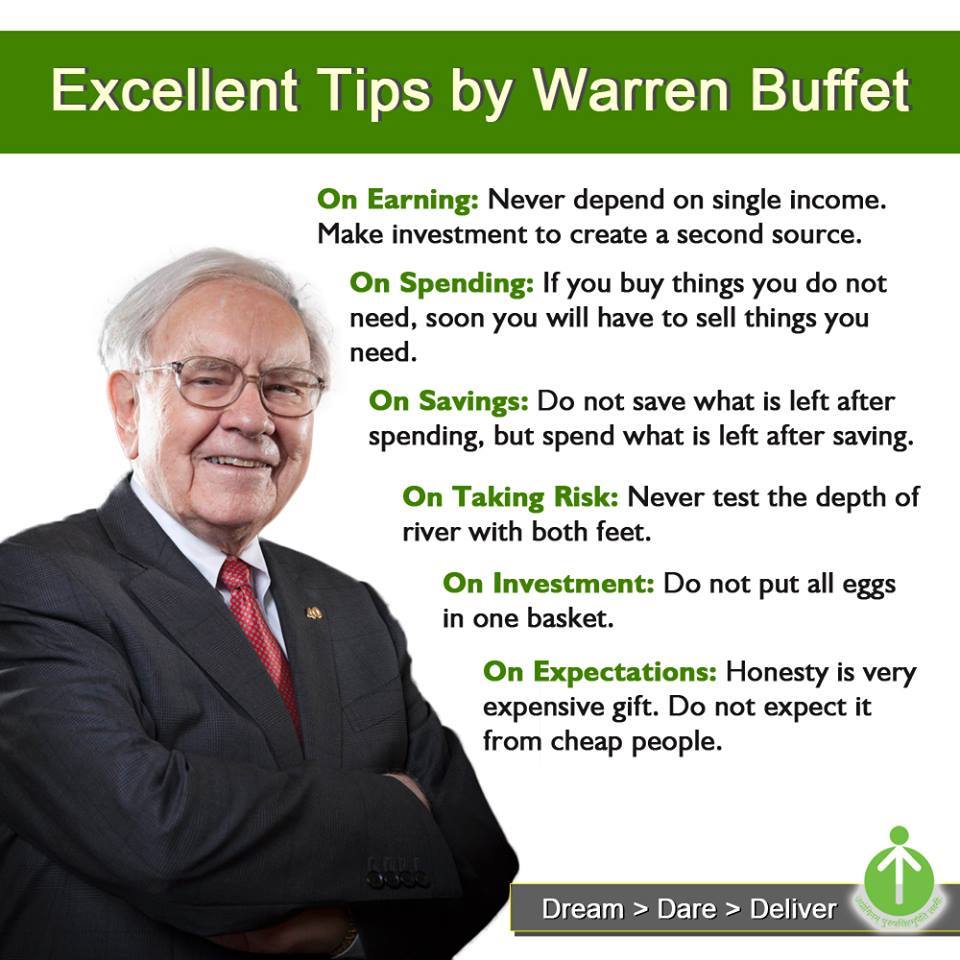

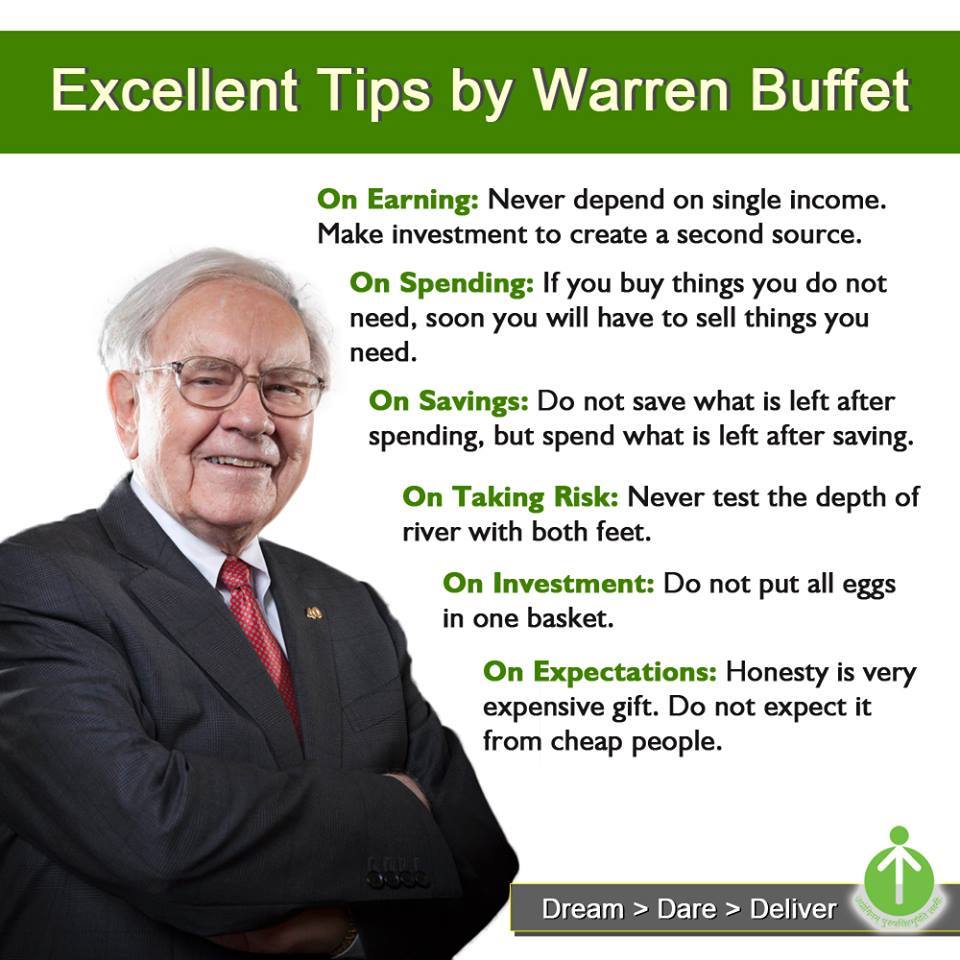

Also this

Don't trade stock options breh...I need the best option to put this money to good use so I'm seeing over 100k in the next 5 years..

Open a Roth IRA with Vanguard.

Put $5,500 in there (yes I know, but just trust me).

Buy cheap index funds that diversify your assets. (VIIIX, VEMPX, and VTPSX... buy all 3).

Then put $5,500 in there every year till you retire.

You're not gonna reach 100k anytime soon, and that's ok. That's not how this game works. If you're feeling cavalier and really wanna hit that 100k mark, you could take the remaining $9500 and put it into Cryptocurrency ICOs, but... I wouldn't.

just open up a small index account. save the rest because you need some liquidity

Yeah, you definitely should look into at least CDs. There are better options, but CDs are offered by most banks, so you can arrange them with a single visit+phone call. Get interest on it, because if you arent getting at least 2% or somewhere in there, inflation is literally eating your money.

You don't have to have it all in a CD, but about 80% of that should definitely be in one just so you aren't literally losing money for holding it.

Congratulations man!

1. Don't tell anybody (chicks, homeboys etc.)

2. Whatever you do, whatever you do: please take a percentage and put it away e.g. 25%. Whatever happens keep that somewhere JUST IN CASE (car breaks down, family issue etc.)

3. Spend some time on quora.com reading about finances and investments

4. Then pick a few that seem interesting

5. Then make appointments with 2 consultants, 1 at a bank and 1 highly recommended independent ones

6. From that point make your best possible decision; whatever you do - don't put all your eggs in one basket

7. Don't trust anybody breh, assume that people want to fukk you over - stay in control and only go with things you truly believe in and have vetted

8. Avoid extremists 'BitCoin will CHANGE THE WORLD MAN!' 'THIS STOCK, ONLY THIS STOCK NOW MAN.. this is the ONE!' watch out, be aware of this

9. Don't borrow/give money - borrowing = throwing away money, you won't get it back

10. Look up an Instagram account called 'investingsimple' they tend to have good investment tips

Also this

I mean, we need to know more. Make sure you have at least 1x of your yearly salary in fluid cash accessible. Stick it in a CD with low early withdrawal penalties. I would do that until you had at least 1.5 years of your salary away. That's step one before you do anything else. If you got that already, look into establishing an umbrella insurance policy. Get a good one with good limits to protect what you have and will have before you continue building it. Imagine spending the next 15 getting your shyt right, only to snuff some nikka in a bar for talking crazy and he falls wrong and ends up in a coma with 800k in bills on your ass post lawsuit. That shyt will end your whole shot at financial freedom and early retirement instantly.

After that, traditional investment lanes, then riskier investment lanes depending on your personal risk tolerance imo.

DM me too.Check your DM