OfTheCross

Veteran

https://www.miamiherald.com/news/business/article259630329.html?ac_cid=DM624023&ac_bid=-667287810

The vast majority of small businesses that took out PPP loans have had their balances forgiven, but a small but significant number of small businesses are still struggling to win approval for their requests for forgiveness, nearly two years after the program was first created.

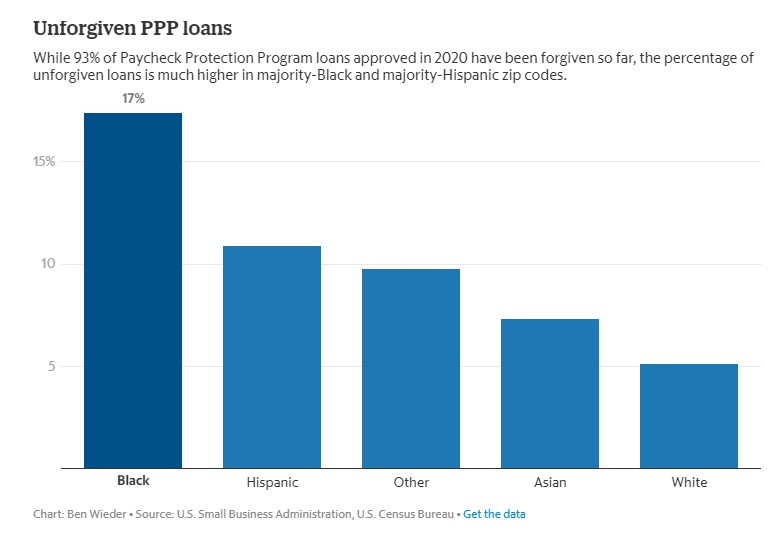

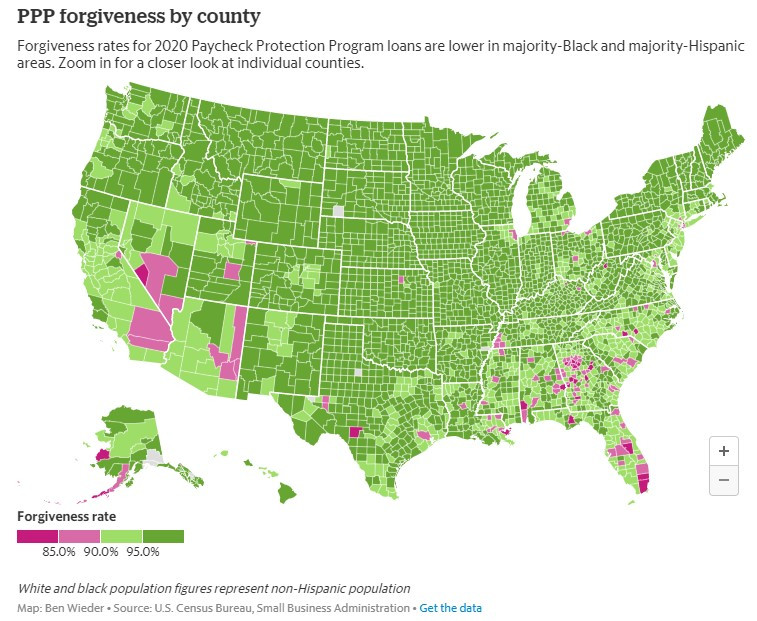

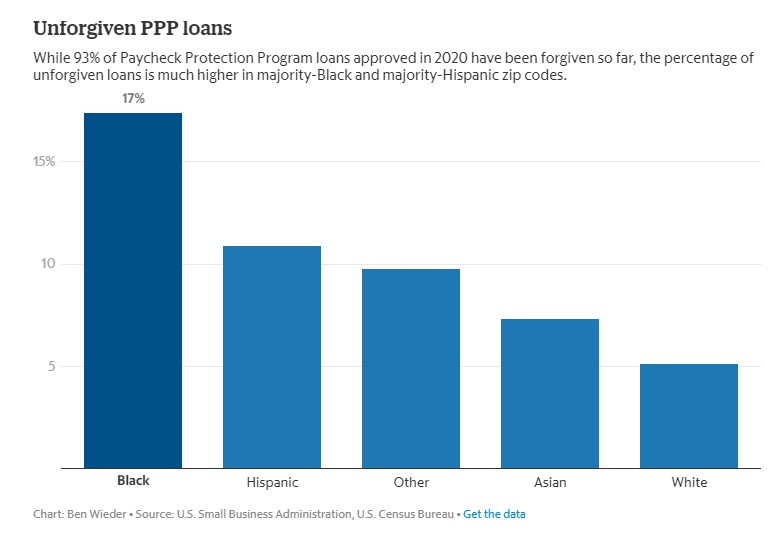

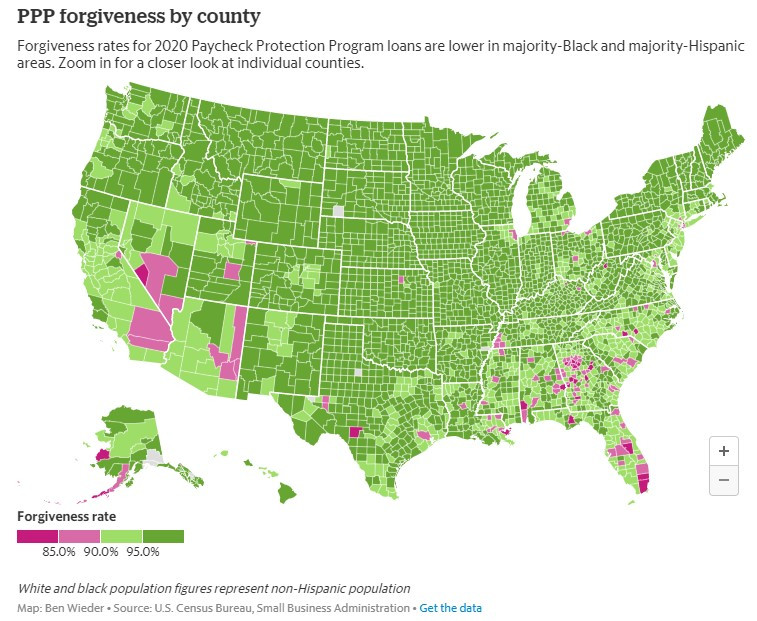

And a Miami Herald analysis of the most recent SBA data finds that forgiveness rates have been significantly lower for small businesses, like Raymonvil’s, that are based in majority Black and majority Hispanic ZIP codes. The percentage of loans that remain unforgiven in majority Black ZIP codes is more than three times higher than the percentage of unforgiven loans in majority white ZIP codes, while the percentage of unforgiven loans in majority Hispanic ZIP codes is more than double that of majority white ZIP codes.

The analysis of the data, which is current as of early January, included loans approved in 2020, all of which are past the grace period during which PPP loans are not required to be repaid. The Herald analyzed forgiveness rates by ZIP codes rather than by the race or ethnicity of individual business owners because roughly 70% of loans in the data contained no information about the race or ethnicity of the business owner.

The vast majority of small businesses that took out PPP loans have had their balances forgiven, but a small but significant number of small businesses are still struggling to win approval for their requests for forgiveness, nearly two years after the program was first created.

And a Miami Herald analysis of the most recent SBA data finds that forgiveness rates have been significantly lower for small businesses, like Raymonvil’s, that are based in majority Black and majority Hispanic ZIP codes. The percentage of loans that remain unforgiven in majority Black ZIP codes is more than three times higher than the percentage of unforgiven loans in majority white ZIP codes, while the percentage of unforgiven loans in majority Hispanic ZIP codes is more than double that of majority white ZIP codes.

The analysis of the data, which is current as of early January, included loans approved in 2020, all of which are past the grace period during which PPP loans are not required to be repaid. The Herald analyzed forgiveness rates by ZIP codes rather than by the race or ethnicity of individual business owners because roughly 70% of loans in the data contained no information about the race or ethnicity of the business owner.

but as usual america has two justice systems

but as usual america has two justice systems . this shyt was ripe for the taking)

. this shyt was ripe for the taking)