the guy

long article

How WallStreetBets Pushed GameStop Shares to the Moon

How WallStreetBets Pushed GameStop Shares to the Moon

By

Brandon Kochkodin

January 25, 2021, 9:57 AM EST

The WallStreetBets legend claims he rolled his initial $53,566.04 in GameStop call options into an $11.2 million paper fortune.

It’s a role cast for them with relish by their chat-room usurpers, the tens of thousands of average Joe day-traders whose fervor for a left-for-dead retailer has become a self-fulfilling prophecy in its 245% rally this year. GameStop has become a money geyser for the options-obsessed crowd that gathers in Reddit’s WallStreetBets forum. For those wagering on a decline, it’s been a catastrophe.

Give credit where it’s due. In their frenzy, WSB’s cocky hordes have managed to turn the tables in a game short sellers invented, spinning gold from the complacency of others. Before this year, GameStop was a cash register for bearish traders, who borrowed and sold more shares than the company issued. Hedge funds had been winning so long that they overlooked the tinderbox they were creating should sentiment turn.

Now it has, violently. GameStop, which isn’t expected to turn a profit before 2023, has seen its market value triple to $4.5 billion in three weeks, burning the skeptics whose any attempt to cover is likely to further propel its ascent.

A notable victim of the shift has been Citron Research’s Andrew Left, once Wall Street’s most celebrated iconoclast for his role hounding Bill Ackman out of another battleground stock, Valeant Pharmaceuticals, five years ago. Today, Left finds himself first among the hunted, his decision to stop publicly bashing GameStop helping drive it up as much as 78% on Friday.

“Price movement aside, I am most astounded by the thought process that goes in to making these decisions,” Left said in an email to Bloomberg News on Monday. “Any rational person knows this type of trading behavior is short lived.”

Last week, before his decision to go mute on GameStop, Left issued a plea to would-be buyers: “look at valuations,” which are by some measures stretched. Ironically, in tracing the history of WallStreetBets’ fascination with the stock, that’s exactly what the chat-room faithful said they were doing when they set out on their journey. Here’s the story of that uprising.

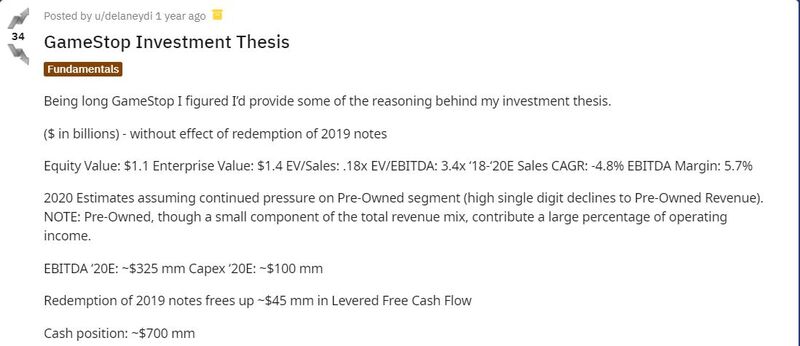

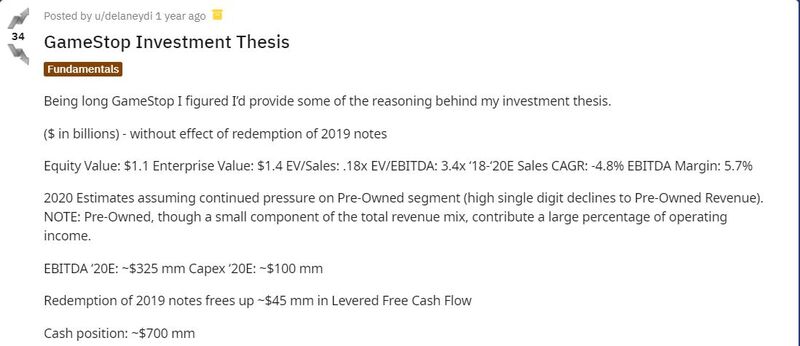

Twenty-two months ago, inklings of a bull case started showing up on WallStreetBets, the Reddit forum that has become synonymous with retail zeal in the pandemic age. With GameStop’s shares and profits both falling for years, a thread by user “delaneydi” said detractors were undervaluing the retailer’s cash, with which the shares were deceptively cheap.

The GameStop value thesis

“My thesis is not contingent on a turnaround or business expansion, this is solely a deep value play,” wrote delaneydi. “Even if we assume double-digit top line sales declines and gross margin contraction, the companies valuation does not reflect the current earnings power, especially when considering the companies large cash horde.” (WSB posters are not distinguished by their spelling or punctuation.)

The view fell mostly on deaf ears as the shares continued to tank and enrich bears. GameStop fell 15% in April of that year, 12% in May, 28% in June and 27% in July. Yet two things happened around that time to lay the foundation for the events of this month.

One was Michael Burry –- of Big Short fame and the veritable spirit animal for internet stock gurus hoping to hit the big time –- saying he was long the shares through his fund Scion Asset Management.

Second was the surfacing of an idea, first in jest, that eventually evolved into the blueprint for the crowd-sourced short squeeze that has blown up in January. Could GameStop fall so far as to make a takeover possible -- by WallStreetBets itself?

It would only cost about $45 million to buy up the entire float if the stock dropped to 50 cents a share, said user MGE5 in a June 5, 2019, post

long article

How WallStreetBets Pushed GameStop Shares to the Moon

How WallStreetBets Pushed GameStop Shares to the Moon

By

Brandon Kochkodin

January 25, 2021, 9:57 AM EST

-

One trader turned $53,566 into more than $11 million -

The mania was years in the making and started as a value play

The WallStreetBets legend claims he rolled his initial $53,566.04 in GameStop call options into an $11.2 million paper fortune.

It’s a role cast for them with relish by their chat-room usurpers, the tens of thousands of average Joe day-traders whose fervor for a left-for-dead retailer has become a self-fulfilling prophecy in its 245% rally this year. GameStop has become a money geyser for the options-obsessed crowd that gathers in Reddit’s WallStreetBets forum. For those wagering on a decline, it’s been a catastrophe.

Give credit where it’s due. In their frenzy, WSB’s cocky hordes have managed to turn the tables in a game short sellers invented, spinning gold from the complacency of others. Before this year, GameStop was a cash register for bearish traders, who borrowed and sold more shares than the company issued. Hedge funds had been winning so long that they overlooked the tinderbox they were creating should sentiment turn.

Now it has, violently. GameStop, which isn’t expected to turn a profit before 2023, has seen its market value triple to $4.5 billion in three weeks, burning the skeptics whose any attempt to cover is likely to further propel its ascent.

A notable victim of the shift has been Citron Research’s Andrew Left, once Wall Street’s most celebrated iconoclast for his role hounding Bill Ackman out of another battleground stock, Valeant Pharmaceuticals, five years ago. Today, Left finds himself first among the hunted, his decision to stop publicly bashing GameStop helping drive it up as much as 78% on Friday.

“Price movement aside, I am most astounded by the thought process that goes in to making these decisions,” Left said in an email to Bloomberg News on Monday. “Any rational person knows this type of trading behavior is short lived.”

Last week, before his decision to go mute on GameStop, Left issued a plea to would-be buyers: “look at valuations,” which are by some measures stretched. Ironically, in tracing the history of WallStreetBets’ fascination with the stock, that’s exactly what the chat-room faithful said they were doing when they set out on their journey. Here’s the story of that uprising.

Twenty-two months ago, inklings of a bull case started showing up on WallStreetBets, the Reddit forum that has become synonymous with retail zeal in the pandemic age. With GameStop’s shares and profits both falling for years, a thread by user “delaneydi” said detractors were undervaluing the retailer’s cash, with which the shares were deceptively cheap.

The GameStop value thesis

“My thesis is not contingent on a turnaround or business expansion, this is solely a deep value play,” wrote delaneydi. “Even if we assume double-digit top line sales declines and gross margin contraction, the companies valuation does not reflect the current earnings power, especially when considering the companies large cash horde.” (WSB posters are not distinguished by their spelling or punctuation.)

The view fell mostly on deaf ears as the shares continued to tank and enrich bears. GameStop fell 15% in April of that year, 12% in May, 28% in June and 27% in July. Yet two things happened around that time to lay the foundation for the events of this month.

One was Michael Burry –- of Big Short fame and the veritable spirit animal for internet stock gurus hoping to hit the big time –- saying he was long the shares through his fund Scion Asset Management.

Second was the surfacing of an idea, first in jest, that eventually evolved into the blueprint for the crowd-sourced short squeeze that has blown up in January. Could GameStop fall so far as to make a takeover possible -- by WallStreetBets itself?

It would only cost about $45 million to buy up the entire float if the stock dropped to 50 cents a share, said user MGE5 in a June 5, 2019, post