the bossman

Superstar

Look yall. Another low information voter.

This the type of stupidity that needs to be flushed out of the community

www.consumerfinance.gov

www.consumerfinance.gov

www.consumerfinance.gov

www.consumerfinance.gov

advocacy.consumerreports.org

advocacy.consumerreports.org

apnews.com

apnews.com

This the type of stupidity that needs to be flushed out of the community

Anyway, CFPB hasn’t really done anything. It would be nice if they focused on scammers because they are the ones ruining the lives of every day people.

CFPB Orders TD Bank to Pay $28 Million for Breakdowns that Illegally Tarnished Consumer Credit Reports | Consumer Financial Protection Bureau

The CFPB ordered TD Bank to pay $7.76 million to tens of thousands of victims because of the bank’s illegal actions.

WASHINGTON, D.C. – Today, the Consumer Financial Protection Bureau (CFPB) ordered TD Bank to pay $7.76 million to tens of thousands of victims of the bank’s illegal actions. For years, the bank repeatedly shared inaccurate, negative information about its customers to consumer reporting companies. The information included systemic errors about credit card delinquencies and bankruptcies. In addition to the redress, the CFPB is ordering TD Bank to pay a $20 million civil money penalty.

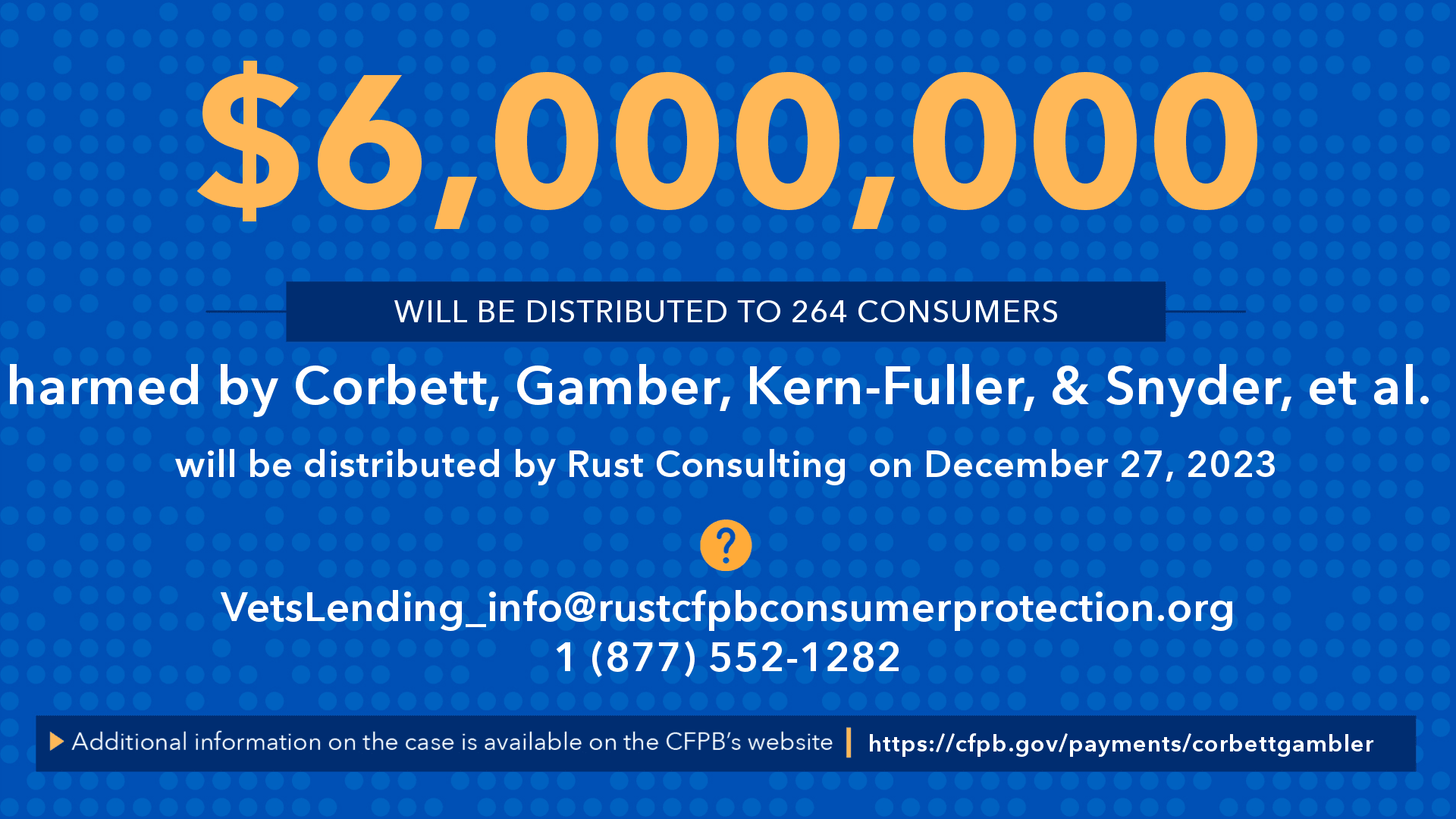

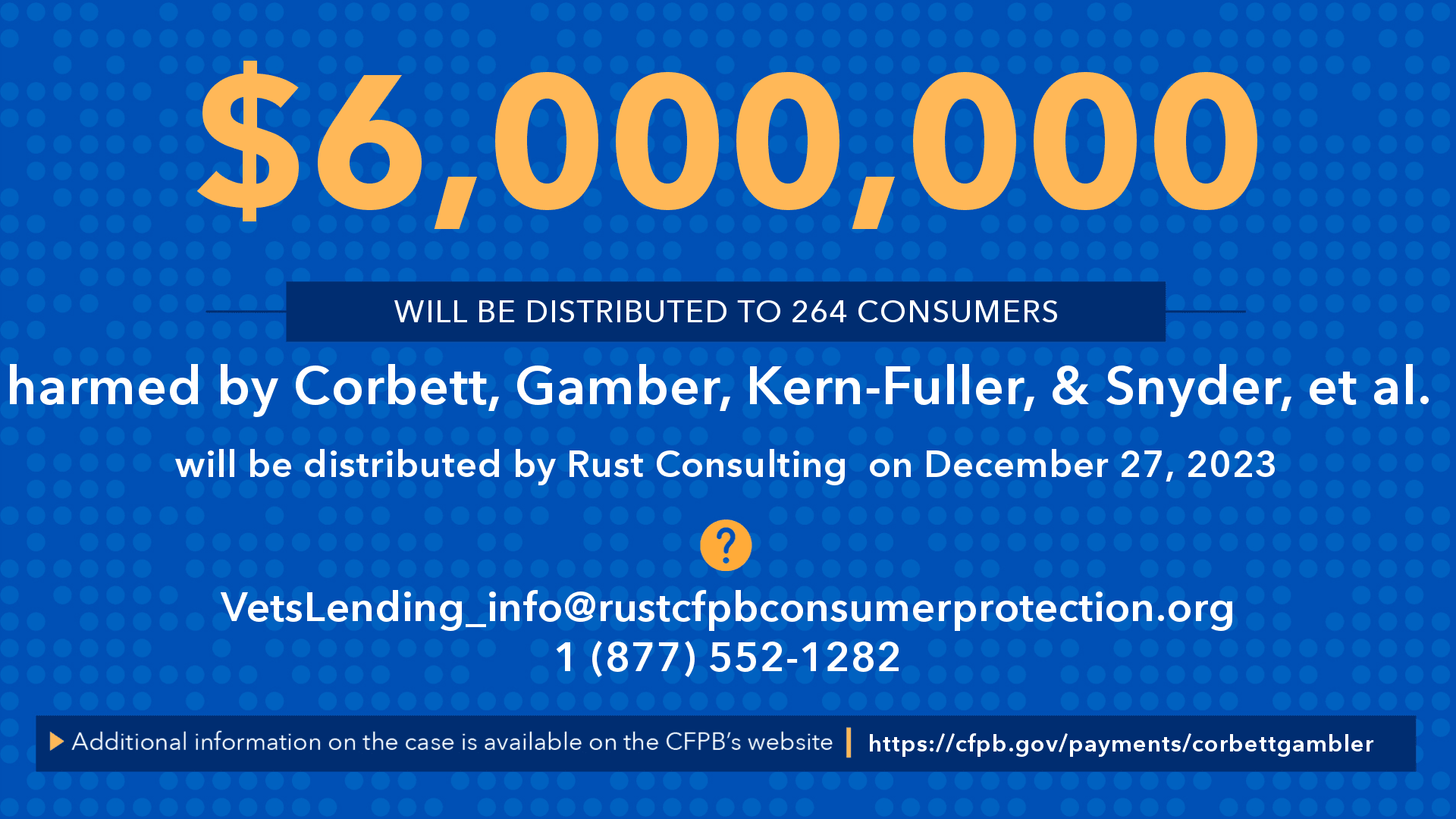

CFPB to distribute nearly $6 million to consumers harmed by predatory loans to veterans | Consumer Financial Protection Bureau

In December, 264 consumers started receiving checks from a series of lawsuits involving four individuals who brokered illegal high-interest credit offers to veterans.

In December, the CFPB sent $6 million in financial relief to consumers harmed by illegal lending practices targeting veterans. Five people and their companies misled veterans and other consumers into selling their pension and disability payments, which is illegal under federal and relevant state law. These transactions were instead illegal high-interest loans.

CFPB penalizes Cash App for failing to treat scam victims fairly - CR Advocacy

Consumer Reports calls on payment app providers to adopt stronger protections for consumers tricked into sending money to crooks WASHINGTON D.C. – Consumer Reports applauded…

WASHINGTON D.C. – Consumer Reports applauded the Consumer Financial Protection Bureau today for ordering the operator of Cash App to pay $175 million and adopt a number of measures to improve the way it handles fraudulent transactions reported by consumers. CR praised the action in light of its own investigation, which found weaknesses with how Cash App and other peer-to-peer payment apps handle disputes over fraud.

Nationstar, the fourth-largest mortgage servicer in the U.S., is set to pay $91 million to settle claims brought by the Consumer Financial Protection Bureau and state attorneys general alleging that the company failed to honor mortgage forbearance agreements and unfairly foreclosed on homeowners.

Consumer watchdog agency called ‘vicious’ by Trump seen as a ‘hero’ to many it aided

The Consumer Financial Protection Bureau is in the crosshairs of a White House that has halted its work, closed its headquarters and fired dozens of its workers.

A decade ago, Seese was pestered by debt collectors who claimed her 95-year-old father had unpaid dentist bills. Even as the calls persisted and got increasingly ugly, the debt collectors refused to give basic information for Seese to check if there actually were bills that she let slip through the cracks.

She reached out to attorneys general in two states but it wasn’t until she filed a claim with CFPB that anything changed. Within a day, the calls stopped, and a week later, the case was closed. The debt, it turned out, was for another man with the same name as her father.

Hence where we are today.

Hence where we are today.