ogc163

Superstar

If you have been tracking the torturous workings of the infrastructure bills working their way through Congress, consideration is now being given to a "billionaire" tax, focused on a extraordinarily small subset of Americans, and intended to raise tens, perhaps even hundreds, of billions of dollars in revenues, to cover the costs of the bill. I am constantly amazed by the capacity of legislatures to write bad tax law, but this one takes the cake as perhaps the worst thought-through and most ineffective attempt ever, at rewriting tax code. That is a little unfair, I know, because the details are still being hashed out, and it is conceivable that the final version will be redeemable, but given that the clock is ticking, I am not hopeful!

The Billionaire Tax: History and Proposal

To get a sense of why we are discussing a billionaire tax, you have to start with a historical context, beginning with a recognition of increasing wealth inequality and the perception (real or otherwise) that the wealthiest were not paying their fair share of taxes, continuing with promises made during the most recent presidential campaign and culminating in the last few months of legislative slogging to get a passable bill.

The Rise of Populism

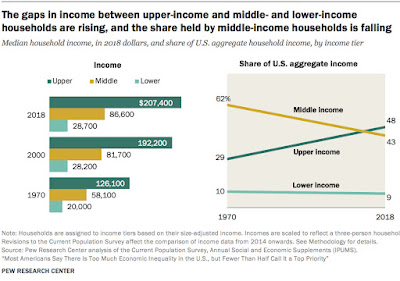

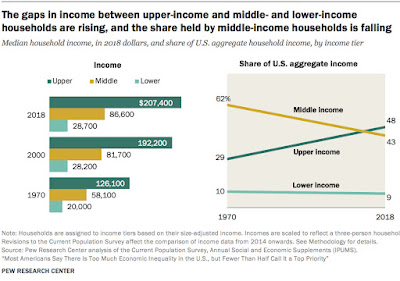

For much of this century, the big story in economics and politics has been increasing inequality, with the spread in income and wealth between the richest and the rest of society widening over time. The graph below, from the Pew Research Center, is a good starting point, since it highlight the shift in the share of aggregate US income flowing to upper, middle and lower income households.

While economists and politicians continue to debate the causes and consequences of this inequality, that income inequality is magnified when you look at the wealth levels different income groups, with the lowest income households falling even further behind. A rising stock market has augmented the wealth inequality, since the wealthiest hold the preponderance of equities in the market.

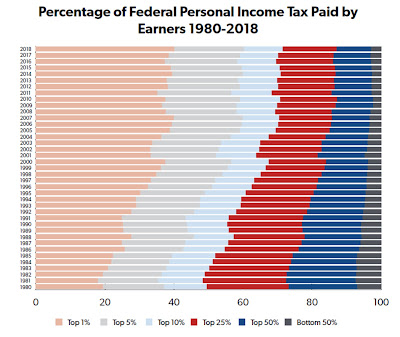

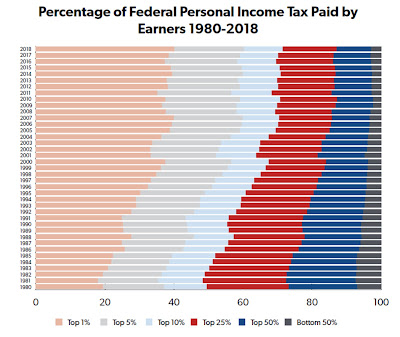

In conjunction with this widening inequality, the perception is building that the wealthy don't pay their fair share in taxes, even though the question of whether they are depends upon the prism you look through. If you focus just on federal tax dollars paid by each group, the wealthy are actually paying a larger share of federal taxes collected than ever before in history, undercutting the claim that they are welching on their tax responsibilities.

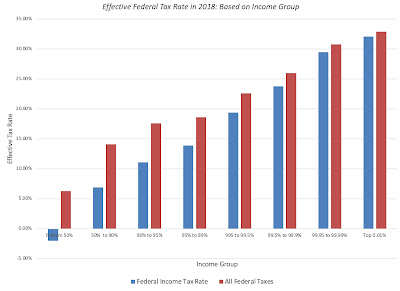

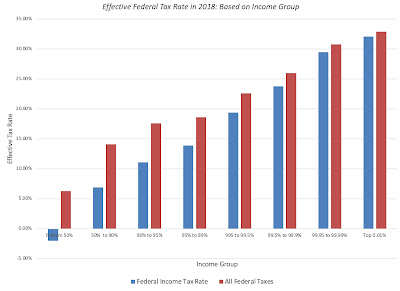

The pushback from progressives is that this graph misses key components, including other taxes collected by the government (payroll taxes, Medicare taxes, estate taxes etc.), and that it is the tax rate that is paid, not dollar taxes, that better measures fairness. In 2018, for instance, the federal effective tax rates paid by different income groups were as follows:

Clearly, while the richest are paying a higher percentage of income in taxes than the poorest, the argument made by some is that they are paying a lower percent of their taxes than they were 40 or 50 years ago (which is true) and that they can afford to pay more (which is debatable).

Elections and Infrastructure Legislation

To understand why the billionaire tax proposal has become one of the center pieces of the revenue side of the infrastructure bill, we have to retrace the path taken during the 2020 presidential election. During the presidential campaign, President Biden promised repeatedly that he would not raise taxes on anyone making less than $400,000 a year in income, effectively locking out 98.2% of income tax payers from any proposed tax increase. In conjunction, he also argued that the the top 1.8% of the populace were not paying their fair share of taxes, and that corporations were also paying too little, and that any rewrite of the tax code would force them to pay their "fair share". In keeping with these two promises, the version of the big infrastructure bills that was initially promoted by the administration raised a significant portion of revenues from changes in tax rates for the wealthiest individuals (by raising the marginal tax rate from 37% to 39.6% for those in the $400,000 plus income range and by adding a surtax on capital gains for those making more than a million dollars in income) and by raising corporate tax rates from 21% to 28%. After months of back and forth between members, the House Ways and Means Committee approved tax provisions on September 15 that included many of these proposals, raising the corporate tax rate from 21% to 26.5%, while putting limits on interest tax deductions, and the individual tax rate to 39.6% (for income) and 25% (for capital gains).

Breaking the Logjam?

The proposals to raise revenues, from the While House and the House committee ran aground, because of objections on raising tax rates from Senator Sinema last week, leading to a rethink of the revenue side. As higher tax rates were taken off the table, the congressional committees had to look elsewhere, and the billionaire tax proposal seems to be gaining traction, as the replacement. Since almost everything we know about the proposals comes from unofficial sources or news leaks, and talks are still continuing, everything could change in the next couple of days, but here is what the proposals look like on Monday, October 25:

The Billionaire Tax: History and Proposal

To get a sense of why we are discussing a billionaire tax, you have to start with a historical context, beginning with a recognition of increasing wealth inequality and the perception (real or otherwise) that the wealthiest were not paying their fair share of taxes, continuing with promises made during the most recent presidential campaign and culminating in the last few months of legislative slogging to get a passable bill.

The Rise of Populism

For much of this century, the big story in economics and politics has been increasing inequality, with the spread in income and wealth between the richest and the rest of society widening over time. The graph below, from the Pew Research Center, is a good starting point, since it highlight the shift in the share of aggregate US income flowing to upper, middle and lower income households.

While economists and politicians continue to debate the causes and consequences of this inequality, that income inequality is magnified when you look at the wealth levels different income groups, with the lowest income households falling even further behind. A rising stock market has augmented the wealth inequality, since the wealthiest hold the preponderance of equities in the market.

In conjunction with this widening inequality, the perception is building that the wealthy don't pay their fair share in taxes, even though the question of whether they are depends upon the prism you look through. If you focus just on federal tax dollars paid by each group, the wealthy are actually paying a larger share of federal taxes collected than ever before in history, undercutting the claim that they are welching on their tax responsibilities.

The pushback from progressives is that this graph misses key components, including other taxes collected by the government (payroll taxes, Medicare taxes, estate taxes etc.), and that it is the tax rate that is paid, not dollar taxes, that better measures fairness. In 2018, for instance, the federal effective tax rates paid by different income groups were as follows:

Clearly, while the richest are paying a higher percentage of income in taxes than the poorest, the argument made by some is that they are paying a lower percent of their taxes than they were 40 or 50 years ago (which is true) and that they can afford to pay more (which is debatable).

Elections and Infrastructure Legislation

To understand why the billionaire tax proposal has become one of the center pieces of the revenue side of the infrastructure bill, we have to retrace the path taken during the 2020 presidential election. During the presidential campaign, President Biden promised repeatedly that he would not raise taxes on anyone making less than $400,000 a year in income, effectively locking out 98.2% of income tax payers from any proposed tax increase. In conjunction, he also argued that the the top 1.8% of the populace were not paying their fair share of taxes, and that corporations were also paying too little, and that any rewrite of the tax code would force them to pay their "fair share". In keeping with these two promises, the version of the big infrastructure bills that was initially promoted by the administration raised a significant portion of revenues from changes in tax rates for the wealthiest individuals (by raising the marginal tax rate from 37% to 39.6% for those in the $400,000 plus income range and by adding a surtax on capital gains for those making more than a million dollars in income) and by raising corporate tax rates from 21% to 28%. After months of back and forth between members, the House Ways and Means Committee approved tax provisions on September 15 that included many of these proposals, raising the corporate tax rate from 21% to 26.5%, while putting limits on interest tax deductions, and the individual tax rate to 39.6% (for income) and 25% (for capital gains).

Breaking the Logjam?

The proposals to raise revenues, from the While House and the House committee ran aground, because of objections on raising tax rates from Senator Sinema last week, leading to a rethink of the revenue side. As higher tax rates were taken off the table, the congressional committees had to look elsewhere, and the billionaire tax proposal seems to be gaining traction, as the replacement. Since almost everything we know about the proposals comes from unofficial sources or news leaks, and talks are still continuing, everything could change in the next couple of days, but here is what the proposals look like on Monday, October 25:

- Targeted Taxpayers: The tax will be targeted at individuals who own more than $1 billion in assets or have had income of more than $100 million for three consecutive years. That is pretty elite company, and it is estimated that less than 1000 taxpayers in the United States would be affected.

- Taxable Items: The tax would apply to a wide array of assets, including stocks, bonds, real estate and art. I am assuming that closely held businesses are not covered by the tax, or if they are, they will be dealt with differently, but since the proposal is still in the process of being written, we just don't know.

- The Proposal: The changes in values of these assets will be subject to tax, even though the individuals continue to hold them, making this a tax on "unrealized" capital gains. There is talk that taxpayers will be allowed to deduct "unrealized" capital losses as well, though the details remain fuzzy.

- The Tax Rate: It is not clear what tax rate would apply on these changes in value, i.e., whether it would be an extension of the capital gains tax rate to these unrealized capital gains, or some other rate, and also whether the tax rate will be the same for all assets, irrespective of liquidity.

.

. … also “unintended” consequences.

… also “unintended” consequences.