Bboystyle

FIRE MATT LAFLEUR

link u what?link me porfa

link u what?link me porfa

lol how'd u learn so quick breh?link u what?

Taking the time to learn.lol how'd u learn so quick breh?

lol how'd u learn so quick breh?

After seeing @Bboystyle 's success, I'm interested in learning myself. I got a pen & pad and have been taking notes from this video. 20 minutes in and it's pretty simple and informative so far. I learned that these trading apps have something called a Demo Account that lets you trade real stocks with play-money so you can build up your knowledge and confidence until you're ready to use real money. That shyt is dope!

I'm trying to learn as much as I can before I give it a real shot; any other good beginner friendly resources would be appreciated

After seeing @Bboystyle 's success, I'm interested in learning myself. I got a pen & pad and have been taking notes from this video. 20 minutes in and it's pretty simple and informative so far. I learned that these trading apps have something called a Demo Account that lets you trade real stocks with play-money so you can build up your knowledge and confidence until you're ready to use real money. That shyt is dope!

I'm trying to learn as much as I can before I give it a real shot; any other good beginner friendly resources would be appreciated

Recommended publication: Bulkowski’s compulsory Encylopedia of Chart Patterns - the bible of trading

Recommended YouTuber: Rayner Teo - The Ultimate Technical Analysis Trading Course (For Beginners)

Trading groups are weird and scammy. Get yourself a copy of Bulkowski’s excellent Encylopedia of Chart Patterns and watch some Rayner Teo for visual learning.are there any groups I can join to learn more I seen some telegram groups sometimes they ask money but I have no idea if its legit or not ???

Thx I will look into it and rapport backTrading groups are weird and scammy. Get yourself a copy of Bulkowski’s excellent Encylopedia of Chart Patterns and watch some Rayner Teo for visual learning.

Learning day trading now. Only need 2k to start. Up to $3720 since the 11th. These are quick in and outs. For a portfolio my size, i make about 10 to 30% gains and dip. Do this 5 to 6 times a day. Goal is to make $200 a day at minimum but will go for more if the market is right and never chase losses and never lose more than $100 a day. I know im not gonna win every day so losing half a days winnining is my strategy to build. So far ive had 8 wins and 4 losses. I check back in a month

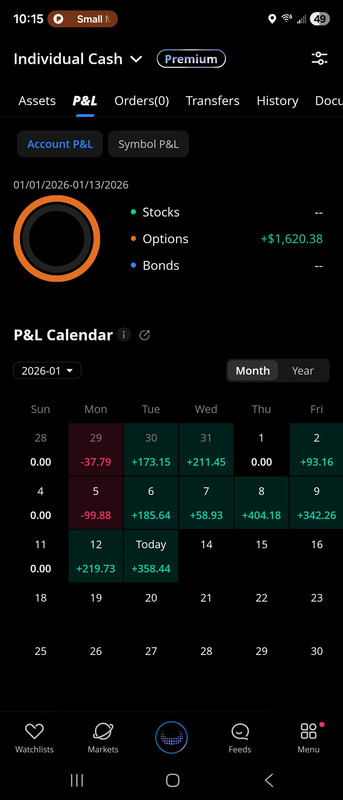

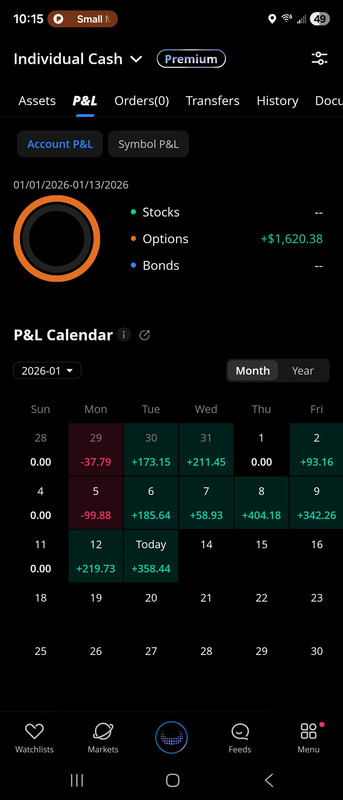

i first learned about options through videos and how to trade them. Most the time u dont need to know the technicals on them (like theta, greeks, ect) just understand what strike price is, days until expiration, what in the money and out the money is. Know that 1 contract = 100 shares. I hyper scalp options so im in and out within mins. My strategy i use goes based off of major support and resistance , Gex, Dex, Volume and price movement. I dont do candles or trends primarily (though i use them to see which way price action may go premarket). I learned about Gex and Dex through a discord im no longer a part of. Other than that, its 80% psychology and 20% strategy. Know when to exit, dont revenge trade and take profits based off of support and resistance areas. Most folks like to hold for 50+% gains. I usually am in and out by +10% to +20%. My size position for each trade is usually $500-1k. So a 10% move will net me $50-$100. My portfolio never goes over 6k and never under 4.5k. I usually trade at opening because thats where the most price action is at and im usually done 5 to 10 mins after the bell. Any profits i make, i withdraw immediately so i dont give it back to the markets and i dont over trade. I usually do 2-4 trades a day and im done. Here's a screen shot of my gains and losses this month so far. Noticed how strict i am with my losses, thats the key. U cant trade options if u dont prioritize risk over profits. Been at this for 8 months now, and been consistently profitable for 4 months. Expensive lessons I took but well worth it.This is what I came here for. I’ve been binging YouTube videos trying to learn how to day trade but there are just too many holes in everyone’s information. How did you learn? Like, from scratch how did you learn day trading?

Is this the woof discord?through a discord im no longer a part of.

yes. I learned from Bowie 1 on 1 and then bounced after 3 months there as i didnt need to follow anyone's trades anymore.Is this the woof discord?

i first learned about options through videos and how to trade them. Most the time u dont need to know the technicals on them (like theta, greeks, ect) just understand what strike price is, days until expiration, what in the money and out the money is. Know that 1 contract = 100 shares. I hyper scalp options so im in and out within mins. My strategy i use goes based off of major support and resistance , Gex, Dex, Volume and price movement. I dont do candles or trends primarily (though i use them to see which way price action may go premarket). I learned about Gex and Dex through a discord im no longer a part of. Other than that, its 80% psychology and 20% strategy. Know when to exit, dont revenge trade and take profits based off of support and resistance areas. Most folks like to hold for 50+% gains. I usually am in and out by +10% to +20%. My size position for each trade is usually $500-1k. So a 10% move will net me $50-$100. My portfolio never goes over 6k and never under 4.5k. I usually trade at opening because thats where the most price action is at and im usually done 5 to 10 mins after the bell. Any profits i make, i withdraw immediately so i dont give it back to the markets and i dont over trade. I usually do 2-4 trades a day and im done. Here's a screen shot of my gains and losses this month so far. Noticed how strict i am with my losses, thats the key. U cant trade options if u dont prioritize risk over profits. Been at this for 8 months now, and been consistently profitable for 4 months. Expensive lessons I took but well worth it.

there is a ChatGPT prompt i used to use to help me develop a trading plan that will help those who are just starting. I dont use it anymore as i can mark my own supports and resistance quickly enough just before open but im open to share it for those interested.