88m3

Fast Money & Foreign Objects

Bryce Covert

Economic Policy Editor at ThinkProgress. Contact me: bcovert@thinkprogress.org

Sep 16

Trump’s plan to destroy science, education, and veterans’ health care

Scientists, educators, veterans, air travelers: look out.

Donald Trump outlining his plan at the Economic Club of New York. CREDIT: AP Photo/ Evan Vucci

Tucked into the details of Republican presidential nominee Donald Trump’srevamped tax and economic package is something that sounds benign: the “Penny Plan.”

It seems simple and maybe even, to some, smart. To reduce spending — in an effort to pay for all of the other costly things he proposes, like big tax cuts — Trump promises to institute a rule that would cut everything that doesn’t go to the military, Social Security, or Medicare by 1 percent each year. That, the campaign claims, would reduce spending by nearly $1 trillion over a decade “without touching defense or entitlement spending.”

But the programs that would feel the knife serve a huge variety of vital purposes — and have already swallowed huge cuts.

Non-defense discretionary spending, the category targeted by Trump, is an enormous bucket encompassing programs that do many different things. The money goes to domestic violence shelters. It funds scientific and medical research through agencies like the National Cancer Institute. Some of it goes to education and childcare, particularly for low-income and disabled students. Air travel depends on it. National parks operate with it, as do harbors and waterways. Low-income families get support for housing. The homebound elderly get nutrition through Meals on Wheels.

It even includes things that have been prioritized by Trump, such as border patrol and the veteran health care system.

The amount of money going to fund these programs is already significantly whittled down. It’s currently equivalent to about 3.3 percent of GDP, just barely above the lowest share it’s ever gotten. A big culprit here is the automatic budget cuts that Congress instituted in 2011 as part of its failure to reach a budget agreement, known as sequestration. The caps on spending have wreaked havoc on these programs’ ability to function.

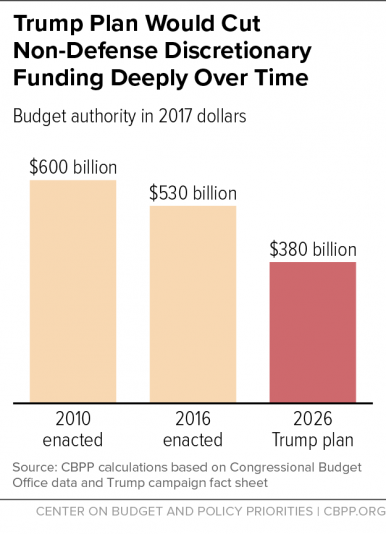

Trump’s plan would make things much, much worse. A new report from the Center on Budget Priorities (CBPP) quantifies just how much of a bite Trump’s penny plan would take. Under his plan, after a decade these programs would have to operate with funding that’s 29 percent lower than what they currently get.

And that’s not even the whole picture. The cuts would come on top of and compound the pain of sequestration. That means that, between sequestration’s budget caps and the penny plan, these programs would get 37 percent less funding by 2026 than they did in 2010.

“They add up to a lot of money,” said Richard Kogan, a senior fellow at the CBPP and a co-author of the report. “These are not trivial portions of this category of spending.”

If a President Trump decided that some of these programs are important enough to protect from cuts — say, perhaps, sparing the Transportation Security Administration so lines at airports don’t stretch indefinitely — the rest of the programs would have to undergo even deeper reductions to make up for it. “The cut everywhere else has to get deeper, much deeper and very quickly,” Kogan said.

And while spending on non-defense programs is already near the lowest share they’ve ever gotten, it would dip below that record if Trump got his way. By 2026, their share of funding would drop to about 2 percent of GDP, a third below the existing record low. Even under Presidents Ronald Reagan or George W. Bush, it never got below 3.3 percent of GDP.

Things could get even worse than the CBPP’s report predicts, however. Earlier this month, Trump said he would call on Congress to lift sequestration’s budget caps on defense spending. If no other changes to existing policy were made, that would mean these non-defense programs would have to shoulder the entire burden of sequestration’s cuts.

Kogan could only estimate, but that could mean cuts going almost a third deeper than what he found in his report, cutting non-defense spending by close to 40 percent over a decade.

https://thinkprogress.org/trump-wou...-security-or-medicare-15103b2da426#.ci2oapxcr

Economic Policy Editor at ThinkProgress. Contact me: bcovert@thinkprogress.org

Sep 16

Trump’s plan to destroy science, education, and veterans’ health care

Scientists, educators, veterans, air travelers: look out.

Donald Trump outlining his plan at the Economic Club of New York. CREDIT: AP Photo/ Evan Vucci

Tucked into the details of Republican presidential nominee Donald Trump’srevamped tax and economic package is something that sounds benign: the “Penny Plan.”

It seems simple and maybe even, to some, smart. To reduce spending — in an effort to pay for all of the other costly things he proposes, like big tax cuts — Trump promises to institute a rule that would cut everything that doesn’t go to the military, Social Security, or Medicare by 1 percent each year. That, the campaign claims, would reduce spending by nearly $1 trillion over a decade “without touching defense or entitlement spending.”

But the programs that would feel the knife serve a huge variety of vital purposes — and have already swallowed huge cuts.

Non-defense discretionary spending, the category targeted by Trump, is an enormous bucket encompassing programs that do many different things. The money goes to domestic violence shelters. It funds scientific and medical research through agencies like the National Cancer Institute. Some of it goes to education and childcare, particularly for low-income and disabled students. Air travel depends on it. National parks operate with it, as do harbors and waterways. Low-income families get support for housing. The homebound elderly get nutrition through Meals on Wheels.

It even includes things that have been prioritized by Trump, such as border patrol and the veteran health care system.

The amount of money going to fund these programs is already significantly whittled down. It’s currently equivalent to about 3.3 percent of GDP, just barely above the lowest share it’s ever gotten. A big culprit here is the automatic budget cuts that Congress instituted in 2011 as part of its failure to reach a budget agreement, known as sequestration. The caps on spending have wreaked havoc on these programs’ ability to function.

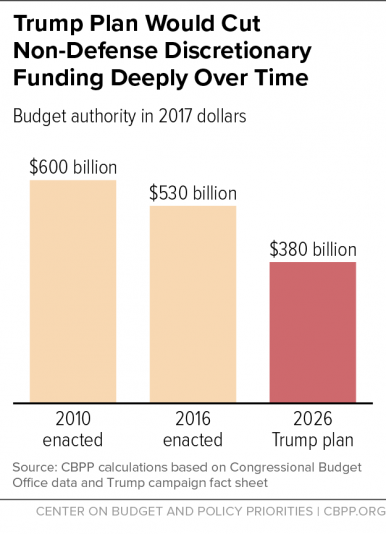

Trump’s plan would make things much, much worse. A new report from the Center on Budget Priorities (CBPP) quantifies just how much of a bite Trump’s penny plan would take. Under his plan, after a decade these programs would have to operate with funding that’s 29 percent lower than what they currently get.

And that’s not even the whole picture. The cuts would come on top of and compound the pain of sequestration. That means that, between sequestration’s budget caps and the penny plan, these programs would get 37 percent less funding by 2026 than they did in 2010.

“They add up to a lot of money,” said Richard Kogan, a senior fellow at the CBPP and a co-author of the report. “These are not trivial portions of this category of spending.”

If a President Trump decided that some of these programs are important enough to protect from cuts — say, perhaps, sparing the Transportation Security Administration so lines at airports don’t stretch indefinitely — the rest of the programs would have to undergo even deeper reductions to make up for it. “The cut everywhere else has to get deeper, much deeper and very quickly,” Kogan said.

And while spending on non-defense programs is already near the lowest share they’ve ever gotten, it would dip below that record if Trump got his way. By 2026, their share of funding would drop to about 2 percent of GDP, a third below the existing record low. Even under Presidents Ronald Reagan or George W. Bush, it never got below 3.3 percent of GDP.

Things could get even worse than the CBPP’s report predicts, however. Earlier this month, Trump said he would call on Congress to lift sequestration’s budget caps on defense spending. If no other changes to existing policy were made, that would mean these non-defense programs would have to shoulder the entire burden of sequestration’s cuts.

Kogan could only estimate, but that could mean cuts going almost a third deeper than what he found in his report, cutting non-defense spending by close to 40 percent over a decade.

https://thinkprogress.org/trump-wou...-security-or-medicare-15103b2da426#.ci2oapxcr

Whats the next headline coming down the Correct the record assembly line. lemme guess..Trump wants to drown kittens?

Whats the next headline coming down the Correct the record assembly line. lemme guess..Trump wants to drown kittens?