Kansas is broke – but you wouldn’t guess it looking at its shining state capitol in Topeka. The imposing limestone monument, crowned by a shiny copper dome and limned with John Steuart Curry’s luminous murals, has just undergone a $325m facelift. What’s happening inside the state house is a lot less pretty, and may well foreshadow the far uglier battle looming over the future of taxation in the United States.

Last month, Donald Trump’s two key economic allies, the treasury secretary. Stephen Mnuchin, and Trump’s chief economic adviser, Gary Cohn, unveiled the outline of Donald Trump’s much-trailed tax plan. The biggest tax cuts “in history” would slash taxes for business, simplify taxes for everyone else, and “pay for themselves” by stimulating economic growth, Trump’s fiscal duo claimed.

The plan’s similarity to the one that has left Kansas in crisis is “unbelievable”, according to Duane Goossen, the former Kansas secretary of administration.

The economic spirit behind Trump’s plan is Arthur Laffer – the go-to guru of “supply-side economics” since the Reagan era, and one of the architects of Kansas governor Sam Brownback’s original tax plan.

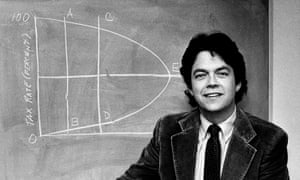

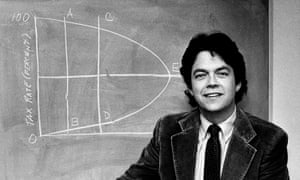

The former member of Reagan’s economic policy advisory board is best known for the “Laffer curve”, an illustration of the theory (not his own) that economic activity is tied to taxation, and that lower taxes, up to a point, mean more revenues.

That curve was famously scribbled by Laffer on a napkin over cocktails with dikk Cheney and Donald Rumsfeld in 1974, and helped underpin Reagan’s so-called trickle-down economics – as well as launching Laffer’s career as one of the most influential economists in Republican circles.

The curve is his calling card, but he also collects and publishes a vast trove of economic data on state revenues and taxes that seems to – handily – point to one conclusion: taxes bad, tax cuts good.

Fairly or not, “Laffernomics” is being blamed for a plan that has left the state in crisis and Brownback’s ratings in the Kansas dust. And Kansas, it seems, is about to act as the model for the biggest US tax cuts since the Gipper was in office.

Thanks to Kansas’s budget woes, Brownback regularly polls as the least popular governor in the union. Nor is there much love for Laffer. “How does he sleep at night?” one parent asked.

“Politics is politics, and I have been the object of political attack and praise. I have gotten both,” Laffer told the Guardian. “What can I tell you? If you climb up the pole, your ass sticks out pretty far, and I climb up. I’m not afraid of taking a position on things.”

‘It just doesn’t work’

Sitting in the capitol’s vaulted lobby, Goossen, now a senior fellow at the Kansas Center for Economic Growth, has little time for Laffer’s arguments, and says that the Trump administration’s recent presentation gave him the shivers.

When Brownback outlined his plan in 2012, he, too, said the tax cuts would pay for themselves. “He too said the tax cuts would benefit everybody, [that] they would be be ‘a shot of adrenaline to the heart’ of the Kansan economy,” said Goossen.

Instead, Goossen claims, the money has gone to a small group of wealthy Kansans while the state’s budget has been left with a roughly $1bn shortfall. Its school system, once its crown jewel, has suffered year after year of cuts, and its savings are gone. The non-partisan Tax Policy Center calculates Trump’s tax plan would cost $6.2tn over the first decade.

“We are a cautionary tale. It sounds great, everybody gets a tax cut and it’ll balance – but it just doesn’t work,” said Goossen.

Campaigning for re-election in 2014, Brownback pledged his tax plans would add 100,000 new jobs over four years. By March this year, the state had added just 12,400 private-sector jobs. Kansas isn’t even keeping up with its neighbors. Hiring in Kansas increased by 0.3% in the last year; Missouri’s growth rate over that same period was 1.4%, according to the US Bureau of Labor Statistics.

The prop of the Brownback plan, as with Trump’s, was a huge cut to taxes paid by limited liability companies (LLCs) – and so-called “pass-through” businesses – which meant independent business owners would pay no state tax on the bulk, if not all, of their income. Those businesses would then go out and invest and create new jobs, or so the argument went.

At the time, Kansas had about 190,000 LLCs. Now it has about 300,000, but so far they have not spurred a new hiring drive in the state. “There is no evidence whatsoever that suggests this plan worked,” said Goossen.

There was no ‘shot of adrenaline’ – you didn’t have to be an economist to see that

Judith Deedy, a mother in Kansas

Upstairs, the state senate is arguing over the budget for the 2018 fiscal year. Estimated revenues are $5.7bn for the year; expenses are $6.4bn – and that’s before you add in $500m-$750m the schools are owed. As Charles dikkens once wrote: “Annual income twenty pounds, annual expenditure nineteen six, result happiness. Annual income twenty pounds, annual expenditure twenty pound ought and six, result misery.”

Goossen said: “The bigger problem is that now all the energy of the state is focused on how we scrape by and make do when we ought to be focused on the future.”

In nearby Lawrence, the business owners Brownback targeted are similarly unimpressed. With his trucker cap and lumberjack beard, Sam Billen is the kind of tech-savvy, knowledge-economy businessman that state governors adore. From a freshly scrubbed warehouse on the edge of downtown, Billen runs Primary Color Music, which makes music and soundtracks for films, videos and commercials. The company has a roster of local and international clients including AMC Theaters, Boulevard Brewery and Hitachi, and recently won a local small business award.

Over freshly prepared burritos at Bon Bon, made with vegetables from the cafe’s garden, Billen outlines all the reasons for working in Lawrence: good schools, great food, central location, fantastic people, relatively cheap. The tax? “I probably get $5,000 to $10,000 a year extra. That’s great, but if I take a step back, where is it coming from? I’d rather it went back into the community. When you see the impact it’s having on education, it’s scary,” he said. “They are making this state worse. For what? I think we’d all pay a little extra to make it better.”

Rick Martin at Limestone Pizza. ‘I didn’t start this business for a tax break.’ Photograph: Jason Dailey for the Guardian

Over at the award-winning Limestone Pizza, the message is the same. “I didn’t start this business for a tax break,” said Rick Martin, the owner and executive chef. “What I wanted to do is get the maximum amount of local products on a pizza. If we are not profitable because of taxes, we are doing something wrong,” he said. The tax break “might be great if you are concentrating on tax avoidance” but a tax break that worked only for business owners, not employees, was “harmful”.

“We do better when we are all pulling together,” said Martin.

Lawrence is a cute little college town where you can pick up a book at the Raven Book Store, with a bookmark declaring “Reading is Resistance”, and go read it over a Moscow mule in the Bourgeois Pig. It’s a small Democratic holdout in Kansas’s deep-red state. You’d probably expect the local people to hate Brownback’s tax plans. But the antipathy is statewide.

‘We are seeing cuts year after year’

A few hours south of Topeka is Wichita, home to Kansas’s most famous business family, the Kochs. The Koch brothers are evangelical about low taxes but not, apparently, at any cost.

“We have consistently said Kansas must first fix our spending problem, then and only then address the tax code. There needs to be more equality in how the tax gets applied. You can’t have half the state exempt and the other half not exempt,” Steve Feilmeier, the chief financial officer and executive vice-president of Koch Industries, told the Kansas City Business Journal earlier this year.

Part of the dislike stems from what the cuts have done to Kansas schools. In March, the Kansas supreme court ruled that state was underfunding schools by hundreds of millions of dollars per year.

One of the parents affected is Judith Deedy, who moved from Cleveland to Johnson County, by the Missouri state line, in 2004 – in large part because of the great reputation of the local schools. “During the recession I got it that budgets were being cut, but when we came out of recession, it just kept on happening. We are seeing cuts year after year that add up to an entire academic career.”

Class sizes are up, teachers are not being replaced, art and music are being slashed. “I’m lucky. This is still a relatively good area, [but] small towns are losing schools. In Wichita, they shortened the school year and increased the length of the school day. No one likes it,” she says. Small towns that lose a school are being devastated by the cuts, and parents are worried schools may not reopen after the summer break unless an agreement can be reached in Topeka.

“I chose to live in Kansas. We don’t have beaches, we don’t have mountains, but we have great public schools. Well, not any more. There was no shot of adrenaline – you didn’t have to be an economist to see that. The cuts have been so deep we may never get back to where we were,” said Deedy.

Facebook Twitter Pinterest

Judith Deedy and her children, Kathleen, Anne and Evan. ‘The cuts have been so deep we may never get back to where we were.’ Photograph: Jason Dailey for the Guardian

Laffer blames politics and timidity rather than economic theory for Kansas’s woes. So what went wrong with Kansas?

“It sucks,” said Laffer. “Look at it. This doesn’t have beaches, it doesn’t have palm trees. It doesn’t really have a low tax, what is it now, 4.9%, something like that. Take a look at my state, Tennessee. We have the lowest tax burden of any state in the nation, we have the highest growth in employment as a percentage of population of any state in the nation in the last 12 months, we have a budget surplus of $2bn. Two billion dollars in this little crappy state!”

Brownback’s problems stem from a bill that was originally a fairly modest tax cut but which spiralled out of his control because of politics and hostility toward the governor, said Laffer. His advice would have been to go for a bigger cut.

“When you put an atomic bomb on a place, it will materially change the place – but a cherry bomb probably won’t change the buildings or anything else,” he said.

The fact remains, Laffer argued, that “you can’t tax a state into prosperity. A poor person can’t spend themselves into wealth.” Nor does spending guarantee success and prosperity.

If people seem to blame him for the collapse of that state? “I don’t mind,” said Laffer. “It comes with the territory. I try to do the best I can with regards to economics.”

Back in Topeka, Brownback has told the Kansas City Star he’s “heartened” by Trump’s tax plans, saying they would spur business growth. Meanwhile, Democrats and Republicans are seeking to kill off his business tax breaks as the state struggles to balance it books.

In the lobby of the Kansas state capitol, there is a poster of Dwight Eisenhower, partially covered by signs. “The opportunist thinks of me and today. The statesman thinks of us and tomorrow,” the adopted Kansan is quoted as saying. No doubt both sides would claim he is speaking for them.

'We are a cautionary tale': Kansas feels the pain of massive Trump-style tax cuts

Last month, Donald Trump’s two key economic allies, the treasury secretary. Stephen Mnuchin, and Trump’s chief economic adviser, Gary Cohn, unveiled the outline of Donald Trump’s much-trailed tax plan. The biggest tax cuts “in history” would slash taxes for business, simplify taxes for everyone else, and “pay for themselves” by stimulating economic growth, Trump’s fiscal duo claimed.

The plan’s similarity to the one that has left Kansas in crisis is “unbelievable”, according to Duane Goossen, the former Kansas secretary of administration.

The economic spirit behind Trump’s plan is Arthur Laffer – the go-to guru of “supply-side economics” since the Reagan era, and one of the architects of Kansas governor Sam Brownback’s original tax plan.

The former member of Reagan’s economic policy advisory board is best known for the “Laffer curve”, an illustration of the theory (not his own) that economic activity is tied to taxation, and that lower taxes, up to a point, mean more revenues.

That curve was famously scribbled by Laffer on a napkin over cocktails with dikk Cheney and Donald Rumsfeld in 1974, and helped underpin Reagan’s so-called trickle-down economics – as well as launching Laffer’s career as one of the most influential economists in Republican circles.

The curve is his calling card, but he also collects and publishes a vast trove of economic data on state revenues and taxes that seems to – handily – point to one conclusion: taxes bad, tax cuts good.

Fairly or not, “Laffernomics” is being blamed for a plan that has left the state in crisis and Brownback’s ratings in the Kansas dust. And Kansas, it seems, is about to act as the model for the biggest US tax cuts since the Gipper was in office.

Thanks to Kansas’s budget woes, Brownback regularly polls as the least popular governor in the union. Nor is there much love for Laffer. “How does he sleep at night?” one parent asked.

“Politics is politics, and I have been the object of political attack and praise. I have gotten both,” Laffer told the Guardian. “What can I tell you? If you climb up the pole, your ass sticks out pretty far, and I climb up. I’m not afraid of taking a position on things.”

‘It just doesn’t work’

Sitting in the capitol’s vaulted lobby, Goossen, now a senior fellow at the Kansas Center for Economic Growth, has little time for Laffer’s arguments, and says that the Trump administration’s recent presentation gave him the shivers.

When Brownback outlined his plan in 2012, he, too, said the tax cuts would pay for themselves. “He too said the tax cuts would benefit everybody, [that] they would be be ‘a shot of adrenaline to the heart’ of the Kansan economy,” said Goossen.

Instead, Goossen claims, the money has gone to a small group of wealthy Kansans while the state’s budget has been left with a roughly $1bn shortfall. Its school system, once its crown jewel, has suffered year after year of cuts, and its savings are gone. The non-partisan Tax Policy Center calculates Trump’s tax plan would cost $6.2tn over the first decade.

“We are a cautionary tale. It sounds great, everybody gets a tax cut and it’ll balance – but it just doesn’t work,” said Goossen.

Campaigning for re-election in 2014, Brownback pledged his tax plans would add 100,000 new jobs over four years. By March this year, the state had added just 12,400 private-sector jobs. Kansas isn’t even keeping up with its neighbors. Hiring in Kansas increased by 0.3% in the last year; Missouri’s growth rate over that same period was 1.4%, according to the US Bureau of Labor Statistics.

The prop of the Brownback plan, as with Trump’s, was a huge cut to taxes paid by limited liability companies (LLCs) – and so-called “pass-through” businesses – which meant independent business owners would pay no state tax on the bulk, if not all, of their income. Those businesses would then go out and invest and create new jobs, or so the argument went.

At the time, Kansas had about 190,000 LLCs. Now it has about 300,000, but so far they have not spurred a new hiring drive in the state. “There is no evidence whatsoever that suggests this plan worked,” said Goossen.

There was no ‘shot of adrenaline’ – you didn’t have to be an economist to see that

Judith Deedy, a mother in Kansas

Upstairs, the state senate is arguing over the budget for the 2018 fiscal year. Estimated revenues are $5.7bn for the year; expenses are $6.4bn – and that’s before you add in $500m-$750m the schools are owed. As Charles dikkens once wrote: “Annual income twenty pounds, annual expenditure nineteen six, result happiness. Annual income twenty pounds, annual expenditure twenty pound ought and six, result misery.”

Goossen said: “The bigger problem is that now all the energy of the state is focused on how we scrape by and make do when we ought to be focused on the future.”

In nearby Lawrence, the business owners Brownback targeted are similarly unimpressed. With his trucker cap and lumberjack beard, Sam Billen is the kind of tech-savvy, knowledge-economy businessman that state governors adore. From a freshly scrubbed warehouse on the edge of downtown, Billen runs Primary Color Music, which makes music and soundtracks for films, videos and commercials. The company has a roster of local and international clients including AMC Theaters, Boulevard Brewery and Hitachi, and recently won a local small business award.

Over freshly prepared burritos at Bon Bon, made with vegetables from the cafe’s garden, Billen outlines all the reasons for working in Lawrence: good schools, great food, central location, fantastic people, relatively cheap. The tax? “I probably get $5,000 to $10,000 a year extra. That’s great, but if I take a step back, where is it coming from? I’d rather it went back into the community. When you see the impact it’s having on education, it’s scary,” he said. “They are making this state worse. For what? I think we’d all pay a little extra to make it better.”

Rick Martin at Limestone Pizza. ‘I didn’t start this business for a tax break.’ Photograph: Jason Dailey for the Guardian

Over at the award-winning Limestone Pizza, the message is the same. “I didn’t start this business for a tax break,” said Rick Martin, the owner and executive chef. “What I wanted to do is get the maximum amount of local products on a pizza. If we are not profitable because of taxes, we are doing something wrong,” he said. The tax break “might be great if you are concentrating on tax avoidance” but a tax break that worked only for business owners, not employees, was “harmful”.

“We do better when we are all pulling together,” said Martin.

Lawrence is a cute little college town where you can pick up a book at the Raven Book Store, with a bookmark declaring “Reading is Resistance”, and go read it over a Moscow mule in the Bourgeois Pig. It’s a small Democratic holdout in Kansas’s deep-red state. You’d probably expect the local people to hate Brownback’s tax plans. But the antipathy is statewide.

‘We are seeing cuts year after year’

A few hours south of Topeka is Wichita, home to Kansas’s most famous business family, the Kochs. The Koch brothers are evangelical about low taxes but not, apparently, at any cost.

“We have consistently said Kansas must first fix our spending problem, then and only then address the tax code. There needs to be more equality in how the tax gets applied. You can’t have half the state exempt and the other half not exempt,” Steve Feilmeier, the chief financial officer and executive vice-president of Koch Industries, told the Kansas City Business Journal earlier this year.

Part of the dislike stems from what the cuts have done to Kansas schools. In March, the Kansas supreme court ruled that state was underfunding schools by hundreds of millions of dollars per year.

One of the parents affected is Judith Deedy, who moved from Cleveland to Johnson County, by the Missouri state line, in 2004 – in large part because of the great reputation of the local schools. “During the recession I got it that budgets were being cut, but when we came out of recession, it just kept on happening. We are seeing cuts year after year that add up to an entire academic career.”

Class sizes are up, teachers are not being replaced, art and music are being slashed. “I’m lucky. This is still a relatively good area, [but] small towns are losing schools. In Wichita, they shortened the school year and increased the length of the school day. No one likes it,” she says. Small towns that lose a school are being devastated by the cuts, and parents are worried schools may not reopen after the summer break unless an agreement can be reached in Topeka.

“I chose to live in Kansas. We don’t have beaches, we don’t have mountains, but we have great public schools. Well, not any more. There was no shot of adrenaline – you didn’t have to be an economist to see that. The cuts have been so deep we may never get back to where we were,” said Deedy.

Facebook Twitter Pinterest

Judith Deedy and her children, Kathleen, Anne and Evan. ‘The cuts have been so deep we may never get back to where we were.’ Photograph: Jason Dailey for the Guardian

Laffer blames politics and timidity rather than economic theory for Kansas’s woes. So what went wrong with Kansas?

“It sucks,” said Laffer. “Look at it. This doesn’t have beaches, it doesn’t have palm trees. It doesn’t really have a low tax, what is it now, 4.9%, something like that. Take a look at my state, Tennessee. We have the lowest tax burden of any state in the nation, we have the highest growth in employment as a percentage of population of any state in the nation in the last 12 months, we have a budget surplus of $2bn. Two billion dollars in this little crappy state!”

Brownback’s problems stem from a bill that was originally a fairly modest tax cut but which spiralled out of his control because of politics and hostility toward the governor, said Laffer. His advice would have been to go for a bigger cut.

“When you put an atomic bomb on a place, it will materially change the place – but a cherry bomb probably won’t change the buildings or anything else,” he said.

The fact remains, Laffer argued, that “you can’t tax a state into prosperity. A poor person can’t spend themselves into wealth.” Nor does spending guarantee success and prosperity.

If people seem to blame him for the collapse of that state? “I don’t mind,” said Laffer. “It comes with the territory. I try to do the best I can with regards to economics.”

Back in Topeka, Brownback has told the Kansas City Star he’s “heartened” by Trump’s tax plans, saying they would spur business growth. Meanwhile, Democrats and Republicans are seeking to kill off his business tax breaks as the state struggles to balance it books.

In the lobby of the Kansas state capitol, there is a poster of Dwight Eisenhower, partially covered by signs. “The opportunist thinks of me and today. The statesman thinks of us and tomorrow,” the adopted Kansan is quoted as saying. No doubt both sides would claim he is speaking for them.

'We are a cautionary tale': Kansas feels the pain of massive Trump-style tax cuts

feel bad for the 9% POC but otherwise

feel bad for the 9% POC but otherwise

@ Kansas with 2 billion dollar surplus

@ Kansas with 2 billion dollar surplus