I'm not sure for mine, I print money. Long as there is no power outage my mint and print facility just keep going. I'm the plug for the Federal Reserve

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

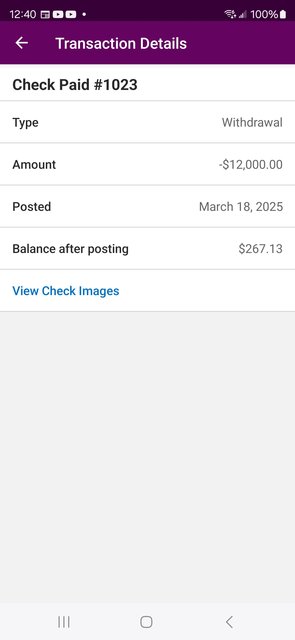

What Balance do you have in your Checking Account Right Now

- Thread starter EducatedBrothaFromTheBank

- Start date

More options

Who Replied?UpAndComing

Veteran

I don’t get it what’s wrong with having 50k in a savings account?

Always park your money in an account or investment that beats the rate of inflation. If not, then you are dwindling the value of the money you have

Depends on what that money is for and your net worth. I have my "life's savings" sitting in investment accounts that are not retirement accounts. That $27K I have sitting in savings is not my "life's savings" It's some money incase I decide I'm tired of renting and want to get a house and in the event of an emergency it could be used for that also.Always park your money in an account or investment that beats the rate of inflation. If not, then you are dwindling the value of the money you have

If it's money you might want to access in a pinch like an emergency fund keep it fully liquid and easily available. If it's down payment money also liquid and easily available.

Elim Garak

Veteran

Once I get my money back right I'm going to look into a brokerage account. I really don't know anything about them. I think I'm getting myself back on track financially.Typically savings rates are trash, so it’s better to put your money to work in a brokerage account, after 3-6 months worth of expenses is covered.

Basically depreciation

Last edited:

If you know nothing about investing you'll probably be better off buying shares or fractional shares of $SPY. It's a basket of stocks that makes up the S&P500 the 500 biggest US companies by marketcap. It's a brainless investment that you can just set and forget.FC

Once I get my money back right I'm going to look into a brokerage account. I really don't know anything about them. I think I'm getting myself back on track financially.

The optimal way is to open a Roth IRA which is a post tax investment account where the money grows tax free if you take it out after reaching retirement age. You max that out then put the rest in a regular brokerage account.

Elim Garak

Veteran

I've heard similar things before. I can open up a Roth IRA through T. rowe Price since I already have a 401k through them. I will read up on this also.If you know nothing about investing you'll probably be better off buying shares or fractional shares of $SPY. It's a basket of stocks that makes up the S&P500 the 500 biggest US companies by marketcap. It's a brainless investment that you can just set and forget.

The optimal way is to open a Roth IRA which is a post tax investment account where the money grows tax free if you take it out after reaching retirement age. You max that out then put the rest in a regular brokerage account.

GhettoTeK

All Star

Checking- $13.09

Savings- $110.10

I bet you killing it now

Let's get the update bruh...

Joint checking: 7K

HYSA: 25K

Personal checking $569

Brokerage: $106.19

Roth IRA: $6,537.39

401K: $80K

I was late to investing due to my credit card usage in my 20s which held me back for years

But now I’m debt free minus the mortgage

2.9 interest rate

sanityovar8ted

OG Moma Coli....dat bytch Thowd!!!

Checking.....4 cents

Savings.......1 cent

Savings.......1 cent