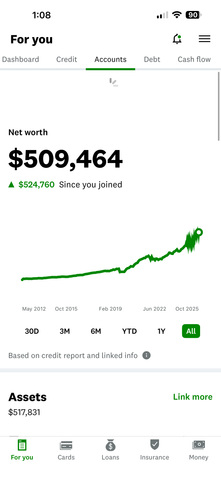

Assets should actually be $446,510. For some reason it doesn't count my car since it's a 2024 model. Hoping to get close to half a million without owning a home this year.

It's unfortunate I didn't get serious about money until really 2019.

)

)

Ugh, just pay off the car and whatever the other CC debt is.My deal is I keep my total debt at under $12K right now it's at $8.3K and $7K of that is the car.

that is very dumbI will openly admit I have not been smart or frugal with my money at all. I've done dumb stuff like buy a brand new car in 2024 then trade it in and buy another brand new car in 2025.

My credit card "debt" is just the float of my living expenses and purchases. I pay all my statement balances in full every month so I'm not paying any interest. The only way I'll ever have a zero balance is if I just stop using the cards which I don't because I get reward points on all of them. I'll always show a balance but if I'm not paying interest it's irrelevant.Ugh, just pay off the car and whatever the other CC debt is.

vgt u mean?Thread reminds me i need to start dumping more into voo

Even with this logic it makes more sense to just pay it off .I do have the money to pay off the car right now but I don't feel the need. The interest that high yield account earns is 4.4% and the loan is 5.9% so the loan cost me 1.5%. I will eventually just pay it off because it's a 5 year loan and I don't need to take it 5 years. Payment is $153 a month and every paycheck I add $120 to the account with the money to pay it off. In less than 2 years the extra money I've added will be enough to wipe out the loan.