First step... If you want to have a conversation on building wealth in the black community,

you need to actually define what wealth actually is.

What is the actual definition of wealth in financial terms? A lot of people don't know.

A lot of wealthy black people aren't actually wealthy. They're rich.

The black people with money we look up to and attempt to emulate are often professional athletes & entertainers (rappers, producers, etc.).

Then we have the professionals (lawyers, doctors, engineers, etc.)

They may make good money, but it's hard to build wealth with the type of money they're getting.

In these terms, their income is/was

"earned income." In order to build wealth, you need

"leveraged" "passive" or "portfolio" income.

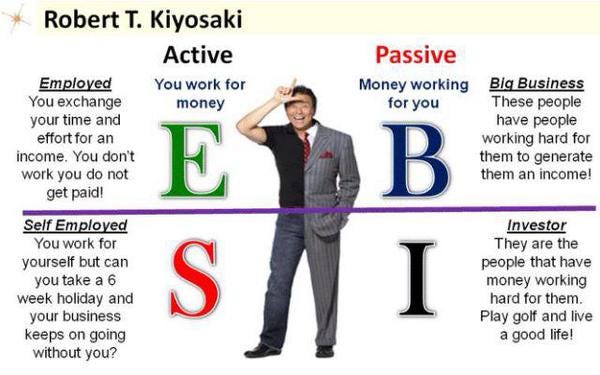

- Earned: When you work a job, your paycheck is "earned income." You are your only asset. If you don't get your "ass"et to work, you don't get paid. Earned income is linear, meaning it is virtually the same check every pay. no matter how hard you work. Earned income is the hardest way to get rich or build wealth, because it is also the most taxed of all incomes.

- Leveraged: When you "leverage" the efforts of others or a system that automatically produces products and services. Think Jim Rohn's quote "I'd rather have 1% of effort from 99 people than 100% of my own."

- Passive: When you continuously receive income based on an asset you own. (Renting properties, holding fees from television shows/commercials, etc.)

- Portfolio: When you invest money into something that increases in value (Real Estate, Stock Market)

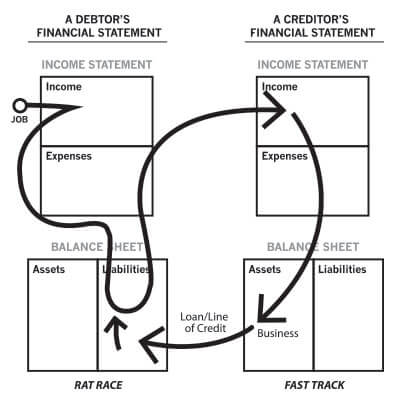

Basically,

wealth is money that you get without having to work a job. You can't pass down a job to your kids. Y

ou CAN however, pass down a SYSTEM that continually makes you and your family money (wealth) to your kids.

Business ownership, real estate holdings and a stock portfolio are the type of things that can increase the amount of money your future generations receive.

If we want to get REAL about wealth, we need to understand the difference between having a JOB, having STOCK ownership in a company, OWNING a business and being a CONTRACTOR.

Once you get a good grasp of HOW people get their money and HOW it sets them up, the next step is understanding HOW to get there.

As most of us have jobs, we don't know how to transition from that E quadrant to the B / I quadrant.

First step to building wealth is managing money like a wealthy person. We're never going to be able to invest anything without money saved, and in order to that we have to discipline ourselves to take money from that check and dedicate it to things that will get you money without you having to consistently labor in managing and maintaining it.

Understanding debt; good debt vs bad debt... assets and liabilities, credit and taxes are the first steps to getting BETTER at managing money.

I could go even deeper, but we need to start here.