Ezekiel 25:17

Veteran

Live within your means, brehs/brehettes.

This is all it boils down to. Stay at home or get a roommate if you need help. Folks buying 3 series, eating out, buying luxury clothes.

Live within your means, brehs/brehettes.

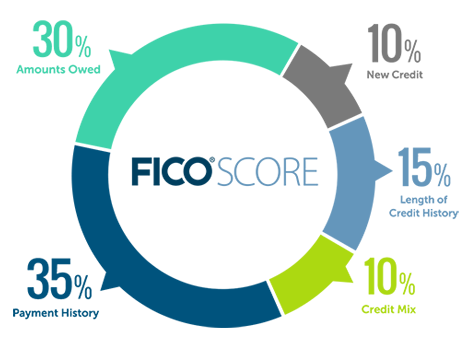

You’re supposed to use 15% to 30% of your credit. I think that’s how it works.This makes no sense

@ all times I should owe the bank some $?You’re supposed to use 15% to 30% of your credit. I think that’s how it works.

Makes sense when you understand how credit is scored.This makes no sense

If a company extends you credit, they want to see it being used. Being at 0% utilization can look like you're just sitting on a line of credit since the only ones with access to your transaction history is the credit issuer. It's not intuitive but we don't get to make the rules. If you're chasing scores in anticipation of opening a new line of credit, then understanding the scoring system is key. From the breakdown, payment history and amount owed are the biggest pieces, so pay debt down and do it on time. Dont waste your time trying to maximize your score though, because it can change from day to day.Your credit utilization ratio on revolving accounts-the percentage of your available credit you're using-is an important factor in your FICO Scores. Using a high percentage of your available credit means you're close to maxing out your credit cards, which can have a negative impact on your FICO Scores.

On the other hand, using a low percentage of your available credit can have a positive impact. In some cases, a low credit utilization ratio will have a more positive impact on your FICO Scores than not using any of your available credit at all.

My fico is in the 760 range I have nothing but 4 credit cards. Haven’t had an installment loan in 8 years.

your credit isn’t going to go to shyt

I wouldn’t say go to shyt, but you are penalized points if you report zero balances across all accounts. For revolving accounts, you get max points by letting 1-5% of your balance report. If this guy does have zero balances reporting on revolving and paid off his loan, he could lose 40 points or more…he’s then being penalized for lack of account variety. Only time you should worry about it is if you are applying for something large like a house or car, and in some cases a credit card.My credit vardcard balances are $0. All 3 of them. If you have no debt at all your credit score will absolutely go to shyt.

I wouldn’t say go to shyt, but you are penalized points if you report zero balances across all accounts. For revolving accounts, you get max points by letting 1-5% of your balance report. If this guy does have zero balances reporting on revolving and paid off his loan, he could lose 40 points or more…he’s then being penalized for lack of account variety. Only time you should worry about it is if you are applying for something large like a house or car, and in some cases a credit card.

. shyt happened this morning

. shyt happened this morningThat ain’t shyt. Loan must’ve been older than 10 years, but being that you only lost 8 points shows how robust your file is. You’ll get those back just by aging the rest of your file for the next month…I just lost 8 points because a an old auto loan fell off. shyt happened this morning

Country headed to the shytter.

You know....a lot more bodies gonna drop, in cities, throughout America, too. I been stayin my black ass out the way, and stackin, my little bit of chump change.

Tis the holiday season. Nggas are broke, struggling, fraudin, frontin, and desperate. Cacs too. You're an opportunity, out here, to a lot of folks. The govt. is gonna have to break bread, and relieve these financial - restraints, by bailing ppl out, somehow.

COVID Hosiptal bills

max out credit cards to keep rent paid