Thank You. I will pay it off tomorrow

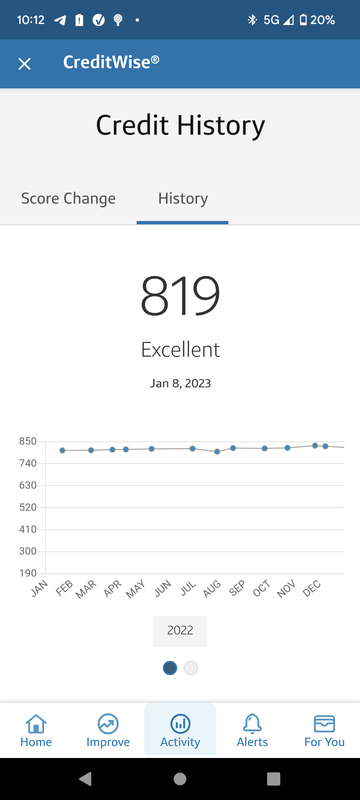

Explain your knowledge 6 fig breh

There's nothing wrong with have a credit card debt balance as long as you are constantly making payments slightly above the monthly minimum payment.

As long as your total debt is under 30% of your overall credit card utilization across all your cards your score will go up.

You need to show that you are responsible with utilization.

What you need to do it takeout a credit card with a 0% interest promotion, around the time the promotion is about to end, you apply for a new card with another 0% interest promotion and then move the debt to that card. As long as you have consistently been making payments and are under 30% utilization when you apply for a new credit card you can ask for a higher credit limit (this also does depend on other things like say income) which then increases the actual amount of your overall utilization of credit that you can use if needs be

For example you have two credit cards of a combined $10k limit between them. Which means your 30% utilization limit is $3k. You have $2k credit card debt. If you apply for another credit card with a $10k limit . Your total credit you can use is now $20k, but your utilization limit is now $6k.

My trick is to have multiple credit cards but to only use 1 main credit card. I apply for a new credit card every 4-6 months. I'm never going to use it and it's just there to bump up my overall credit amount and utilization.

Now while you are doing this you can be saving up actual cash which can be used to clear the debt at any point in the future if needs to be.

good shyt bruh. What’s ya routine? I know it SHOULD be simply paying it off before the payment date, but I’ve heard so many “tricks” ion know wtf to believe

good shyt bruh. What’s ya routine? I know it SHOULD be simply paying it off before the payment date, but I’ve heard so many “tricks” ion know wtf to believe

I had to come back to this post. The layers of truth to this shyt is wild. nikka dropped scripture on a Saturday eve.

I had to come back to this post. The layers of truth to this shyt is wild. nikka dropped scripture on a Saturday eve.

:max_bytes(150000):strip_icc()/91277665-56a9a6fb5f9b58b7d0fdb19a.jpg)

....even more so for folks that had bad credit, foreclosures, and bankruptcy

....even more so for folks that had bad credit, foreclosures, and bankruptcy