1/60

$TSLA Walls are starting to close in for Tesla, let's have a closer look:

2/60

1) The recent turnover in senior executives is incredible, with most having a tenure well over 5 years. From CFO, to head of HR as well as key engineering execs. What do they know that the market doesn't? Not to mention, huge stock sales on exit (e.g. Baglino).

3/60

2) Company has begun an intensive layoff program (estimates are around 10-20% of the workforce (further layoffs announced this weekend p. Linkedin), which appears completely indiscriminate (e.g. entire supercharger team - see the linked article)

4/60

3) Further to the point of layoffs being indiscriminate, the Company has pulled offers made to interns. Aborting hiring the cheapest future talent? What has changed in 6 months?

5/60

4) What has changed is demand. Over the last 18m the Company cut prices aggressively to stimulate short term demand. This works for a while, but ultimately cutting prices in consumer businesses destroys brands and margins (no longer premium, erodes scarcity)

6/60

5) There's only so far price cuts will go. Tesla has one of the oldest lineup among automakers - with the average age of its models at 9 years (ex-Cybertruck) - Where is the innovation to spur more demand?

https://uk.motor1.com/news/677090/lada-oldest-range-zeekr-newest/

7/60

6) Tesla is now in a Catch-22, cut margins further and wreck margins (& burn FCF) and lose rev growth, or keep prices flat and lose growth. Going into Q2, seeing market share losses in Europe with Tesla no longer being the best selling EV in many key markets eg France.

8/60

7) In the US, seeing inventory pile up and nowhere to put it. Recently saw Tesla hire parking at a abandoned mall to park new vehicles.

9/60

8) Recent drone footage of its Fremont site shows inventory piling up on the grass with no parking space available.

[U][URL]https://youtube.com/watch?v=AWoM_AG0EZA&ab_channel=MetGodinWilderness%E5%9C%A8%E6%9B%A0%E9%87%8E%E9%81%87%E8%A6%8B%E7%A5%9E[/URL][/U]

10/60

9) Additionally, outside of self-inflicted factors - Tesla is also being hit by slowing demand for EVs more broadly. As subsidies have lost their impulse to drive short term demand as well as concerns over depreciation/range, Consumers have started to shift back towards ICEs.

11/60

10) Outside of pure consumer demand, fleets and rental car companies have also stopped buying tesla's due to strong depreciation / unpredictable residuals and lack of consumer demand.

12/60

11) The lack of innovation, reliability issues, depreciation as well as Elon's persona has destroyed the brand - with Tesla ranking as the 2nd worst auto brand in an Axios survey in 2023. Months to cause, years to fix.

13/60

12) Rather predictably, Elon has attempted to divert attention from its core automotive business to robotaxis, AI and robots. Full self driving has been promised to be imminent for almost a decade now and investors are getting inpatient.

14/60

13) There is only so much Elon/Tesla can promise today to juice the stock, with the Company's long history of undelivered promises becoming clearer every day. In many way, the Tesla acquisition really showed the emperor had no clothes.

15/60

14) These broken promises historically were driven by his incentivisation structure. Now that it has been revoked, what incentive is there for him to stay (other than his existing stock, but given fading fundamentals he'd be better exiting ASAP)

16/60

15) Now analysts are asking Elon's commitment to Tesla (35:21, Q1 call) and his answer wasn't convincing to anyone. Large deliberate pause, no clear "I'm not leaving Tesla", but rather a vague answer. He also noted autonomy would be possible without him.

17/60

16) Elon is now playing his option value, see if the vote goes through to ratify his 2018 package otherwise he'll likely dump his shareholdings. The desperation of him and what is left of the (non-independent) board is clear with the new vote site

18/60

17) The new video from the chairman of the board pushing for investors to vote yes on ratifying the package, despite the Delaware court decision and the size of the package vs. Tesla's historic profits puts to bed any questions over the independence of the board.

19/60

18) As well as the issues with the board, worth noting the management turnover in key accounting/legal positions makes you highly doubt the Company's reporting. E.g. Dave Morton leaving as CAO after a month, CFOs always internal, GCs constantly leaving

20/60

19) Just to add smoke to the fire here, several whistleblowers have raised question's over the group's accounting - including one noting they were operating two sets of books.

21/60

20) As such, it's incredibly hard to take the Company's financials and $26.8bn of cash at end of Q1 too seriously given the Company likely pulled out all the stops with deliveries, squeezing suppliers and other measures to window dress q/end.

22/60

21) There's a reason nearly every OEM has gone bust in the US at one point or another: capital intensity, operational leverage, cyclicality and competition. Tesla made the classic business mistake of expanding supply too quickly. It will be hard to reverse

23/60

22) Unlike other OEMs, Tesla runs its own dealer network - essentially holding all inventory produced on balance sheet (rather than flushing to its dealer network). There is no exit valve to push more supply to. Without rationalising supply, cash burn & inventory will explode.

24/60

23) If Tesla faces a similar demand drop to what was seen for conventional automakers during 2008 (new vehicle sales dropped 18%), the cash burn rates could be rather incredible. As a reminder, this was the peak quarterly cash burn of the big 3 automakers in the US during 2008.

25/60

24) Q1 begun the unravelling, with FCF of -$2.5bn with deliveries down 9% with the gap between deliveries and supply exploding. If deliveries normalises to 2022 levels now price cuts have slowed and subsidies flatlined, company could easily burn $4-5bn+ a quarter.

26/60

25) Not only this, Tesla faces litigation in relation to its products and services. Most notably, the NHTSA re-opened its probe into Tesla's Autopilot / FSD recall. Should the NHTSA drive a more aggressive recall, could face litigation from consumers.

https://static.nhtsa.gov/odi/inv/2024/INIM-RQ24009-12199.pdf

27/60

26) Outside of litigation from consumers for product quality issues (Cybertruck?) and mis-selling of products (FSD?) - company also faces a major threat of penalties from regulators for mis-selling (Dieselgate style?) as we saw today:

28/60

27) All things considered, Tesla will likely have to raise more capital (debt or equity) either back half of 24 or early 25 given cash burn & minimum cash needs. Elon will likely try and repeat the 2019 playbook by using an event (e.g. Robotaxi event this year) to pump into.

29/60

28) The Robotaxi event is another charade. NHTSA is demanding more information on the recall because of a series of accidents since the "recall" which didn't really affect how people used it. The reality: Tesla has more accidents than any other OEM

30/60

29) Not only has Tesla not made any regulatory actions to start robotaxis, but the FSD software continues to pull outright dangerous moves that show it is nowhere near ready and perhaps never will due to hardware limitations.

31/60

30) So distressed automaker likely needed to raise cash in next 12 months under multiple investigations, with a super stale lineup and how is it priced? Well I'll leave that to your interpretation. Forward multiples also based off goal-seeked hyper bullish sell side estimates.

32/60

31) Over the last 12 months EPS estimates by the street have been cut in half - yet the stock is actually broadly unchanged over the last year. Given the abovementioned trends, I believe we could easily see EPS go negative by the end of the year

33/60

32) Twitter really showed how fast it can unravel and with recent disorderly layoffs, falling demand / deliveries and investigations into the company heating up I strongly believe Tesla will unravel in the next 12 months. Eventually the market will hunt down Elon's margin call.

34/60

33) Just to emphasise how disorderly the layoffs are (outside of interns having offers pulled, entire teams being laid off), Tesla's career site has 3 jobs for the entire US. I get people are being moved around internally with layoffs, but for a firm with 100k+ FTEs this is nuts

35/60

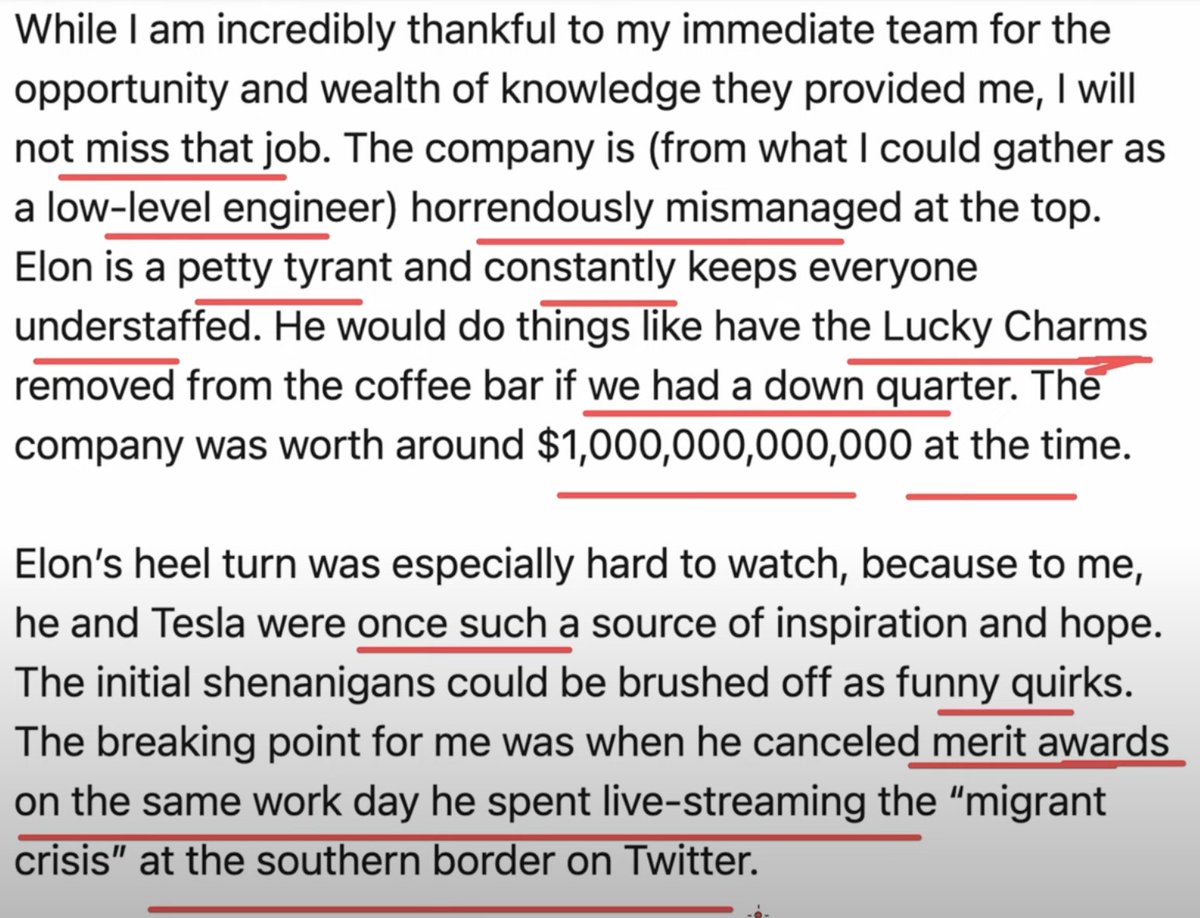

34) Employees through Glassdoor and Linkedin really give you some good insight to what's really going on:

36/60

35) When you dig deeper there's a range of other peculiarities at Tesla. Unlike every other S&P/OEM company, Tesla uses its own ERP system (vs Microsoft, SAP, Oracle etc) called WARP - which when you consider the accounting / governance issues is worrying

Which ERP system does Tesla use?

37/60

36) Tesla/Elon also has a very aggressive retaliation with whistle-blowers & a culture of fear of retaliation preventing anyone stepping out of line. This is not normal.

38/60

37) Instead of whistleblowing and facing the same fate, some employees are just leaving over quality concerns / fear of retribution. Take Ethan Heald for example - senior Mechanical Design Engineer at Tesla.

To post tweets in this format, more info here: https://www.thecoli.com/threads/tips-and-tricks-for-posting-the-coli-megathread.984734/post-52211196

jalopnik.com

jalopnik.com