It doesn't pay to use debt to buy bs like I did. That's how they get you 0% and you start buying stuff you don't need. Many people don't really even get how insipid debt is as a product. I mean I paid $4K down to $1K over that year but I should have paid it off. I'll have $400 left not due till October but it's gonna be gone next month.Damn you down bad right now. I feel you tho do what you gotta do

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Get out of debt brehs

- Thread starter newarkhiphop

- Start date

More options

Who Replied?

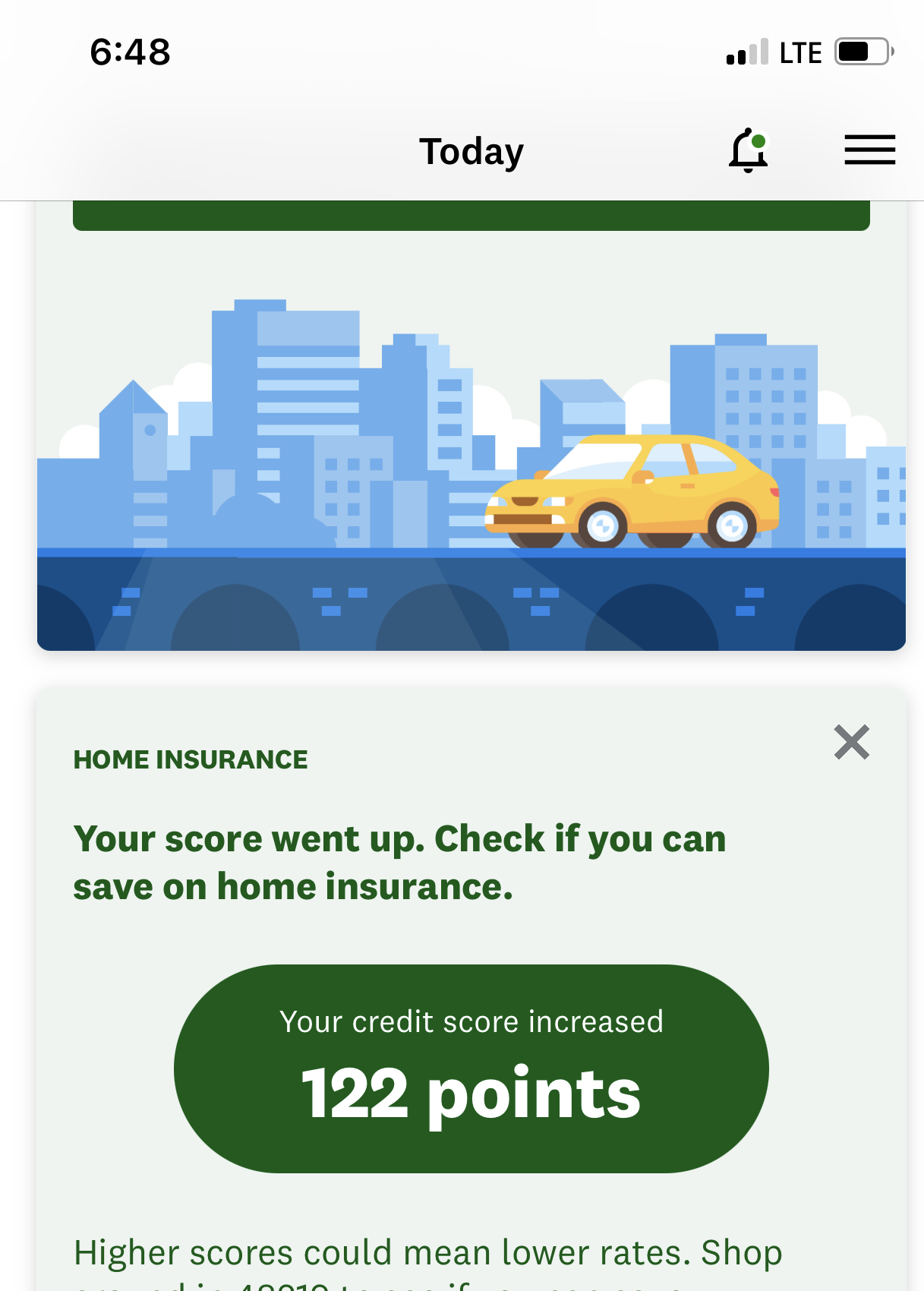

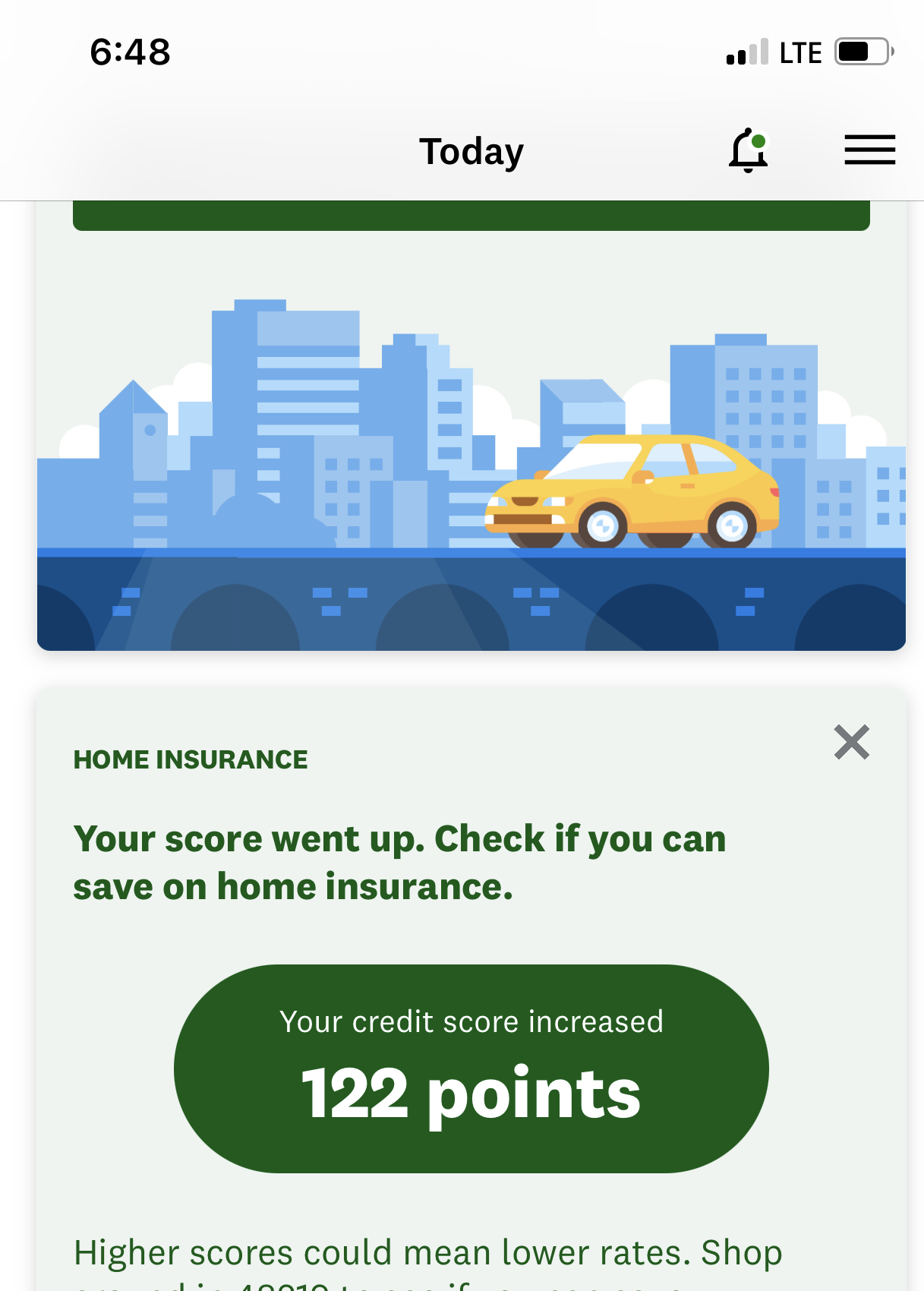

Once the two loans I just paid off factor in. I’m finally at 800

I remember when I had an 850 FICO score. Good times. When I paid off my installment loan my FICO score gradually fell until it reached the upper 700s. It's been stuck there ever since. Sometimes I'd get to 800 or a little over but with no installment loan my FICO score was extra sensitive to whatever credit card balances I had. Now that I have a small car loan I can't get back much above 800 because it's too new at 1.5 years out of 5.

Once the two loans I just paid off factor in. I’m finally at 800

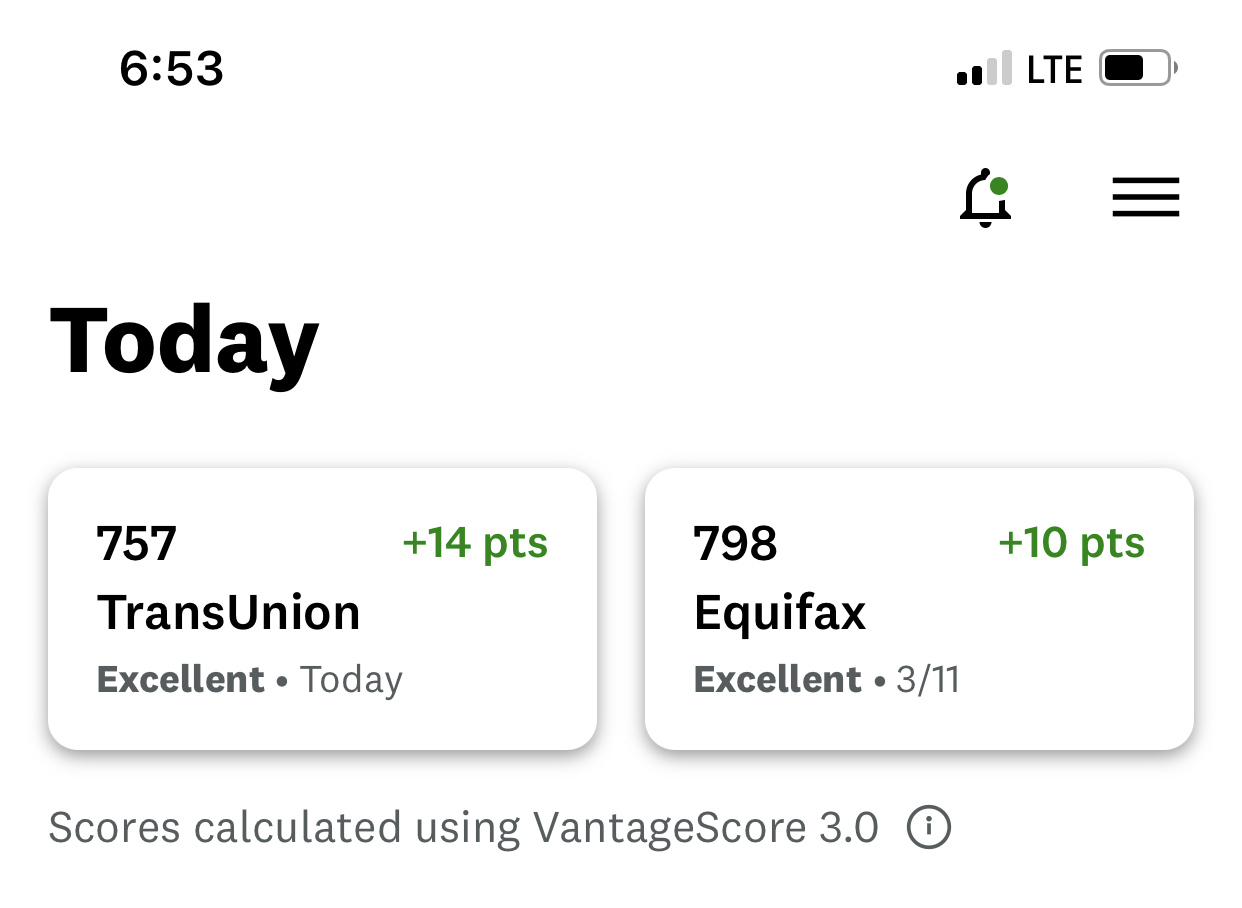

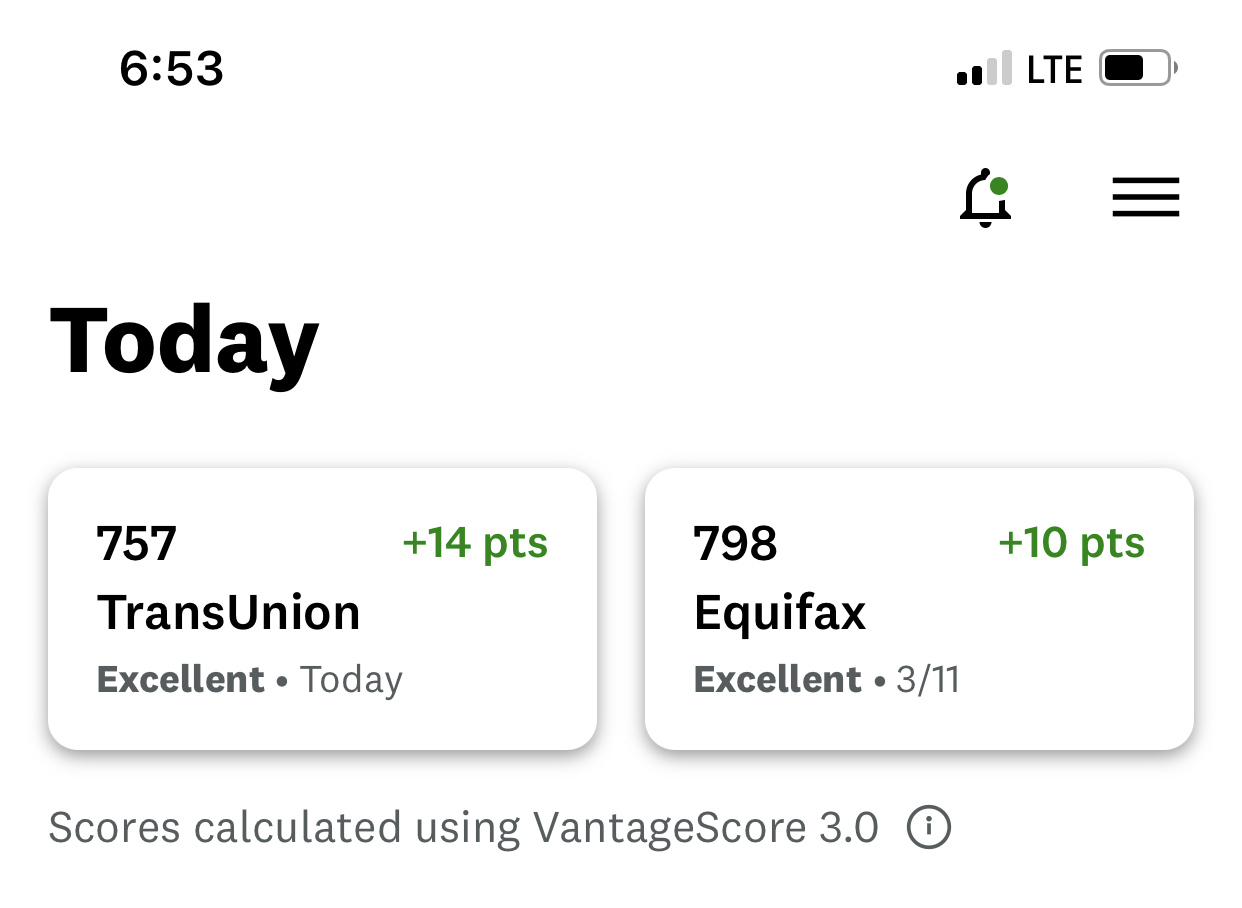

Keep in mind that VantageScore is not worth much. Almost nobody uses it. You need a FICO 2, 4, 5, or 8 score. Amex will give you a FICO 8 score free from Experian. Discover will give you a free FICO 8 score from Transunion. My Experian is 808 and my Transunion is 796. On Credit Karma it says my Transunion VantageScore is 819 so a 23 point difference. FICO 8 scores are almost always higher than the older 2, 4, and 5 scores sometimes by 20-30 points. Those older FICO scores are used for mortgages. The 8 is used for credit cards and auto loans.

Thx for the infoI remember when I had an 850 FICO score. Good times. When I paid off my installment loan my FICO score gradually fell until it reached the upper 700s. It's been stuck there ever since. Sometimes I'd get to 800 or a little over but with no installment loan my FICO score was extra sensitive to whatever credit card balances I had. Now that I have a small car loan I can't get back much above 800 because it's too new at 1.5 years out of 5.

Keep in mind that VantageScore is not worth much. Almost nobody uses it. You need a FICO 2, 4, 5, or 8 score. Amex will give you a FICO 8 score free from Experian. Discover will give you a free FICO 8 score from Transunion. My Experian is 808 and my Transunion is 796. On Credit Karma it says my Transunion VantageScore is 819 so a 23 point difference. FICO 8 scores are almost always higher than the older 2, 4, and 5 scores sometimes by 20-30 points. Those older FICO scores are used for mortgages. The 8 is used for credit cards and auto loans.

use them stimmy checks wisely brehs

use them stimmy checks wisely brehsDeuceZ

Li pitit gason

use them stimmy checks wisely brehs

Folks going to the Gucci and Louis store, I'm tryna clear off this debt and maybe invest some

3 more months to go and my loan is fully paid for. For 5 years it took 1/4th of my paycheck but once its paid only my rent is going to take 1/4th of it

the freedom, not dealing with the bank anymore

a nikka can invest/save again

the freedom, not dealing with the bank anymore

a nikka can invest/save again

3 more months to go and my loan is fully paid for. For 5 years it took 1/4th of my paycheck but once its paid only my rent is going to take 1/4th of it

the freedom, not dealing with the bank anymore

a nikka can invest/save again

Salute Fam, I recently paid back a loan, and it felt great. I still have a long way to go to be complete debt free, but I’m celebrating every win.

Salute Fam, I recently paid back a loan, and it felt great. I still have a long way to go to be complete debt free, but I’m celebrating every win.Yapdatfool

Superstar

WELL...Fixed for me. I've made this bed, I must find & work my way out of it.

Goal this year is to pay off my remaining car note (10k) between august-december of this year. Then start to SERIOUSLY stack bread between work and my side job(s) and look for new work in 2022.

I am almost debt free brehs...

Yeah I tried to refi my house and the scores my mortgage company pulled and credit karma were like almost 100 points apartI remember when I had an 850 FICO score. Good times. When I paid off my installment loan my FICO score gradually fell until it reached the upper 700s. It's been stuck there ever since. Sometimes I'd get to 800 or a little over but with no installment loan my FICO score was extra sensitive to whatever credit card balances I had. Now that I have a small car loan I can't get back much above 800 because it's too new at 1.5 years out of 5.

Keep in mind that VantageScore is not worth much. Almost nobody uses it. You need a FICO 2, 4, 5, or 8 score. Amex will give you a FICO 8 score free from Experian. Discover will give you a free FICO 8 score from Transunion. My Experian is 808 and my Transunion is 796. On Credit Karma it says my Transunion VantageScore is 819 so a 23 point difference. FICO 8 scores are almost always higher than the older 2, 4, and 5 scores sometimes by 20-30 points. Those older FICO scores are used for mortgages. The 8 is used for credit cards and auto loans.

Rell Lauren

Banned

Getting used to spending cash instead of credit has been an adjustment. Want to pay off the remaining balances on my Cap One and Discover before I even consider it again.

Yapdatfool

Superstar

WELL...

Goal this year is to pay off my remaining car note (10k) between august-december of this year. Then start to SERIOUSLY stack bread between work and my side job(s) and look for new work in 2022.

I am almost debt free brehs...

fukk all that, paid that bytch off TODAY

If all goes well, I should be making my final payment on this Pepboys CC by July, which should save me $150 a month going forward. Debt free journey continues