You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Man takes his $12/hr job and invests. His new networth is over $500,000.

- Thread starter WheresWallace

- Start date

More options

Who Replied?What exception? Did you not hear that he made no more than 20,000 a year or 12/hr. He's the definition of "trying to get by"that's the exception not the rule. most people are trying to get by on what they make.

WheresWallace

Superstar

Nah breh. I dont believe in the American dream.nikkas still thinking the American dream is a reality that anyone can achieve

Stories like the OP shared are 1/1,000,000 and are the feel good stories republicans LOVE to share to spread their tax cuts for the rich BS, keep middle income and poor thinking "I'll become rich one day so they better keep those taxes down so when I become rich I don't Obama taking my money"

If you look at my OP you see my lessons learned from the video. Save your bread, avoid taking debt and don't accept limits (dude didn't let his dyslexia stop him from gaining knowledge.)

Yall coming into this thread as if someone is tryna shame yall or something. People acting like they are offended by dude's story. This is for inspiration to aim for more.

Mr. Earl did that so hopefully we wont have to go through that. His job puts him in an advantageous situation but that's no excuse for the rest ofus. Earl being surrounded by professionals but using dyslexia as an excuse is like me having access to books and the Internet, but using the lack of personal connections as an excuse. I believe luck and timing is significant, but working hard and smart is something we can all get results from

great story ....

i've been dripping more a minute and it works.... made some adjustments and don't have any debt and may eat well like mr. earl one day

Definition of 'Dividend Reinvestment Plan - DRIP'

A plan offered by a corporation that allows investors to reinvest their cash dividends by purchasing additional shares or fractional shares on the dividend payment date.

http://www.investopedia.com/terms/d/dividendreinvestmentplan.asp

http://en.wikipedia.org/wiki/Dividend_reinvestment_plan

Dividend ReInvestment Plans (DRIPs)

Dividend ReInvestment Plans (also known as Dividend ReInvestment Programs, or DRIPs) are a great tool for long-term investors. The compounding interest of DRIPs allows investors to purchase additional shares of stock at no cost -- simply reinvest the dividends, and when enough money is accrued, additional shares are automatically purchased.

http://www.dividend.com/dividend-stock-library/dividend_reinvestment_plans.php

compound interest

i've been dripping more a minute and it works.... made some adjustments and don't have any debt and may eat well like mr. earl one day

Definition of 'Dividend Reinvestment Plan - DRIP'

A plan offered by a corporation that allows investors to reinvest their cash dividends by purchasing additional shares or fractional shares on the dividend payment date.

http://www.investopedia.com/terms/d/dividendreinvestmentplan.asp

http://en.wikipedia.org/wiki/Dividend_reinvestment_plan

Dividend ReInvestment Plans (DRIPs)

Dividend ReInvestment Plans (also known as Dividend ReInvestment Programs, or DRIPs) are a great tool for long-term investors. The compounding interest of DRIPs allows investors to purchase additional shares of stock at no cost -- simply reinvest the dividends, and when enough money is accrued, additional shares are automatically purchased.

http://www.dividend.com/dividend-stock-library/dividend_reinvestment_plans.php

compound interest

That;s $24k before taxes.You invest $3k a year, who can not invest $3k a year? Are you really saying someone making 24k($12/hour) can't put $3k aside?

Invest in an index fund, these funds have a steady return. Index funds that follow S&P 500 are good.

All you need is a steady return.

Here is what Warren Buffet says about index funds:

Here is an investment calculator, play around with the numbers:

http://www.bankrate.com/calculators/retirement/investment-goal-calculator.aspx

Compound Interest Formula

P = principal amount (the initial amount you borrow or deposit)

r = annual rate of interest (as a decimal)

t = number of years the amount is deposited or borrowed for.

A = amount of money accumulated after n years, including interest.

n = number of times the interest is compounded per year

Example:

An amount of $1,500.00 is deposited in a bank paying an annual interest rate of 4.3%, compounded quarterly. What is the balance after 6 years?

Solution:

Using the compound interest formula, we have that

P = 1500, r = 4.3/100 = 0.043, n = 4, t = 6. Therefore,

So, the balance after 6 years is approximately $1,938.84.

https://qrc.depaul.edu/StudyGuide2009/Notes/Savings Accounts/Compound Interest.htm

_____________________________________________

Rule of 72

From Wikipedia, the free encyclopedia

In finance, the rule of 72, the rule of 70 and the rule of 69 are methods for estimating an investment's doubling time. The rule number (e.g., 72) is divided by the interest percentage per period to obtain the approximate number of periods (usually years) required for doubling. Although scientific calculators and spreadsheet programs have functions to find the accurate doubling time, the rules are useful for mental calculations and when only a basic calculator is available.[1]

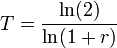

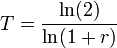

These rules apply to exponential growth and are therefore used for compound interest as opposed to simple interest calculations. They can also be used for decay to obtain a halving time. The choice of number is mostly a matter of preference, 69 is more accurate for continuous compounding, while 72 works well in common interest situations and is more easily divisible. There are a number of variations to the rules that improve accuracy. For periodic compounding, the exact doubling time for an interest rate of r per period is

,

,

where T is the number of periods required. The formula above can be used for more than calculating the doubling time. If you want to know the tripling time, for example, simply replace the constant 2 in the numerator with 3. As another example, if you want to know the number of periods it takes for the initial value to rise by 50%, replace the constant 2 with 1.5.

http://en.wikipedia.org/wiki/Rule_of_72

P = principal amount (the initial amount you borrow or deposit)

r = annual rate of interest (as a decimal)

t = number of years the amount is deposited or borrowed for.

A = amount of money accumulated after n years, including interest.

n = number of times the interest is compounded per year

Example:

An amount of $1,500.00 is deposited in a bank paying an annual interest rate of 4.3%, compounded quarterly. What is the balance after 6 years?

Solution:

Using the compound interest formula, we have that

P = 1500, r = 4.3/100 = 0.043, n = 4, t = 6. Therefore,

So, the balance after 6 years is approximately $1,938.84.

https://qrc.depaul.edu/StudyGuide2009/Notes/Savings Accounts/Compound Interest.htm

_____________________________________________

Rule of 72

From Wikipedia, the free encyclopedia

In finance, the rule of 72, the rule of 70 and the rule of 69 are methods for estimating an investment's doubling time. The rule number (e.g., 72) is divided by the interest percentage per period to obtain the approximate number of periods (usually years) required for doubling. Although scientific calculators and spreadsheet programs have functions to find the accurate doubling time, the rules are useful for mental calculations and when only a basic calculator is available.[1]

These rules apply to exponential growth and are therefore used for compound interest as opposed to simple interest calculations. They can also be used for decay to obtain a halving time. The choice of number is mostly a matter of preference, 69 is more accurate for continuous compounding, while 72 works well in common interest situations and is more easily divisible. There are a number of variations to the rules that improve accuracy. For periodic compounding, the exact doubling time for an interest rate of r per period is

where T is the number of periods required. The formula above can be used for more than calculating the doubling time. If you want to know the tripling time, for example, simply replace the constant 2 in the numerator with 3. As another example, if you want to know the number of periods it takes for the initial value to rise by 50%, replace the constant 2 with 1.5.

http://en.wikipedia.org/wiki/Rule_of_72

It is noteworthy but that an outlier. $12/hr is less in New York or LA versus Baltimore. He's much older so he got his house at MUCH reasonable rates versus today (inflation). MTV, Worldstarhiphop and Facebook isn't pumping BS in one's face just for the sake of living lavish. Easy to be frugal back then versus now. I didn't watch the video but maybe he had a working wife so that's another income to do whatever. There are many factors to look into in regards to that.

People are trying to live.

People are trying to live.

posterchild336

Superstar

i honestly never heard of people worshiping certs until I came to the coli....smh

It is noteworthy but that an outlier. $12/hr is less in New York or LA versus Baltimore. He's much older so he got his house at MUCH reasonable rates versus today (inflation). MTV, Worldstarhiphop and Facebook isn't pumping BS in one's face just for the sake of living lavish. Easy to be frugal back then versus now. I didn't watch the video but maybe he had a working wife so that's another income to do whatever. There are many factors to look into in regards to that.

People are trying to live.

i watched, it showed his wife but didn't mention her working which she very much well may have. plus it said he hustled on side jobs, and paid for his 3 kids to attend private school.

being frugal in any time age is difficult and requires vast amounts of self discipline.

WheresWallace

Superstar

great story ....

i've been dripping more a minute and it works.... made some adjustments and don't have any debt and may eat well like mr. earl one day

Definition of 'Dividend Reinvestment Plan - DRIP'

A plan offered by a corporation that allows investors to reinvest their cash dividends by purchasing additional shares or fractional shares on the dividend payment date.

http://www.investopedia.com/terms/d/dividendreinvestmentplan.asp

http://en.wikipedia.org/wiki/Dividend_reinvestment_plan

Dividend ReInvestment Plans (DRIPs)

Dividend ReInvestment Plans (also known as Dividend ReInvestment Programs, or DRIPs) are a great tool for long-term investors. The compounding interest of DRIPs allows investors to purchase additional shares of stock at no cost -- simply reinvest the dividends, and when enough money is accrued, additional shares are automatically purchased.

http://www.dividend.com/dividend-stock-library/dividend_reinvestment_plans.php

compound interest

when you said that you were "dripping" I was thinking that you were talking about a way to get high or something.

when you said that you were "dripping" I was thinking that you were talking about a way to get high or something.ThatTruth777

Superstar

One of the greatest lessons I learned from reading Malcolmn X's autobiography is to always observe and listen.

Agree on being frugal period is extraordinary but America it's been embedded into a belief that life isn't worth living unless one is doing extraordinary things.i watched, it showed his wife but didn't mention her working which she very much well may have. plus it said he hustled on side jobs, and paid for his 3 kids to attend private school.

being frugal in any time age is difficult and requires vast amounts of self discipline.