Darth Nubian

I bought my first Ki from my baby momma brother

My fault, I skimmed over it

Dap + rep for the original analysis by the way.

Alright so I'm using your numbers, plus a few assumptions. I'll list them out:

House price in '89: $120,000

Loan term: 30 years

Down payment: 20%

Mortgage rate: 5%

Closing costs: 4% (buy), 6% (sell)

Property tax: 1.2%

Home insurance/month: 0.04%

Annual home appreciation: 3.8% (this makes the home worth $368,000 after 30 years)

Monthly rent: $600

Security deposit: $530

Renters insurance: $100

Annual rent appreciation: 4.1%

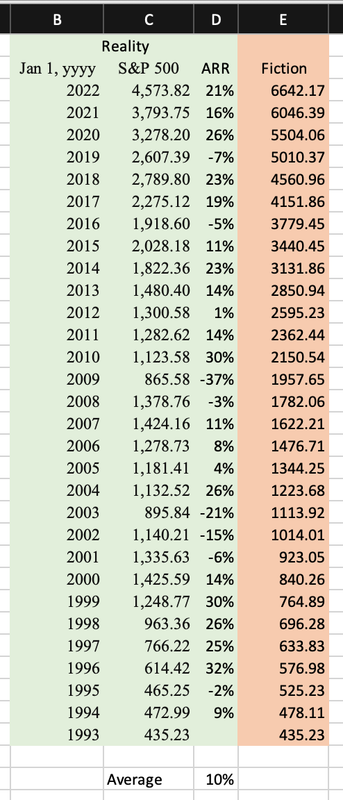

Index fund rate: 10.1%

Alright. A while ago I created an excel sheet to compare the two stances. For the buyer, the calculation is straight forward: price sold - price bought - selling fees. Pre tax.

For the renter, I take the down payment, closing costs for purchase, and throw that in an investment account tracked with index funds to grow for 30 years.

Now here's the tricky part. I assume that if the buyer spends more in a certain month than the renter, the renter can place that delta in the investment account. If the buyer spends less in a certain month than the renter, the buyer can place the delta in an investment account as well.

What you usually see is that in the beginning, the renter has only the rent to worry about. The buyer has to worry about maintenance and home insurance and property taxes and principal and interest. The renter only has to pay the rent and renters insurance. But as time goes on, the rent grows to exceed what the buyer is spending.

In month 2, the buyer will pay $778.98 per month, of which $663.15 is unrecoverable (doesn't go into the principal) The renter will pay $613.38 per month (rent + interest from security deposit + renters insurance.) This means the renter has $49.77 that month to invest. That grows to $1000.22 at the end of the 30 years.

In month 200, the buyer will pay $739.31 in unrecoverable costs. The renter will pay $1166.66. This means the buyer will have an additional $427.35 to invest. That grows to $1633.75 at the end of the 30 years.

So here is the trick: the impact of compound interest is exponential with time. If a renter puts away more in the stock market earlier, he may pay more in expenses later in the 30 years, but he's good, because that money invested earlier on has grown a lot. The buyer may gain the delta advantage later on, but he may not be able to catch up by the end of 30 years. Depends on the numbers. Let's look at the end of 30 years.

The buyer, due to his home appreciation, and ability to invest more funds later in the mortgage, has a net profit pre tax of $666,209.20.

The renter, due to investing his would be down payment and excess funds early on in the 30 years, has a net profit pre tax of $503,609.06.

So given the numbers you provided, the buyer wins. The renter... Doesn't do bad as well though. $500,000, that's good money too.

If I change the rent price to $550, both parties come out about the same. But that's my point, it depends on the numbers, and either way, you're not doing too bad.

Edit: I did the renter a disservice. I'm being generous to the buyer by not including the principal in the delta calculation. If I include the principal, the renter comes ahead. I'll see if I can upload the spreadsheet so you can play around with it if you want, and cross check my analysis.

This is complete bullshyt.

1. You not going to have 4.1% increase in rent each year for 30 years.

2. Your scenatio is predicated on taking every cent of disposable income and investing it which is downright unreasonable.

3. Where is the renter in year 38 when he is still renting and the homeowner been banking for eight years?

On the real, do you own a home? Everybody on this forum who owns a home is saying it was one of the best investments they made. Yet you arguing against it with pollyannaish hypotheticals.

You coulda had that endlessly-increasing-in-price 1-bedroom, breh.

You coulda had that endlessly-increasing-in-price 1-bedroom, breh.