You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

“Normalize mortgage payers to stop saying they’re homeowners, y’all ass renting too”

- Thread starter BrothaZay

- Start date

More options

Who Replied?He doesn't. Homeownership is not an option for him so that's where all this nonsense about renting + invest is somehow better than owning + investing is coming from. If you really want to shut him down, ask him for a screenshot of his stock portfolio and watch the way he spins that one. Something something something identity being exposed something something something internet forum something something something (5 paragraphs later) it's not that serious to me something something somethingSmart dumb nikkas always are loud with the ignorance. Dude likely doesn't own any property.

Last edited:

Everything has it's pros and cons. But at the end of the day when the state or investors want to buy your domicile.

Since it appears that you are at least trying to comprehend, I'm going to point out the fatal flaw in your analysis: Averaging 10% annual returns over a 30 year period is NOT the same as getting a consistent 10% return each year for 30 straight years.

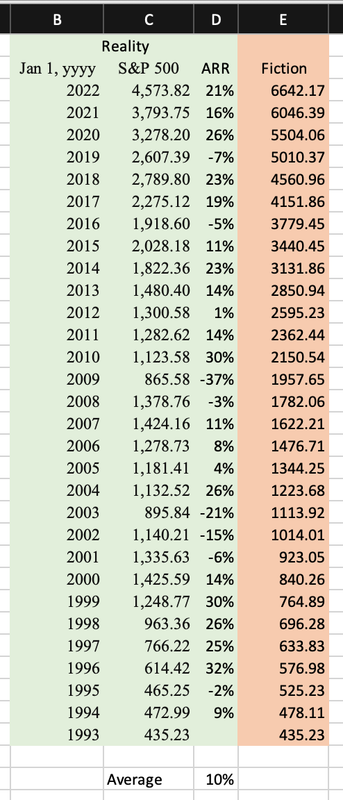

I'll illustrate this fact by looking at the S&P 500 over the last 30 years (SOURCE LINK):

The green shaded cells show how the S&P 500 really grew over the last 30 years. Column C is the actual closing value was on Jan 1 of each year. In Column D, I calculate the actual annual rate of return (ARR) each year, which as you can see averages out to 10% ARR. The S&P 500 actually rose from 435.23 in 1989 to 4,573.82 in 2022. Your analysis assumes that average ARR happens consistently year over year, and is represented in column E, which would see that 435.23 in 1989 rise to 6,642.17 in 2022. This error results in overstating the value of that investment by a whopping 45%!

This is why the example I took the time to write out uses real data over that 30 year period. The Coli/Xferno doesn't automatically underline hyperlinks for some reason, but nearly ever assumption made in that analysis (home prices, rent escalations, taxes, values of the S&P 500, Dow Jones and NASDAQ, etc.) has a hyperlink to the source website from which I got the value used in that assumption. I purposely compared median rent to median home prices to keep the comparison on the type of dwelling fair. It's not a perfect analysis, as I admit I did not include every single expense (or benefit), but I purposely chose the NASDAQ with its 24% average ARR to stack the deck in favor of the renter, and the renter still lost. Using the S&P 500, with it's "modest" 10% average ARR would have been a better reflection of reality (Warren Buffet already showed that even savvy, expensive, hedge fund managers would struggle to beat the S&P 500 over a long period when he bet them a million dollars and crushed them...SOURCE LINK). If I had used the S&P 500 instead of the NASDAQ, the homeowner would have blown the renter out of the water. Leaving out the closing costs doesn't change the bottom line: For most people, most of the time owning your residence is a better financial decision than renting your residence.

Very valid point, and a more accurate analysis would use actual time point returns for both the stock market and real estate price appreciation (I'd love to see the impact of the 07-09 recession on both scenarios).

1 thing you are missing (possibly, I'm skimming again) is the fact that I'm not just looking at the deposit invested. If it's just that against home ownership, the home owner wins. I'm including that and the delta of expenses the renter doesn't have to buy early on. A renter investing in the market when it is down sets him up for greater returns as he's buying stocks on a discount.

But this is an analysis can be taken to insane levels of detail. Your point again is valid, maybe I'll download point index returns and utilize those instead of average returns to see a more realistic return.

And ultimately, stocks outperform real estate. Always. This isn't a me fact, it's corroborated by any index you can find. The overall market beats real estate. Some people value physical property enough to forgo a proven higher return given their resources. I don't. And that's fine.

Buying A House Vs Investing In The Stock Market

Debating buying a house vs. investing in the stock market? While both can be smart money moves and both come with risk, here’s why the latter is the better decision.

www.forbes.com

www.forbes.com

Stocks >>>> real estate

Why? Because you only pay capital gains tax when you sell a security...either short term or long term capital gains.

With a house, you pay taxes on it every year even if you never planned on moving/selling the house.

Owning >>> Renting for the most part only because you HAVE to live somewhere so it makes more sense to buy and build equity in your own domicile instead of essentially just giving up money you'll never see again. Owning is like a 401k that you're forced to contribute to every month. Probably a good strategy if you're inclined to waste money.

That assumes the cost of ownership versus renting is the same.

Buy a home so that you have an asset to pass on. It should never be your primary investment vehicle. If you can't afford to invest in other ways, don't buy.

The taxes are mainly for the maintenance of the area around your house breh. Otherwise you'd be coming out of pocket for sanitation, firefighters, road and infrastructure maintenance, etc.

How do people not get this basic concept?

R.E.N. Spells Ren

Veteran

Very valid point, and a more accurate analysis would use actual time point returns for both the stock market and real estate price appreciation (I'd love to see the impact of the 07-09 recession on both scenarios).

1 thing you are missing (possibly, I'm skimming again) is the fact that I'm not just looking at the deposit invested. If it's just that against home ownership, the home owner wins. I'm including that and the delta of expenses the renter doesn't have to buy early on. A renter investing in the market when it is down sets him up for greater returns as he's buying stocks on a discount.

But this is an analysis can be taken to insane levels of detail. Your point again is valid, maybe I'll download point index returns and utilize those instead of average returns to see a more realistic return.

And ultimately, stocks outperform real estate. Always. This isn't a me fact, it's corroborated by any index you can find. The overall market beats real estate. Some people value physical property enough to forgo a proven higher return given their resources. I don't. And that's fine.

Buying A House Vs Investing In The Stock Market

Debating buying a house vs. investing in the stock market? While both can be smart money moves and both come with risk, here’s why the latter is the better decision.www.forbes.com

*sigh*

I didn’t miss the Delta between expenses; you showed that it starts out with the renter having more to invest and then the buyer has more to invest in later years. Even if the net effect of that is in the renters favor, it’s not greater than the unrealistic bonus I gave the renter by allowing them to see the returns from the NASDAQ with its 24% average ARR instead of the far more likely 10% ARR (which you cited as well). I just told you I gave the renter that bonus to stack the cards in the renter’s favor. Re-run the numbers if you need to (but check your work, cuz I’m not going to waste my time doing it for you any longer). I’m done. Ultimately, you’re free to believe what you want to believe. I just hope Black folks reading it don’t fall victim to this misinformation and do themselves a disservice wasting their prime earning years not trying to find a viable path to home ownership.

I do want to correct the notion that I’m making that argument that investing in real estate is better than investing stocks. That’s not what I’m saying at all. I would never make a blanket statement like that. This conversation is about owning the place you reside versus renting it. Key to the whole conversation is the fact regardless of which path you chose, you’re going to have pay to live somewhere. The buyer is just leveraging this certain expense into an investment that can yield gains where the renter is not. And the cost of doing this (chiefly the down payment; although there are programs where you can do no down payment or significantly reduce it from 20%) does not outweigh that benefit. This is a very different conversation than comparing investing extra capital in real estate (whether buying investment properties or into REITs) to investing that capital in stocks.

Seeing firsthand in 2008 how my parents and everyone around me lost their homes just as easily as they got it. Yes homeownership is a key wealth building tool when used correctlyI don’t know why people downplay home ownership. That’s one of the best financial moves you can make.

but people aren’t completely honest about the work that goes into it, how it can backfire on you and how it can be totally out of your control.

Seeing firsthand in 2008 how my parents and everyone around me lost their homes just as easily as they got it. Yes homeownership is a key wealth building tool when used correctly

but people aren’t completely honest about the work that goes into it, how it can backfire on you and how it can be totally out of your control.

They not giving mortgages out to everyone today, like they en masse did back then. I'm certain of that.

I just hope Black folks reading it don’t fall victim to this misinformation and do themselves a disservice wasting their prime earning years not trying to find a viable path to home ownership.

There is no need to respond to my reply, but I want to highlight this because I think this is the crux of why so many posters in this thread are foaming at the mouth, and why you are acting frustrated over a simple conversation... It ain't that serious.

If you fetishize the idea of home ownership as some sort of sole gateway to financial stability (as part of the American Dream), then it's understandable that when someone comes along, saying, "hey, you can be well off even if you do not prioritize getting a home", you will look at such a viewpoint as anti-Black.

It's not.

There is nothing wrong with desiring a home for whatever emotional reason you want. And in most instances, when done prudently, it is a good financial decision. And you will end up with equity that you can convert to cash, or pass on to your progeny.

However, there are circumstances where buying a house may be less optimal than renting. And in those instances it is irresponsible to insist that buying is ALWAYS better than renting. I stand on that.

Besides that, it is possible that someone would rather not be tied down to a place for 30 year, and wants the flexibility that renting provides. Such a person is not tied down to being a serf, or "calling the landlord daddy" (hotep speak), they also have ways of building equity that can be converted to cash or passed on.

At the end of the day, be honest with yourself. Do the math, speak to experts, do research, and determine what's best for you, taking your financial resources and your personal wants into consideration.

General comment: If you disagree with this, youse the bytch ass nikka black people should stay away from. Not me.

I feel you and I’m so sorry to hear that.Seeing firsthand in 2008 how my parents and everyone around me lost their homes just as easily as they got it. Yes homeownership is a key wealth building tool when used correctly

but people aren’t completely honest about the work that goes into it, how it can backfire on you and how it can be totally out of your control.

Sometimes it’s as simple as coming from a line of home owners so certain information is just taught within the family, sometimes it’s reading the paperwork and knowing the steps to take when you’re in financial trouble, etc.

Even with the pandemic, the mortgage moratorium allowed people to stay in their homes and not make payments for a year+ in some cases. Many people don’t realize options like that are still available for the average person who is going through a “hardship”. It’s much easier to hold onto a house than stay in an apartment if you can’t make your payment — if you know what to do and when.

I refinanced my mortgage to $750.... Do renters have that option? #growup

Talk about it.

Did you lose equity to refinance? Talk about it.

We dont focus on payments. Wr focus on the total. Talk about it.

Read your contract and share.

beenz

Rap Guerilla

Talk about it.

Did you lose equity to refinance? Talk about it.

We dont focus on payments. Wr focus on the total. Talk about it.

Read your contract and share.

I lost a couple grand in equity when I refinanced. but the new payment was so much lower, I gained it all back in like 6 months anyways.

Still have my equity. Payment is slightly (SLIGHTLY) higher than his.Talk about it.

Did you lose equity to refinance? Talk about it.

We dont focus on payments. Wr focus on the total. Talk about it.

Read your contract and share.

Crying tears of joy every month

I did the same thing. Refinanced when the rates hit the floor. Knocked 10 years off my mortgage with the same payment.I lost a couple grand in equity when I refinanced. but the new payment was so much lower, I gained it all back in like 6 months anyways.

There are several scenarios from a financial perspective where it's better to rent than buy.

And every single one of these scenarios involves a lack of funds.

aka broke nikka babble.