88m3

Fast Money & Foreign Objects

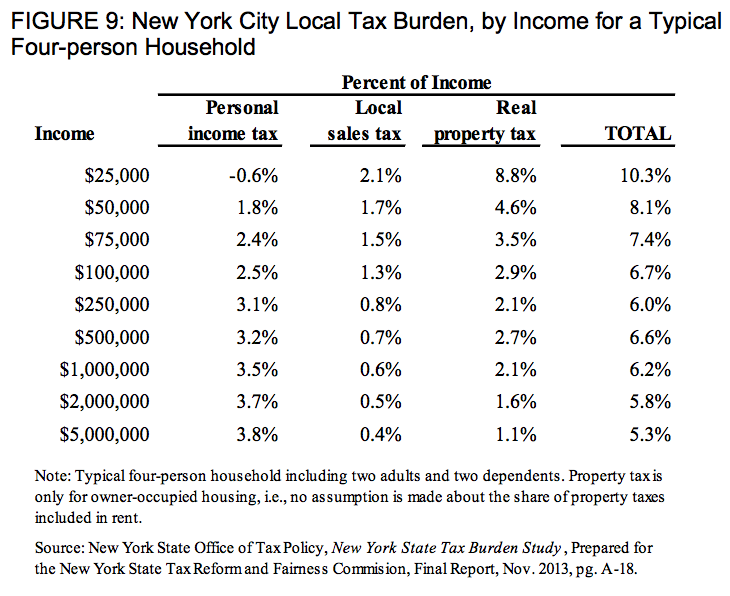

It’s the extreme end game of a tax code that shifts the burden from owners to renters, and from the wealthy to the poor.

"Sure, it's got a great view. But have you read these antiquated tax codes that got me a huge break?" (One57)

When a duplex condominium in New York's new One57 supertall tower sold for $100.5 million dollars in January, it shattered all records. This condo is the most expensive single-family residence ever sold in Manhattan. Yet, at the rate that luxe residential towers are coming online in the part of Midtown known asBillionaires Row—consider the $91.5 million sale just last month—even that mondo One57 record may not last for long.

Steamy eight- or nine-figure sales were always the dream of former Mayor Michael Bloomberg. "If we can find a bunch of billionaires around the world to move here, that would be a godsend,” then-Mayor Bloomberg told The New York Times back in 2013. "Because that’s where the revenue comes to take care of everybody else."

Construction is now underway on Nordstrom Tower, a supertall residential tower designed by Adrian Smith and Gordon Gill, the architects behind the Burj Khalifa. When the building is finished, the Nordstrom Tower will be the tallest residential building in the world. The one-percenters who can afford its lofts will be treated to some of the best views the United States has to offer.

And that's just one of several buildings coming up that caters to the world's wealthiest. So by Bloomberg's logic, Gotham is saved, right? Not quite.

A rendering of the Nordstrom Tower, currently under construction at 217 W. 57th Street. (Adrian Smith + Gordon Gill Architecture)

Thanks to the structure of city and state tax codes, the billionaires buyingpieds-à-terre in the sky over Central Park are hardly paying property taxes at all. The values of these new condos are being assessed at just a fraction of what they're worth. And buyers are paying only a fraction of that fraction in property taxes.

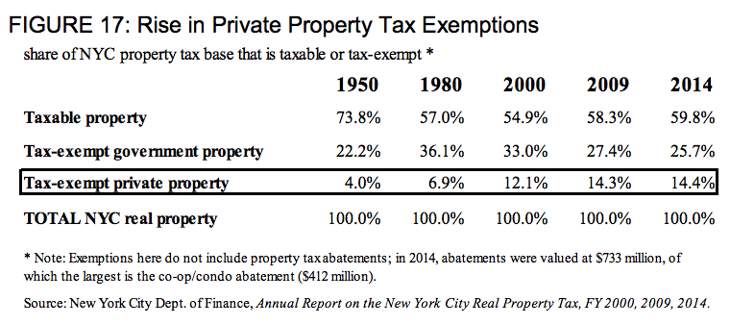

This is a pressing issue for at least three reasons. For one thing, the property-tax levy is New York City's single largest source of revenue. The city is leaving money behind by failing to tax the most valuable homes at a rate closer to their market value. Meanwhile, well apart from the ultra-luxury condos, the city is overtaxing apartment buildings, whose renters are struggling the most with affordability. These outcomes go hand in hand.

Second, with every new supertall residential tower in Midtown—each one more architecturally dramatic than the last—the effective property tax rates paid by owners on Billionaires Row stand to fall even lower. While nice condos attract big tax breaks, nice neighborhoods earn long-lasting tax breaks.

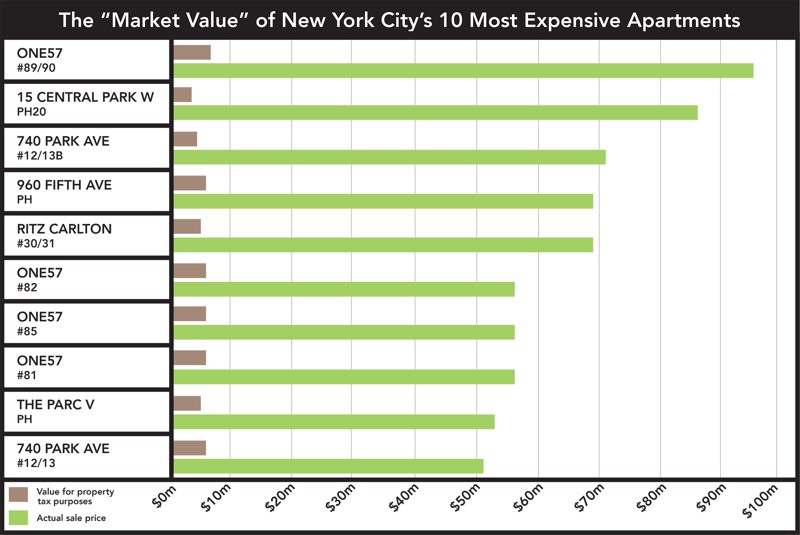

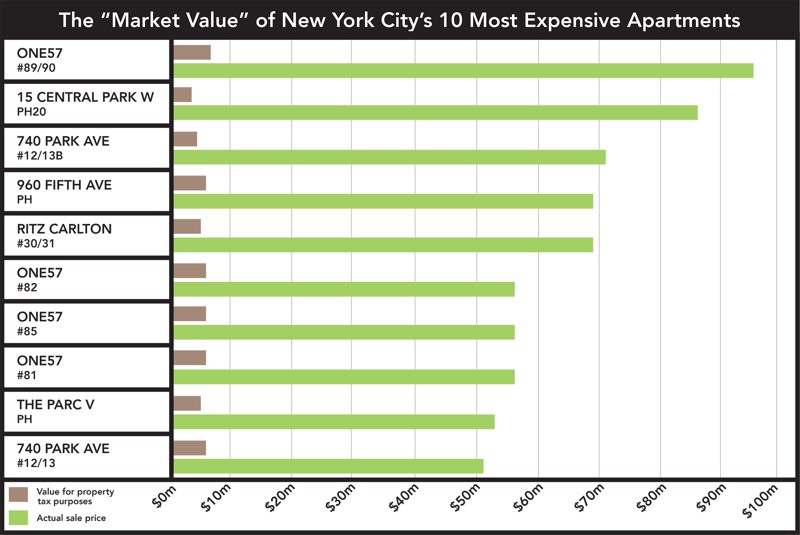

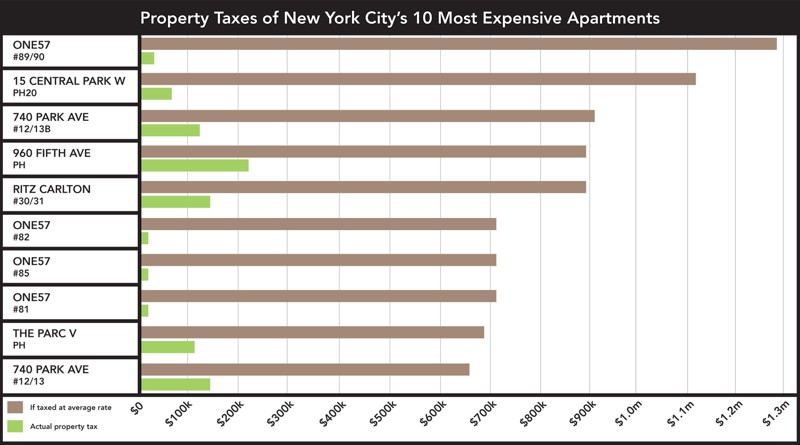

Revaluate, looked at the highest-selling condos in New York to date (minus that $91.5 million sale in April). According to his analysis, the owner of the One57 penthouse pays property taxes as if the unit were a $3–$6 million condo. The gap between billable-assesed value and market-rate value is similar for all 10 of the top condos. (Three of which are also to be found in One57.)

(Data via Max Galka. Chart by Mark Byrnes/CityLab)

"You might commonly think that the assessed value [of a condo] would be based on the sale price," says Mark Willis, executive director of New York University's Furman Center for Real Estate and Urban Policy. "In New York, it’s not true."

Place matters for property-tax purposes. As a 2013 report by the Citizens Budget Commission explains, phase-ins and other mechanisms originally designed to prevent property-tax shocks for homeowners are now a source of "intra-class inequities" across neighborhoods.

"Properties in fast-appreciating neighborhoods end up with lower effective tax rates than identically-valued properties in neighborhoods with more stable prices," the report reads.

Which means that, with Nordstrom Tower going up just a block from One57 (and other supertalls), condo owners on Billionaires Row stand to pay less in property taxes than they would if they owned the same condo in a neighborhood with fewer gee-whiz architectural wonders.

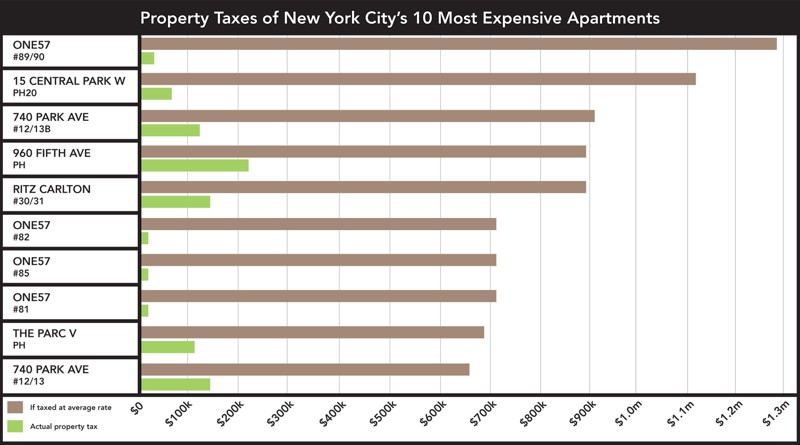

(Data via Max Galka. Chart by Mark Byrnes/CityLab)

What Bloomberg saw as a way to provide for the welfare of New York looks more like one of the firmest expressions of inequality anywhere. And these intra-class inequities are enshrined in state law. There's only so much the de Blasio administration can do about that, but addressing the city's affordability crisis may require him to take a broader stance on property-tax reform.

"Everyone’s waiting to see what the de Blasio administration position on [property taxes] is," says James Parrott, deputy director and chief economist for the Fiscal Policy Institute. "At this point, it’s not clear what proposed changes de Blasio folks will seek, or how Albany will receive them."

Property Taxes for Condos Are Set by Apartment Buildings

The formula by which New York assesses property taxes is positively byzantine. A 2011 report on tax burden and distribution from the Furman Center for Real Estate & Urban Policy provides a brief history on how it came to be so complicated. It's easy to see why it's outmoded: Changes in state law in 1981 yielded the system that's still in place today.

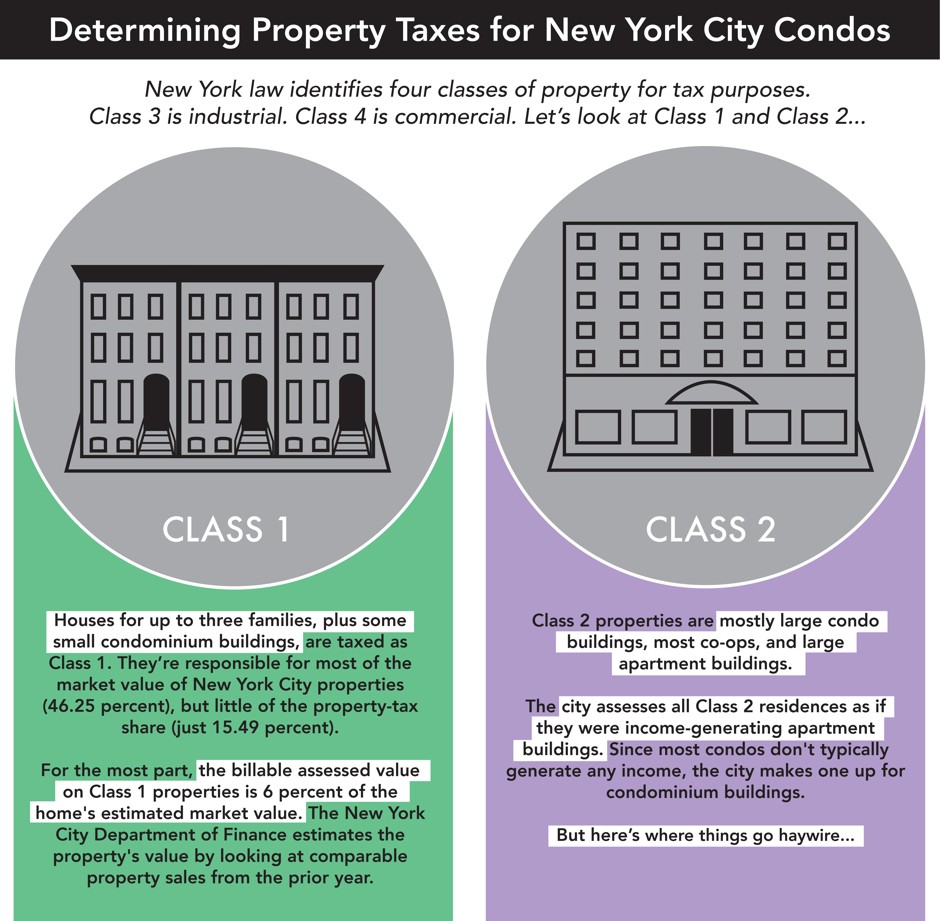

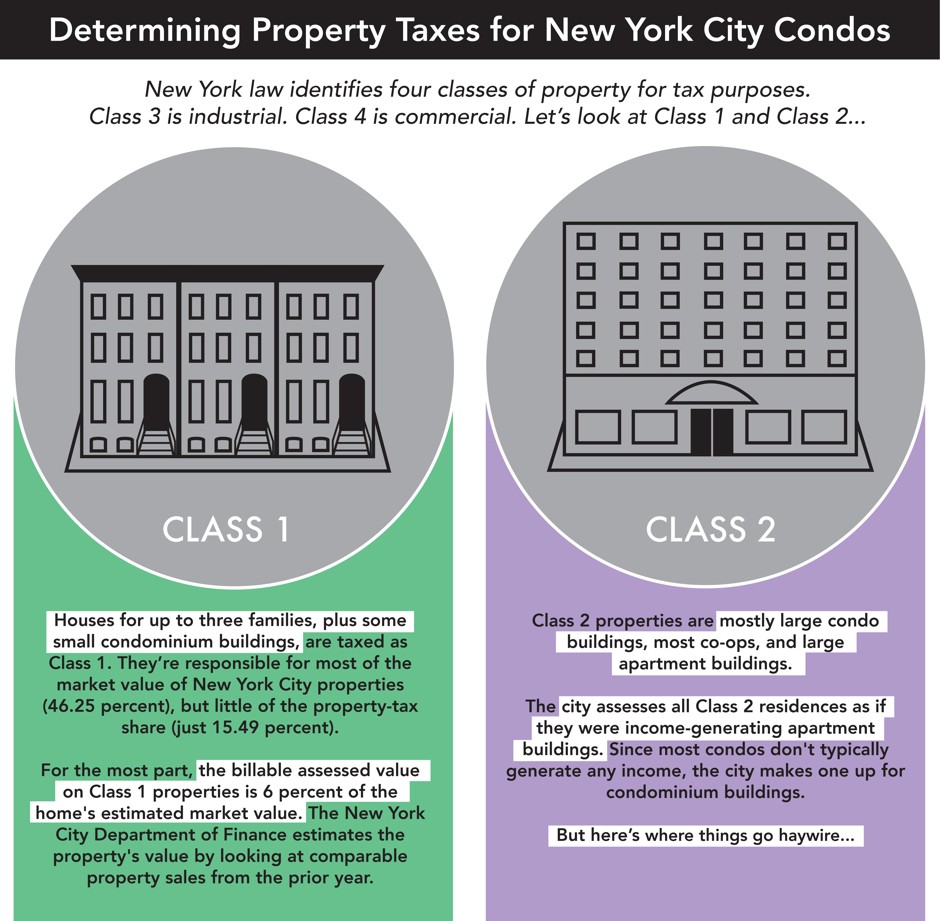

New York law identifies four classes of property for tax purposes. The law fixes the relative share of property taxes that each class pays into municipal coffers—slices of pie whose proportions are more or less fixed.

Class 1 properties are residential: mostly small homes. Houses for up to three families, plus some small condominium buildings, are taxed as Class 1 properties. Class 1 properties are responsible for most of the market value of New York City properties (46.25 percent), but little of the property-tax share (just 15.49 percent).

Class 3 is industrial. Class 4 is commercial. Class 2 is the focus here: Large condo buildings, most co-ops, and large apartment buildings all fall under this category.

Calculating taxes for Class 1 properties such as brownstones is fairly simple. For the most part, the billable assessed value is 6 percent of the home's estimated market value. The New York City Department of Finance estimates the property's value by looking at comparable property sales from the prior year. Easy-peasy.

(Mark Byrnes/CityLab)

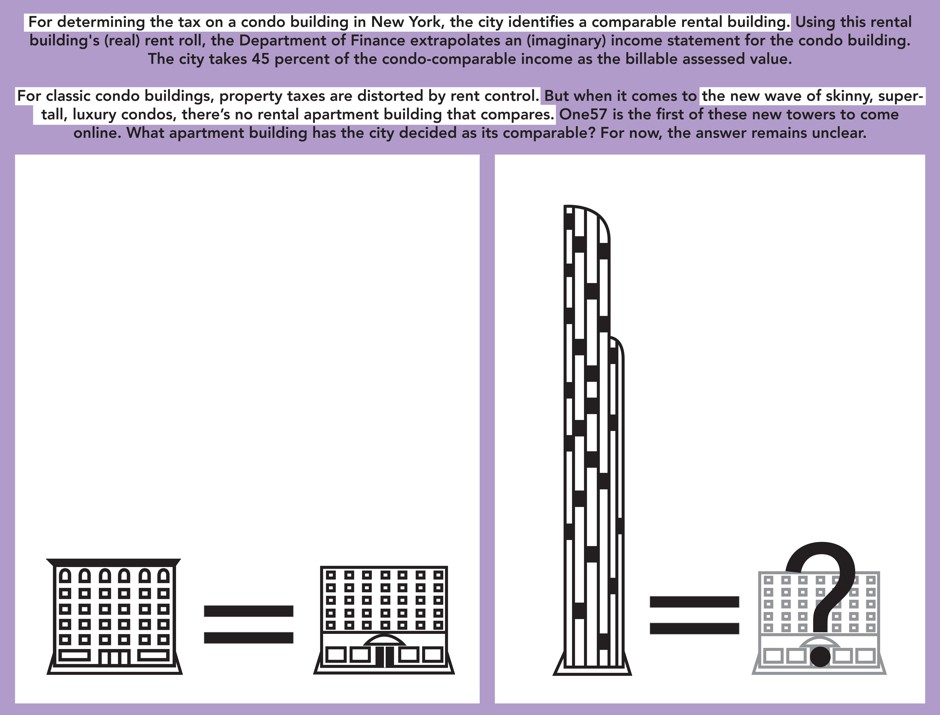

Determining property taxes for Class 2 properties is way weirder. The city assesses all Class 2 residences as if they were income-generating apartment buildings. Since most condos don't typically generate any income, the city makes up income statements for condominium buildings, whole cloth.

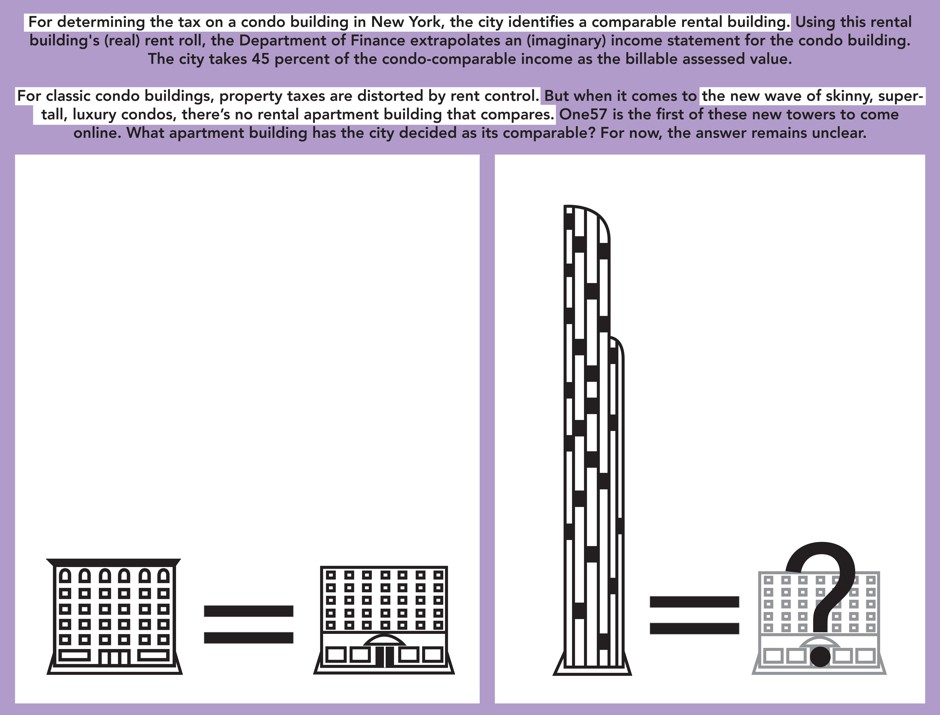

Here's the two-step process the city uses for assessing a condo's value:

Voilà: the property-tax assessment for a condo.

But You Can’t Compare Luxe Condos and Rental Apartments

For two kinds of condos especially, the Class 2 two-step opens up gaping loopholes. The formula simply wasn't designed to anticipate changes in housing more than 30 years after the law was settled.

(Mark Byrnes/CityLab)

- KRISTON CAPPS

- @kristoncapps

- 7:00 AM ET

- 4 Comments

"Sure, it's got a great view. But have you read these antiquated tax codes that got me a huge break?" (One57)

When a duplex condominium in New York's new One57 supertall tower sold for $100.5 million dollars in January, it shattered all records. This condo is the most expensive single-family residence ever sold in Manhattan. Yet, at the rate that luxe residential towers are coming online in the part of Midtown known asBillionaires Row—consider the $91.5 million sale just last month—even that mondo One57 record may not last for long.

Steamy eight- or nine-figure sales were always the dream of former Mayor Michael Bloomberg. "If we can find a bunch of billionaires around the world to move here, that would be a godsend,” then-Mayor Bloomberg told The New York Times back in 2013. "Because that’s where the revenue comes to take care of everybody else."

Construction is now underway on Nordstrom Tower, a supertall residential tower designed by Adrian Smith and Gordon Gill, the architects behind the Burj Khalifa. When the building is finished, the Nordstrom Tower will be the tallest residential building in the world. The one-percenters who can afford its lofts will be treated to some of the best views the United States has to offer.

And that's just one of several buildings coming up that caters to the world's wealthiest. So by Bloomberg's logic, Gotham is saved, right? Not quite.

A rendering of the Nordstrom Tower, currently under construction at 217 W. 57th Street. (Adrian Smith + Gordon Gill Architecture)

Thanks to the structure of city and state tax codes, the billionaires buyingpieds-à-terre in the sky over Central Park are hardly paying property taxes at all. The values of these new condos are being assessed at just a fraction of what they're worth. And buyers are paying only a fraction of that fraction in property taxes.

This is a pressing issue for at least three reasons. For one thing, the property-tax levy is New York City's single largest source of revenue. The city is leaving money behind by failing to tax the most valuable homes at a rate closer to their market value. Meanwhile, well apart from the ultra-luxury condos, the city is overtaxing apartment buildings, whose renters are struggling the most with affordability. These outcomes go hand in hand.

Second, with every new supertall residential tower in Midtown—each one more architecturally dramatic than the last—the effective property tax rates paid by owners on Billionaires Row stand to fall even lower. While nice condos attract big tax breaks, nice neighborhoods earn long-lasting tax breaks.

Revaluate, looked at the highest-selling condos in New York to date (minus that $91.5 million sale in April). According to his analysis, the owner of the One57 penthouse pays property taxes as if the unit were a $3–$6 million condo. The gap between billable-assesed value and market-rate value is similar for all 10 of the top condos. (Three of which are also to be found in One57.)

(Data via Max Galka. Chart by Mark Byrnes/CityLab)

"You might commonly think that the assessed value [of a condo] would be based on the sale price," says Mark Willis, executive director of New York University's Furman Center for Real Estate and Urban Policy. "In New York, it’s not true."

Place matters for property-tax purposes. As a 2013 report by the Citizens Budget Commission explains, phase-ins and other mechanisms originally designed to prevent property-tax shocks for homeowners are now a source of "intra-class inequities" across neighborhoods.

"Properties in fast-appreciating neighborhoods end up with lower effective tax rates than identically-valued properties in neighborhoods with more stable prices," the report reads.

Which means that, with Nordstrom Tower going up just a block from One57 (and other supertalls), condo owners on Billionaires Row stand to pay less in property taxes than they would if they owned the same condo in a neighborhood with fewer gee-whiz architectural wonders.

(Data via Max Galka. Chart by Mark Byrnes/CityLab)

What Bloomberg saw as a way to provide for the welfare of New York looks more like one of the firmest expressions of inequality anywhere. And these intra-class inequities are enshrined in state law. There's only so much the de Blasio administration can do about that, but addressing the city's affordability crisis may require him to take a broader stance on property-tax reform.

"Everyone’s waiting to see what the de Blasio administration position on [property taxes] is," says James Parrott, deputy director and chief economist for the Fiscal Policy Institute. "At this point, it’s not clear what proposed changes de Blasio folks will seek, or how Albany will receive them."

Property Taxes for Condos Are Set by Apartment Buildings

The formula by which New York assesses property taxes is positively byzantine. A 2011 report on tax burden and distribution from the Furman Center for Real Estate & Urban Policy provides a brief history on how it came to be so complicated. It's easy to see why it's outmoded: Changes in state law in 1981 yielded the system that's still in place today.

New York law identifies four classes of property for tax purposes. The law fixes the relative share of property taxes that each class pays into municipal coffers—slices of pie whose proportions are more or less fixed.

Class 1 properties are residential: mostly small homes. Houses for up to three families, plus some small condominium buildings, are taxed as Class 1 properties. Class 1 properties are responsible for most of the market value of New York City properties (46.25 percent), but little of the property-tax share (just 15.49 percent).

Class 3 is industrial. Class 4 is commercial. Class 2 is the focus here: Large condo buildings, most co-ops, and large apartment buildings all fall under this category.

Calculating taxes for Class 1 properties such as brownstones is fairly simple. For the most part, the billable assessed value is 6 percent of the home's estimated market value. The New York City Department of Finance estimates the property's value by looking at comparable property sales from the prior year. Easy-peasy.

(Mark Byrnes/CityLab)

Determining property taxes for Class 2 properties is way weirder. The city assesses all Class 2 residences as if they were income-generating apartment buildings. Since most condos don't typically generate any income, the city makes up income statements for condominium buildings, whole cloth.

Here's the two-step process the city uses for assessing a condo's value:

- For every condo building in New York, the city identifies a comparable rental building. A condo-comparable rental building means an apartment building with units of a similar number, size, age, location, and so on.

- Using this rental building's (real) rent roll, the Department of Finance extrapolates an (imaginary) income statement for the condo building. The condo board decides the portion allocated to individual units.

Voilà: the property-tax assessment for a condo.

But You Can’t Compare Luxe Condos and Rental Apartments

For two kinds of condos especially, the Class 2 two-step opens up gaping loopholes. The formula simply wasn't designed to anticipate changes in housing more than 30 years after the law was settled.

(Mark Byrnes/CityLab)

and gyms arent seeing a dime off of these new buildings. If anything, all those local businesses are losing business they could have had if the buildings were built for people who actually planned to live in them. And even everyone who is involved in the design/construction/transaction is shooting themselves in the foot. The real estate agent for example might hit this big lick, but that's it.... those speculators are going to sit on that property forever. As opposed to condos for regular people, which have a much higher turnover and by extension a more steady revenue stream for real estate brokers. Developers, contractors, architects etc. win in the short term, but in the long term lose out as the wealth gap grows. No contractors or architects are living in these condos and the effects of this displacement ripple all the way out to Westchester/the boroughs/Jersey etc.

and gyms arent seeing a dime off of these new buildings. If anything, all those local businesses are losing business they could have had if the buildings were built for people who actually planned to live in them. And even everyone who is involved in the design/construction/transaction is shooting themselves in the foot. The real estate agent for example might hit this big lick, but that's it.... those speculators are going to sit on that property forever. As opposed to condos for regular people, which have a much higher turnover and by extension a more steady revenue stream for real estate brokers. Developers, contractors, architects etc. win in the short term, but in the long term lose out as the wealth gap grows. No contractors or architects are living in these condos and the effects of this displacement ripple all the way out to Westchester/the boroughs/Jersey etc. Who the fukk is networking in an empty building?

Who the fukk is networking in an empty building?