You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

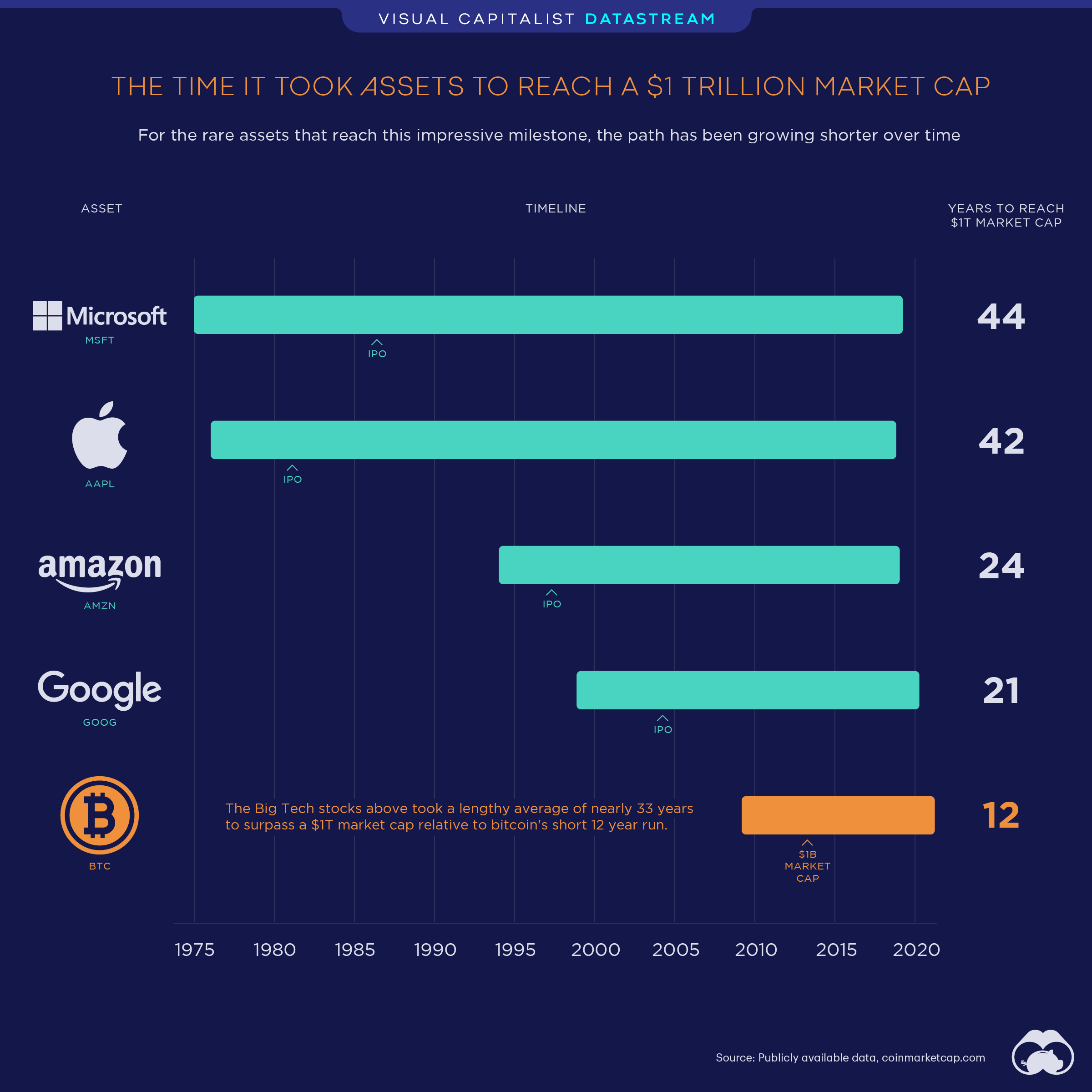

Bitcoin is the Fastest Asset to Reach a $1 Trillion Market Cap

- Thread starter OfTheCross

- Start date

More options

Who Replied?OfTheCross

Veteran

Bitcoin is the Fastest Asset to Reach a $1 Trillion Market Cap

I still don't really buy into it, though

I still don't really buy into it, though

Hood Critic

The Power Circle

It's gotten too big to ignore.Bitcoin is the Fastest Asset to Reach a $1 Trillion Market Cap

I still don't really buy into it, though

null

...

It's gotten too big to ignore.

what's to stop it being replaced by something better?

or rather, if something better came out would people switch to that?

like how they switch from yahoo and altavista to google.

i just tried to pay with bitcoin at targetIt's gotten too big to ignore.

they said no

i guess they still ignoring it

DaddyFresh

Superstar

It’s The Godfather of cryptocurrency and has a finite supply. Even if something better does come along it will be extremely hard for it to take over and the limited supply will make owning one damn near collectible status even decades from now.what's to stop it being replaced by something better?

or rather, if something better came out would people switch to that?

like how they switch from yahoo and altavista to google.

null

...

It’s The Godfather of cryptocurrency and has a finite supply. Even if something better does come along it will be extremely hard for it to take over and the limited supply will make owning one damn near collectible status even decades from now.

which other product/item with 21 million examples is collector status?

DaddyFresh

Superstar

Are you really going to use past examples to compare to something that is revolutionary and never been done? I’m not going to sit here and try to convince you why Bitcoin should be taken very serious. It’s easier to knock something then to learn about it. One trillion market cap should make anyone trying to make money do their due diligence.which other product/item with 21 million examples is collector status?

null

...

Are you really going to use past examples to compare to something that is revolutionary and never been done? I’m not going to sit here and try to convince you why Bitcoin should be taken very serious. It’s easier to knock something then to learn about it. One trillion market cap should make anyone trying to make money do their due diligence.

you are good at dodging questions. let me know when you have some answers.

DaddyFresh

Superstar

You asked what past item with a 21 mil supply is considered a collectible. None. Bitcoin is doing something that’s never been done before. Which is why it’s the fastest asset to reach one trillion dollar market cap. I answered your question but you’re just trying to play contrarian. The numbers speak for themselves.you are good at dodging questions. let me know when you have some answers.

What's gonna stop it is people won't trust it and they won't buy into it, actually, that's what bitcoin cash and satoshis vision tried to do and it failed miserably, and now you've got companies with more wealth than me and you will ever be able to see scooping it up so at this point the world has made it's decision on it.what's to stop it being replaced by something better?

or rather, if something better came out would people switch to that?

like how they switch from yahoo and altavista to google.

Hood Critic

The Power Circle

what's to stop it being replaced by something better?

or rather, if something better came out would people switch to that?

So what if something new comes along or becomes the new king of the crypto hill, crypto is not a primary currency, its more of a commodity and its use is purely by choice. If another crypto currency can survive everything that bitcoin has, it will more than likely be used as another payment option (see mastercard, visa, amex, discover, etc.). Chances are extremely likely that we will see a crypto based currency whose value will more align with primary currencies and can be used as such. At this point, buying bitcoin is like investing in precious metals.

like how they switch from yahoo and altavista to google.

Nonsensical comparison.

null

...

So what if something new comes along or becomes the new king of the crypto hill, crypto is not a primary currency, its more of a commodity and its use is purely by choice. If another crypto currency can survive everything that bitcoin has, it will more than likely be used as another payment option (see mastercard, visa, amex, discover, etc.). Chances are extremely likely that we will see a crypto based currency whose value will more align with primary currencies and can be used as such. At this point, buying bitcoin is like investing in precious metals.

what's to stop it being replaced by something better?

or rather, if something better came out would people switch to that?

Nonsensical comparison.

good argument.

null

...

What's gonna stop it is people won't trust it and they won't buy into it, actually, that's what bitcoin cash and satoshis vision tried to do and it failed miserably, and now you've got companies with more wealth than me and you will ever be able to see scooping it up so at this point the world has made it's decision on it.

how is "bitcoin cash" technically different aka BETTER

?

?(HINT: I already know that you will dodge that question because fundamentally they are the same tech. Or in other words you didn't read and understand my original question)

Technically it is better because it handles transactions faster but again, bitcoin has first movers advantage and a smaller supply and clout, when it comes to value, it's like basketball, 10% is physical, 90% is mental. I'll end it off like this, you're at the mercy of the market, the market has decided bitcoin is king and will keep it that way because it'll be beneficial to the market movers as well. Eth is way better for usecase than bitcoin, and is only 2.3k, that's just how it is, we can debate all we want but me and you are just some ants to this whole thing.how is "bitcoin cash" technically different aka BETTER?

(HINT: I already know that you will dodge that question because fundamentally they are the same tech. Or in other words you didn't read and understand my original question)