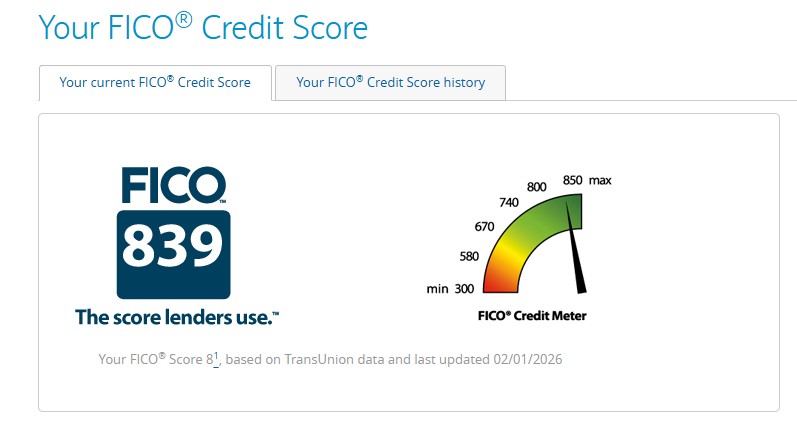

I focus on payment history and amount owed. My score has been over 800 for years but it's due to paying debt off almost immediately by making multiple payments per month.

FICO scores are all different depending on the institution anyway. The score a Dealership uses will be different than your Bank etc.

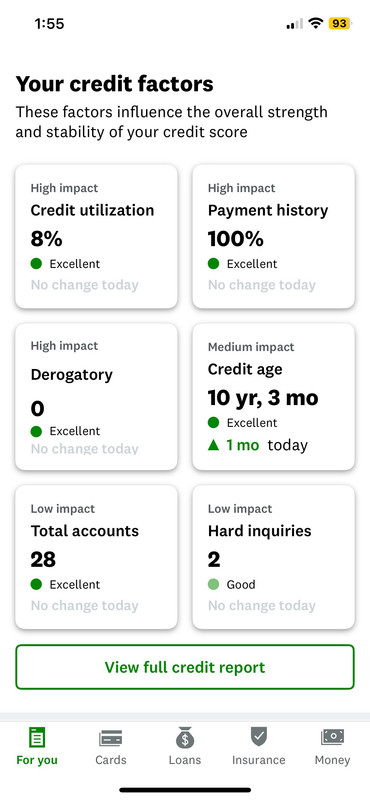

- Payment History (35%): Whether you pay bills on time.

- Amounts Owed (30%): Total debt and credit utilization ratio.

- Length of Credit History (15%): Age of accounts and oldest/newest account.

- New Credit (10%): Number of recent inquiries and new accounts.

- Credit Mix (10%): Variety of accounts, such as credit cards and loans.

FICO scores are all different depending on the institution anyway. The score a Dealership uses will be different than your Bank etc.

, two cars and a mortgage

, two cars and a mortgage