Spotify’s $1 Billion Podcast Bet Turns Into a Serial Drama

The prospect of podcast riches led to aggressive investments in celebrity deals and original programming for what appeared a sky’s-the-limit media frontier.

Spotify’s $1 Billion Podcast Bet Turns Into a Serial Drama

The prospect of podcast riches led to aggressive investments in celebrity deals and original programming for what appeared a sky’s-the-limit media frontier

Sept. 5, 2023 at 12:01 am ETSpotify spent more than $1 billion to build a podcasting empire. It struck splashy deals with Kim Kardashian, the Obamas and Prince Harry and Meghan Markle. It paid $286 million for a pair of podcast studios and spent $250,000 and more an episode on exclusive shows to lure new listeners.

The bet hasn’t paid off.

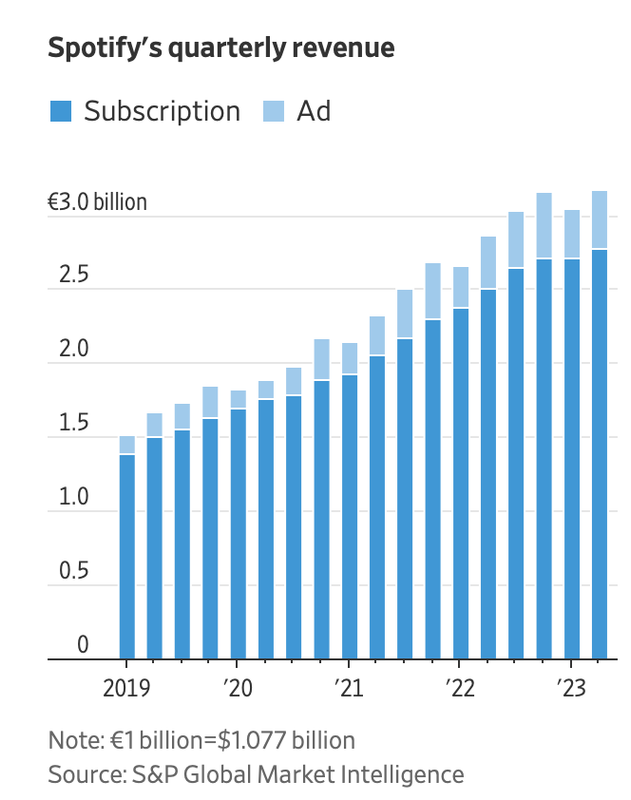

Most of its shows aren’t profitable, according to people familiar with the matter, and the company has recently cut staff and programming to slow its losses. The company, which has struggled to report consistent profits, lost €527 million, equivalent to about $565 million, in the six months ending in June, on €6.2 billion in revenue.

No one in the business is making much money on podcasts, but Spotify, which has spent far more on the medium than its rivals, has more to lose than most. Spotify’s competitors, including Amazon Apple and Google, tech behemoths with their own audiostreaming services, have other, more profitable businesses.

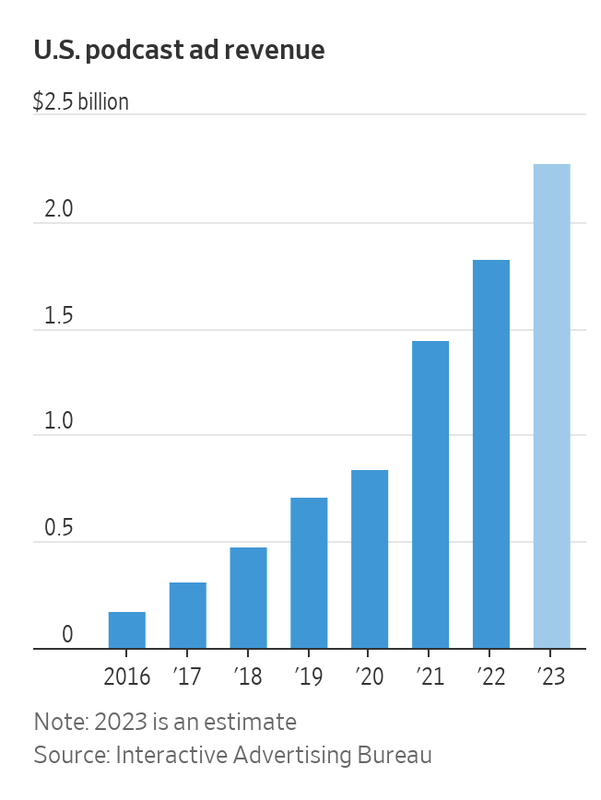

Podcast revenue in the U.S. is expected to reach $2.3 billion this year, a 25% increase from 2022, according to the Interactive Advertising Bureau, an industry group, and is expected to more than double by 2025. That represents a tiny slice of the $200 billion digital-ad market. Spotify spent its way to the top of an industry that turned out to be less lucrative than it appeared when it began its podcast quest in 2018.

“The size of the bet up against the size of the market just seems irrational in retrospect,” Evan Shapiro, a media consultant and producer, said of Spotify’s podcast investment. “They’re out of runway.”

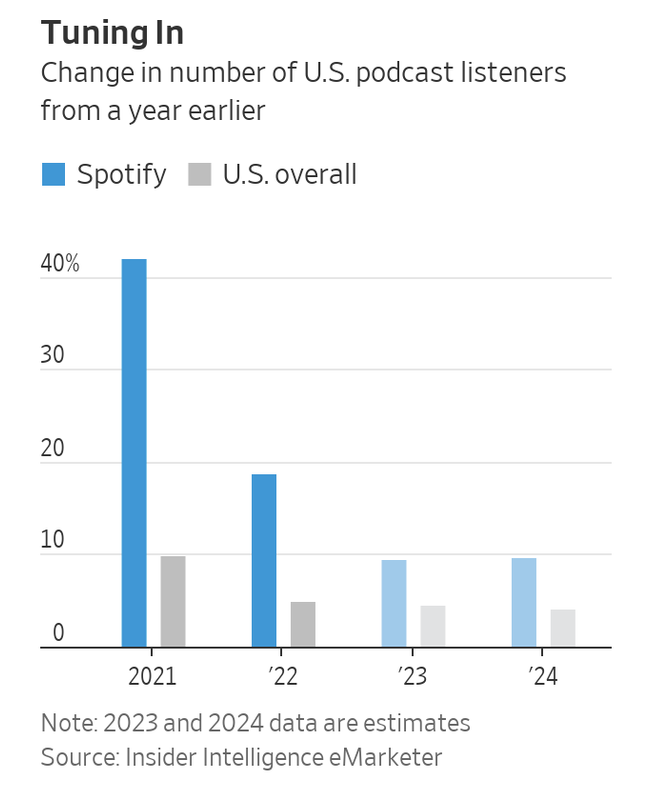

The pool of podcast listeners is growing, but the flood of shows on various streaming platforms makes it tough to break new hits. Facing competition across genres and formats, Spotify found that exclusive podcasts generally don’t draw subscribers away from its rivals. Podcast costs at the company rose €29 million in the first half of this year.

The company, which had 220 million paid subscribers to its premium service in June, said it has more than 100 million podcast listeners on its platform, 10 times what it had in 2019. Spotify said it is on track to make its podcast business profitable in 2024.

Under pressure from investors to meet that profitability goal, the company in June laid off 200 employees, about 2% of its workforce, and culled shows to focus on a more limited stable of original and exclusive content. It did away with its and Gimlet brands, consolidating its original work into a unit called Spotify Studios. In July, Spotify raised the price of core subscriptions by a dollar to $10.99 a month.

Spotify has started to share more of the risk with its talent. The company recently agreed to pay comedian Trevor Noah $4 million in a deal that allows the company to collect revenue from the podcast to cover its investment, according to people familiar with the matter. After that, both sides share the take. :picardSpotify intends to pursue similar deals, executives said.

Sirius, iHeart, NPR and other podcast rivals have gone through their own podcast-related layoffs and budget cuts, part of a larger cost-trimming trend among media and technology companies this year.

Chief Executive Daniel Ek has said he wants Spotify to be the world’s largest audio company, spanning audiobooks, education, sports and news. Podcasts are only the first step toward Spotify’s goal of evolving from a music-streaming company to an audio giant, generating $100 billion in revenue by 2030.

Spotify reported €11.7 billion in revenue in 2022.

Spotify reported €11.7 billion in revenue in 2022.

While the company probably overpaid for some content, Ek said, the investments helped Spotify achieve its goal of becoming the top podcast platform. The company expects podcast ad revenue to grow 30% this year, ahead of Spotify’s overall revenue growth, executives have told staff in recent months.

“We’ve been very focused on pursuing shows that drive really loyal audiences and also attract advertisers,” said Sahar Elhabashi, head of Spotify’s podcast business. “We have a very strong portfolio now which does that.”

Spotify’s library of more than five million shows includes fiction, nonfiction and personality programming. Among its original shows are the Pulitzer Prize-winning nonfiction podcast “Stolen,” as well as “Heavyweight,” which explores people’s regrets and “Serial Killers.” It also carries thousands of podcasts from other publishers and media companies. News Corp’s Dow Jones & Co., publisher of The Wall Street Journal, has a content partnership with Spotify.

Last edited: