You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

62% of Americans have less than $1000 in savings

- Thread starter Koba St

- Start date

More options

Who Replied?Black Wealth: It Only Looks Like We Are Rich…

Black Wealth: It Only Looks Like We Are Rich… : ThyBlackMan.com

Travel through any metropolitan city like DC or Atlanta, and you are likely to see an assortment of luxury vehicles from Mercedes and BMWs to Bentleys and Maseratis most driven by African Americans. Even in some of the most distressed urban neighborhoods it is not uncommon to see high end vehicles lining the streets. Catch us out on the town, and you will find us wearing the latest designer fashions with hair freshly styled even when we are sinking in debt.

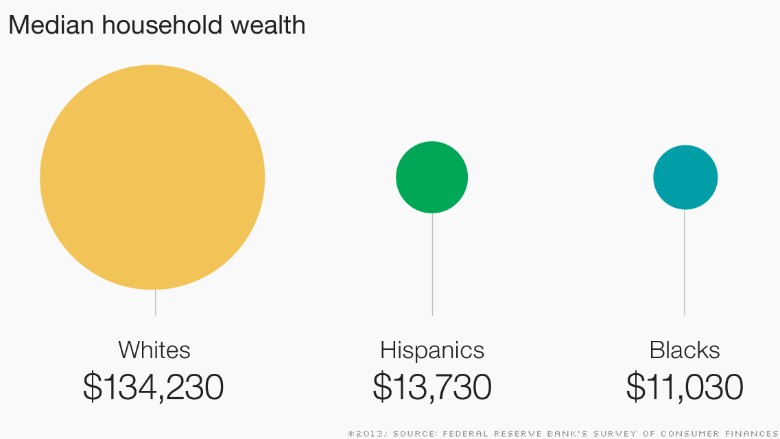

To the casual observer one could draw the conclusion that African Americans are doing well. But how is this possible when, according to Money Coach Lynnette Khalfani-Cox the median net worth of Black households in 2009, was $2,200 compared with a median net worth of $97,900 for White households.

How are we able to look so wealthy when the truth is of the 36 million African Americans, less than .01 percent or 112,000 of Black households in the U.S. have a net worth of $1 million or more. Even at $500,000 in net worth only 333,000 Black household fall into this range. Given these facts, not very many African Americans are truly wealthy even though we look like we are.

According to a report published by Target Market News of the total earning power of $836 Billion that Blacks earn. In 2009, Black households spent an estimated $507 billion in 27 product and service categories. That is an increase of 16.6% over the $435 billion spent in 2008. Most of what African Americans are spending their money on has no appreciable value.

Consider Michael, 44, he drives a brand new Range Rover, has a 5 bedroom house in the suburbs, and wears Hugo Boss suits to his job as a Purchasing Manager. Although he earns $87,000, Michael is just getting by. After he pays his $1,400 car payment, $1,700 mortgage and other expenses, Michael has no money left for savings or investments. From the outside looking in, Michael looks wealthy. The reality is that Michael has less than $2,000 in savings and a negative net worth that includes over $50,000 he had to borrow to earn his graduate degree. Not to mention the decrease in value of the home he purchased right before the real estate downturn.

Michael’s story is not unique; he is like so many African Americans who have been seduced by the appearance of wealth. Many believe driving a luxury car, living in a sprawling home in the suburbs, and wearing designer clothes communicate to the world that they have “arrived.”

John and Valerie Hall have been trying to keep up with “the Joneses” since they got married in 2008. With a combined income of $165,000 annually, they appear to be living the “good life”: they live in a prestigious golf and country club community in Atlanta; he drives a 2010 Porsche Cayenne, and; she drives a 2010 Lexus I250c. From all external indications the Halls are living well, but the truth is that over eighty percent of their take home pay is spent on mortgage, car payments, credit cards, etc. They don’t have an emergency fund and are starting to feel the strain of their lavish spending.

Even those at the lower end of the economic scale are stretching their dollars to obtain the things that are symbolic of wealth. Take Wanda, 47, who works in retail. Although she earns $11.00 an hour, she drives a 2003 528I BMW, and gets her hair professionally styled twice a month which consumes close to 40 percent of her income.For the past eighteen months she has been renting a room from a relative because she cannot afford her own place.

Looking wealthy and being wealthy are vastly different. Wealth is not the same as earning a high income. Income is what people earn from work, interest, dividends, rents or royalties paid from property. Wealth is the value of everything a person or family owns minus their debts. One of the theories about assets says: income feeds your stomach, but assets change your head.

When you are truly wealthy there is a certain confidence that you carry that is not dependent on what you drive or what you are wearing.

Black Wealth: It Only Looks Like We Are Rich… : ThyBlackMan.com

Larry Lambo

Superstar

Black Wealth: It Only Looks Like We Are Rich…

Black Wealth: It Only Looks Like We Are Rich… : ThyBlackMan.com

Some sad stories there.

Most of the successful black folks I know are fairly modest, but the ones I'm not cool enough to hang with.....

Mr.bocario

Superstar

Watching those life or debt shows, all I could here was GMB, GMB, GMB, GMB

WE ain't goin never lose

WE ain't goin never lose

Watching those life or debt shows, all I could here was GMB, GMB, GMB, GMB

WE ain't goin never lose

You've got to know your significant other's views on spending and saving before jumping the broom.

The problem is people tend to discuss that shyt after they jump the broom! It almost never ends well that way!

Disputes over finances are the leading causes of divorces.

If you don't think this matters, ask your self what happens when 1/3 of teh country has a medical emergency, car breaks down, house gets flooded, etc. That puts pressure on government to provide those social services.

I just started a good paying job, but I'm realizing I'm not saving any money. I started tracking all my purchases a few months ago, like someone else mentioned, then fell off. I'm bout to start doing that again so I can figure my money out & start stacking. I shouldn't be looking at my bank account worrying how much is left like I was in college

I waited as long as I could to get a credit card & I'm glad cuz those shyts are the fukkin devil

I'll swipe the CC & look at my checking account not move like

But then the bill is due & I'm

Its crazy how food (& weed ) cost so much

I waited as long as I could to get a credit card & I'm glad cuz those shyts are the fukkin devil

I'll swipe the CC & look at my checking account not move like

But then the bill is due & I'm

Its crazy how food (& weed ) cost so much

It really is crazy/sad how most people are living paycheck to paycheck. What good are materials gains when you're stressing about how you're gonna pay your bills? Man, folks gotta talk about finances/kids/etc. before getting married.

I'm better with money, so I handle most of the finances in my house. We came up with some short-term and long-term goals, created a plan, and save a healthy amount each month. I have an extensive spreadsheet that I use to track all expenses.

I'm better with money, so I handle most of the finances in my house. We came up with some short-term and long-term goals, created a plan, and save a healthy amount each month. I have an extensive spreadsheet that I use to track all expenses.

Crayola Coyote

Superstar

G.O.A.T Squad Spokesman

Logic Is Absent Wherever Hate Is Present

posterchild336

Superstar

But republicans all say economy booming, stock market great this year jobs booming everyone has bigger paychecks how could this be..tax breaks to large companies trickle down effects to workers and bigger bonuses

That can’t be true. Not with all the Christmas gifts I saw on facebook and Instagram. nikkas is ballin outchea

Doobie Doo

Veteran

I got a vanguard, fundrise, wealthfront, ally bank savings and a few other accounts all valued over a g

I got a vanguard, fundrise, wealthfront, ally bank savings and a few other accounts all valued over a g