With the ink barely dried after Ellison closed an $8bn takeover of Paramount this summer, he set his sights on Warner and began making bids for it in September.

Zaslav bristled at the approaches, having already announced a plan to split apart WBD that would allow him to continue running the studio, streaming group and HBO — the more glamorous, faster-growing parts of the business — and spinning off legacy TV channels weighing on the share price.

But Warner's board realised it had to move quickly or risk losing control of events, said people briefed about the matter. WBD formally kicked off an auction in October as Zaslav sought out other buyers. "It became obvious [Paramount] weren't going to go away," said a person involved in the sale process.

To keep momentum for the auction, Warner imposed an extraordinarily compressed timetable, giving bidders days to revise terms that would typically take weeks.

"This was so big, it impacted so many people, we had to get on with it and not dilly dally," said a person close to Warner Bros' chief executive. During just six weeks, board directors were pulled into near-daily emergency meetings, all-night drafting sessions and a Thanksgiving-weekend of tough negotiations.

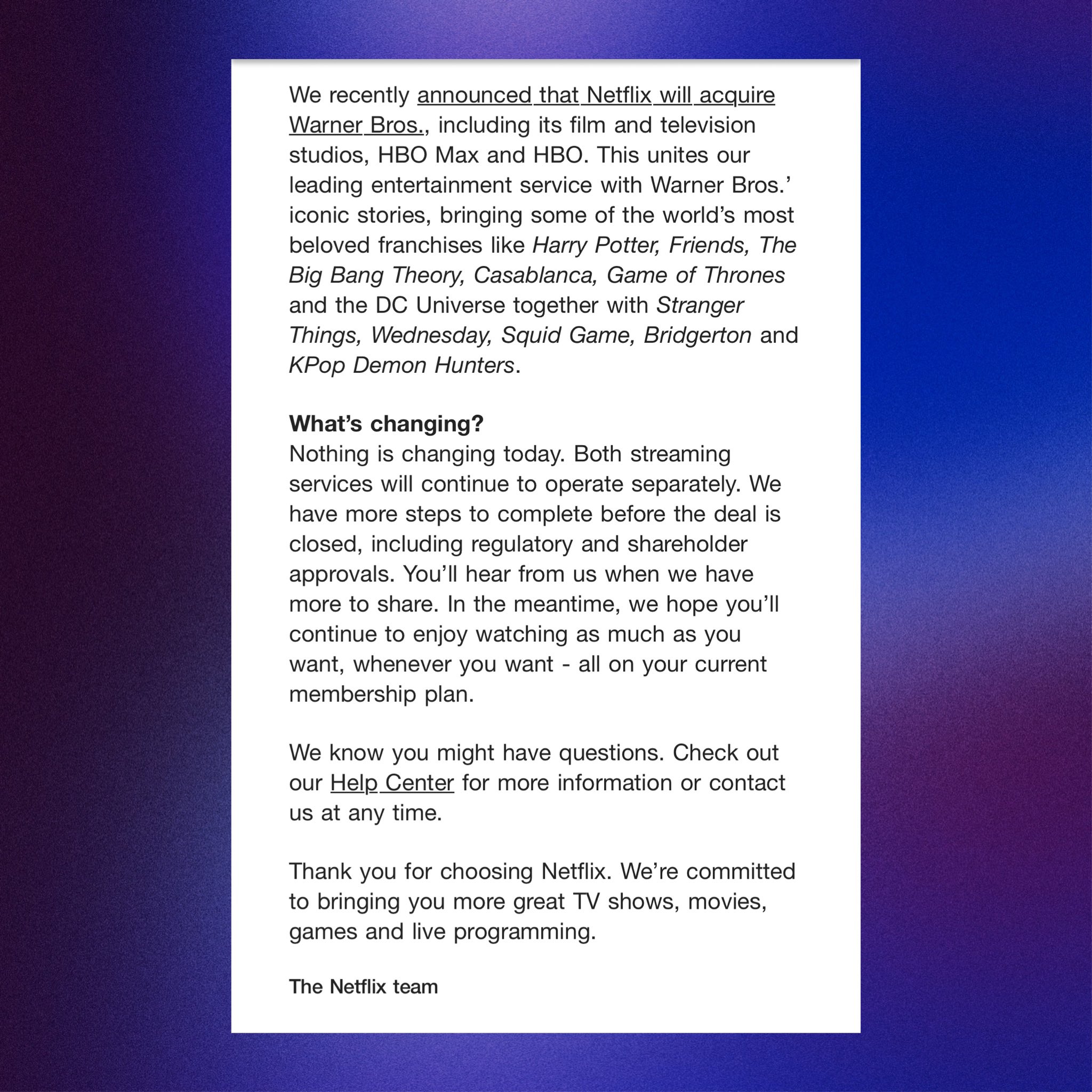

The auction came to a head this week, with final offers due on Monday morning. Netflix, Paramount and Comcast each submitted sharply different proposals. By Thursday night, after hours of debate, the board went into executive session and emerged with a unanimous verdict: accept Netflix's offer.

Netflix had not been the obvious frontrunner. The company had never attempted a deal of this magnitude. But inside the boardroom, one factor outweighed price: Netflix had presented a fully-formed offer.

"Netflix was ready to execute this deal in every material way," said a person involved in the sale negotiations. Its team spent 10 consecutive days addressing every request, tightening covenants and agreeing a $5.8bn break fee, among the largest on record.

The board wanted a proposal it could sign immediately. Netflix was the only bidder whose paperwork was fully executable that night. "Minutes after the vote, the contracts were signed," said one person involved. Netflix's offer met all of the Warner board's demands and it was willing to adopt requested changes to get the deal done. Paramount and Comcast, by contrast, were still seeking to negotiate certain terms, according to people familiar with the matter.

Zaslav could retain operational control of Warner even after Netflix takes over, although a formal agreement has not been signed. This is a luxury he would not have been afforded under the Paramount deal, where he would have shared the chief executive role with Ellison.

Netflix said it expected the deal to close in 12 to 18 months. But people close to US regulators said the process could last longer as the transaction is expected to face serious antitrust hurdles. The combination of two of the largest streamers in the US was likely to be seen as anti-competitive, said a person close to Trump's regulatory officials.